The stock market rebounded on Monday as investors prepared for an inflation reading. Such is believed to be crucial to the central bank’s decision making.

The stock market rebounded on Monday as investors prepared for an inflation reading. Such is believed to be crucial to the central bank’s decision making.

Overall, S&P 500 climbed 0.9% to 4,518, while NASDAQ rose 0.6% to 13,994.

Tweet of the Day

$DOCN DigitalOcean is down by 22% after ER. Some investors are surprised, but we aren't.

– Forward growth slowed to ~15%.

– Mgt calling bottoming is here but has not ended yet.

– Expect the newly acquired GPU VPS provider Paperspace to contribute 3% growth for the next year,…— Convequity (@convequity) August 4, 2023

Chart of the Day

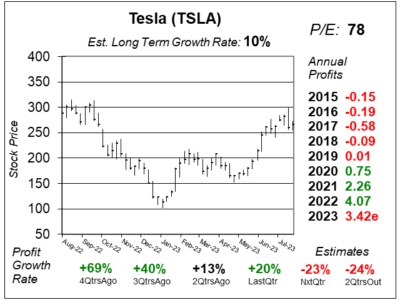

Our chart of the day is the one-year chart of Tesla (TSLA) as of July 25, 2023, when the stock was at $265.

Our chart of the day is the one-year chart of Tesla (TSLA) as of July 25, 2023, when the stock was at $265.

Tesla designs, develops, manufactures, sells, and leases high-performance fully electric vehicles (EVs), energy generation, and energy storage systems. Products are generally sold directly to consumers, which gives the company a great edge in auto manufacturing that it doesn’t have the overhead of dealerships.

Tesla cut vehicle prices this year to spur vehicle demand, and that’s caused Operating Margin to shrink from 14.6% to 9.6% year-over-year. Some of the margin shrinkage is due to Musk wanting to keep cars affordable in this high interest rate environment. These price cuts, however, helped Tesla reach record levels of vehicle production and deliveries. Vehicle deliveries jumped last quarter 86% to 466,000 vehicles. In addition, the Model Y was the world’s best-selling vehicle during the first quarter of this year, beating all vehicles, even those that are sold at lower prices. This makes Model Y the first electric vehicle to become a best-selling vehicle. Overall, profits grew 20% last quarter while revenue grew 47%.

TSLA is part of our Growth Portfolio and Aggressive Growth Portfolio. David Sharek thinks the future of the stock really depends on Full Self-Driving. If that can be mastered, profits could grow exponentially.