Lululemon (LULU) Stores Are Busy For the Holiday Shopping Season

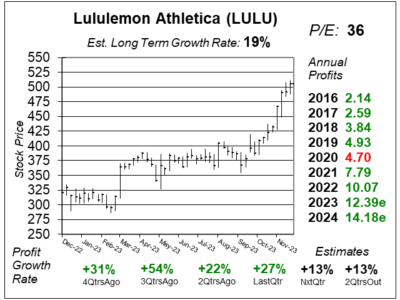

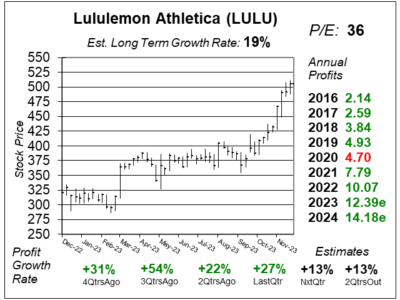

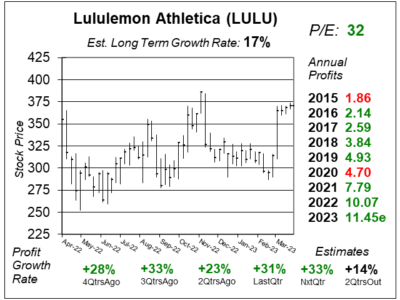

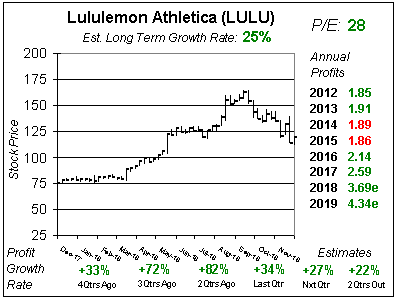

Lululemon (LULU) is having a busy holiday shopping season. But the stock’s recent run higher has zapped a lot of its upside.

Lululemon (LULU) is having a busy holiday shopping season. But the stock’s recent run higher has zapped a lot of its upside.

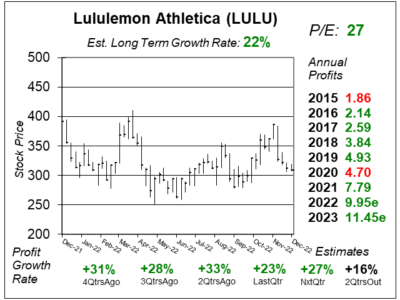

Lululemon (LULU) is one retailer that’s still growing strong in this weak economy. Profits grew 22% last qtr on 18% sales growth.

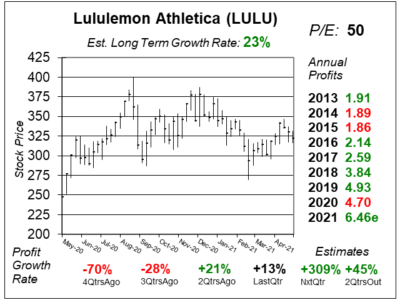

Lululemon (LULU) is seeing strong profit growth as sales continue to rise briskly, while logistics costs simmer down, helping margins.

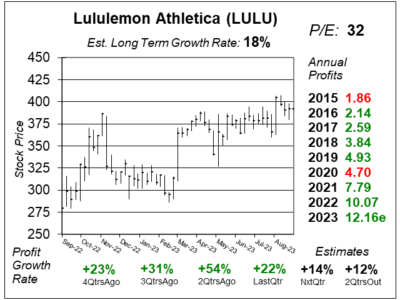

Lululemon’s (LULU) inventory jumped 82% two quarters ago, and this added apparel helped boost sales a solid 30% last quarter.

Lululemon (LULU) has high inventory. That’s a good thing, as last year the company was having to pay more to get inventory in.

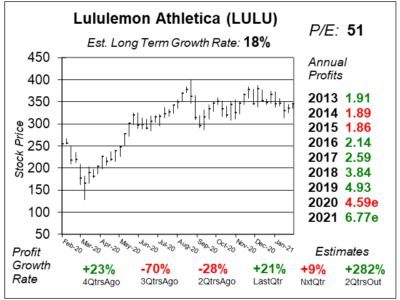

Lots of retail stores that sell clothing are in a deep recession. Not lululemon (LULU), which just grew profits 33% last quarter.

Lululemon (LULU) has a bunch of new clothing lines that can boost sales, including footwear, hiking, golf, tennis and throwback.

