The stock market ended mixed on Friday following stronger earnings results from several big U.S. companies.

The stock market ended mixed on Friday following stronger earnings results from several big U.S. companies.

Overall, S&P 500 fell 0.1% to 4,505, while NASDAQ declined 0.2% to 14,114.

Tweet of the Day

Wow! I didn't think it was possible that Netflix $NFLX could find success in video games. Yet it has. THis looks like a catalyst for the stock.https://t.co/H14l9XBOJO

— David Sharek (@GrowthStockGuy) July 14, 2023

Chart of the Day

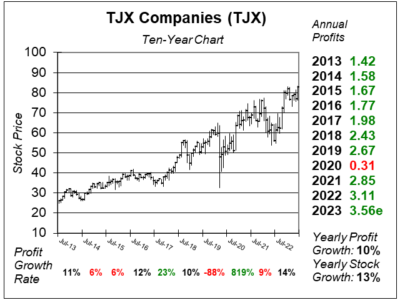

Here is the ten-year chart of TJX Companies (TJX) as of June 28, 2023, when the stock was at $83.

Here is the ten-year chart of TJX Companies (TJX) as of June 28, 2023, when the stock was at $83.

TJX is the largest major international off-price retailer in the world, which operates in the U.S. since 1976, in Canada since 1990 (Winners), and in the U.K. and Ireland since 1994 (where its stores are named as T.K. Maxx). The company offers a rapidly changing assortment of quality brand names and designer merchandise that is 20% to 60% below full-price retailers.

TJX reported good results last quarter, with strength in apparel sales with weakness in home accessories (HomeGoods). Sales at Marmaxx (TJ Maxx, Marshalls, and Sierra) increased 7% last quarter, while HomeGoods sales declined 3% as that store had extraordinary growth during the pandemic. Same-store sales (SSS) at Marmaxx were up a solid 5% last quarter, while HomeGoods’ SSS were down 7%.

Overall, last quarter, the company delivered 12% profit growth on 5% revenue growth, including 3% same-store sales growth. Pretax profit margin surged to 10.3% from 7.5% a year ago due to a significant benefit from lower freight costs and better deals when buying inventory. Management’s long-term goal is to have pretax margin climb to 10.6%.

TJX has been one of the stock market’s finest stocks the past 35 years. This is a well oiled machine that is a juggernaut in the world of fashion. Overall, this stock seems like a 12% grower long-term.

TJX is part of the Conservative Growth Portfolio.