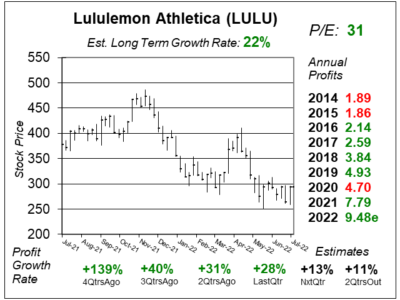

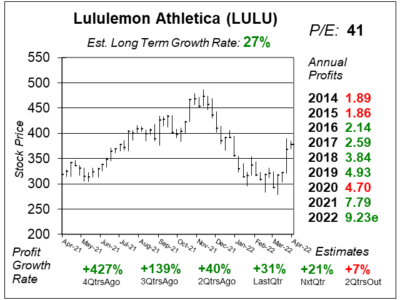

Shares of Lululemon (LULU) jumped after it solid earnings growth of 31%, but witha P/E of 41 the shares are now fairly valued.

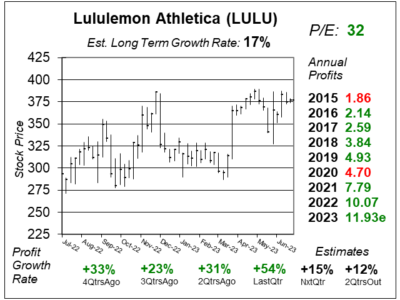

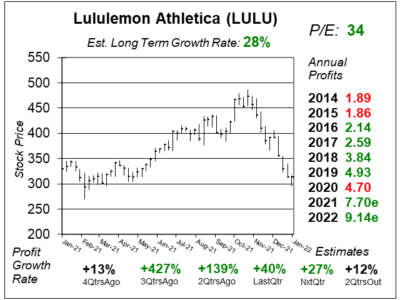

Lululemon’s (LULU) P/E ratio just dropped from 62 last qr to 34 this qtr, that’s the cheapest valuation LULU’s had since 2018.

Lululemon (LULU) already has ffantasti momentum going, and up next the company is set to launch its own sneaker line.

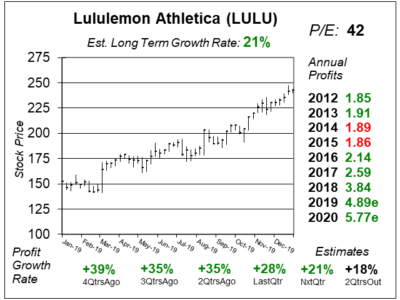

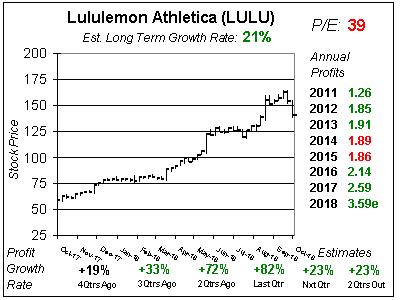

Lululemon’s (LULU) has been on a tear as e-commerce and a rebound in their brick and mortar stores are fueling growth.

Lululemon’s (LULU) ecommerce revenue has ballooned to more than hald of of total company revenue. Sweet!

Lulumenon (LULU) has grown its market share of the athletic apparel market, as ecommerce sales have surged.

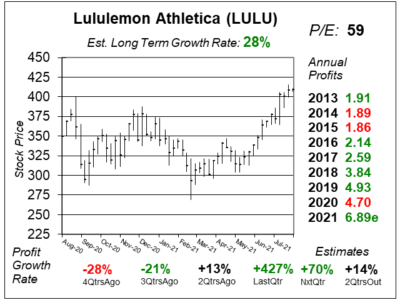

Lululemon (LULU) has seen e-commerce sales surge higher. Now that the stores are re-opened, business could flourish.

Lululemon’s (LULU) direct to consumer sales increased 68% last qtr, and now represent 54% of total revenue.

In the long-run, Lululemon (LULU) should benefit from the new casual dress work-from-home environment.

Lululemon (LULU) management sees significant opportunities in China, with significant opportunities in Tier 2 cities.

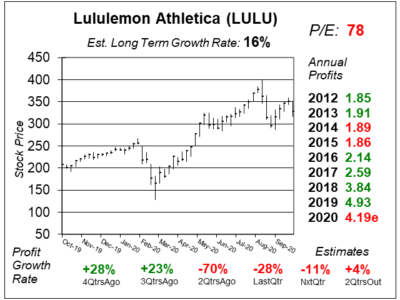

Lululemon (LULU) proves its a stock market leader as the stock is already at All-Time highs in this new market rally.

Lululemon Athletica (LULU) is growing in many ways including Internationally, via e-commerce, menswear and skincare.

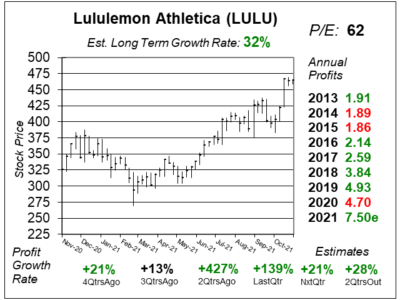

Lululemon (LULU) is hot right now — both the stock and company profits. And management foresees good growth for the next 5 years.

Shares of Lululemon (LULU) fell after the company reported solid profit growth of 34% last qtr. LULU dropped when it should have popped.

Lululemon (LULU) is clicking on all cylinders right now, the problem is everyone knows this and the stock is sky high.

Lululemon Athletica (LULU) is on fire right now, as e-commerce and International sales are growing better than 50%.

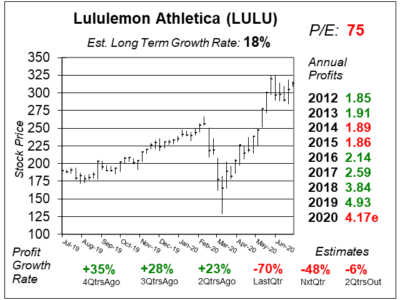

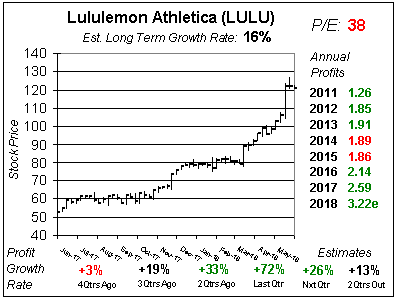

Shares of Lululemon (LULU) have been on a serious run in the past year — a run that’s taken it from $50 to $90. Let’s take a closer look at LULU.

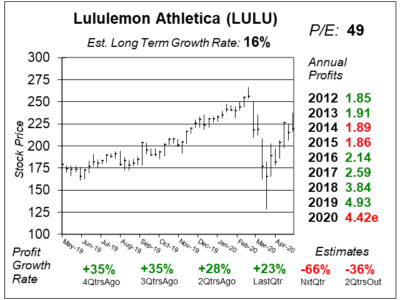

Lululemon (LULU) has really lost its luster because LULU’s earnings estimates continue to deteriorate.

Lululemon’s (LULU) numbers continue to deteriorate, so I’ll sell LULU today. Lots of other stocks are on sale, I can use the cash.

Lululemon (LULU) is having issues right now, But each time the stock’s been at its lows its bounced back.

I wish to increase my position in Lululemon Athletica (LULU) but the stock isn’t low enough for me to make the move.

Lululemon (LULU) is past its clothign recall, but now the CEO resignation brought down the stock. Still, LULU should rebound in a big way in 2014.

We have to learn the Art of Patience as we hold Lululemon (LULU). Sit. Wait. Investors should be rewarded in 2014 for their patience.

Stock’s that can grow 40% a year continuously are rare finds. Lululemon (LULU) is one of those stocks that’s done it and continues to do it.

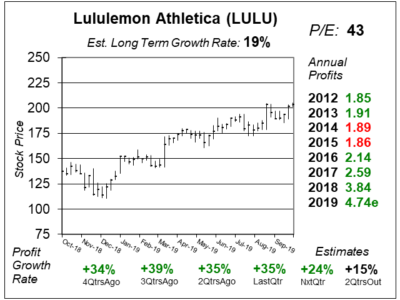

Lululemon (LULU) got its mojo back after reporting a solid quarter that beat the street. The problem is this stock has little upside.

Lululemon (LULU) isn’t a top-tier growth stock anymore. I’m taking LULU’s Fair Value P/E down from 50 to 35. Time to take profits.

Could a retail stock be worth 50 times earnings? Well Lululemon Athletica (LULU) might be worth it. LULU’s got great momentum right now.

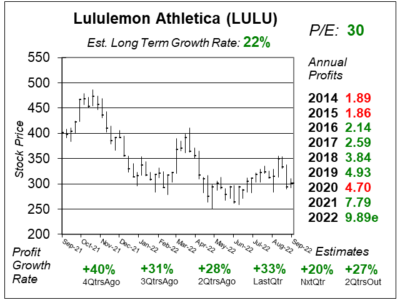

Last holiday season Lululemon (LULU) paid extra for airfreight so it could get stock shelves. This year it’s reducing costs.

Lululemon Athletica (LULU) is done selling out of its inventory. Now that the shelves are being stocked, profit margins won’t be as robust as they have been. But same-store sales and Internet sales continue to thrive.

Lululemon (LULU) is a must own stock for me. I have to take advantage of the drop to get in while LULU isn’t so expensive.

Lululemon Athletica (LULU) continues to put on a show as its now looking to take out $100 a share. Here’s what I think of this stock.

Ok, I dropped the ball not getting Lululemon (LULU) last year (or the year before). Now, every time I evaluate the stock, it doesn’t seem like a great value

Here’s a six-pack of stock’s I have on my radar. One stock stands out from the pack — and might be something I buy in the near future.

Lululemon Athletica (LULU) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $2.39 vs. $2.28 = +5%

Revenue Est: +10%