The stock market tumbled on Tuesday as investors assessed the hotter-than-expected January inflation report. The Consumer Price Index (CPI) rose 0.3%, up from the 0.2% forecast. The latest economic data spiked the 10-year Treasury yields to 4.3%. In addition, the market bets that the Federal Reserve will hold interest rates steady on its next policy meeting.

The stock market tumbled on Tuesday as investors assessed the hotter-than-expected January inflation report. The Consumer Price Index (CPI) rose 0.3%, up from the 0.2% forecast. The latest economic data spiked the 10-year Treasury yields to 4.3%. In addition, the market bets that the Federal Reserve will hold interest rates steady on its next policy meeting.

Overall, S&P 500 declined 1.4% to 4,953, while NASDAQ fell 1.8% to 15,656.

Tweet of the Day

On Monday, a new signal from a voting member in the Risk-Off Composite Model issued a warning. pic.twitter.com/YsU8kbUzEi

— SentimenTrader (@sentimentrader) February 9, 2024

Chart of the Day

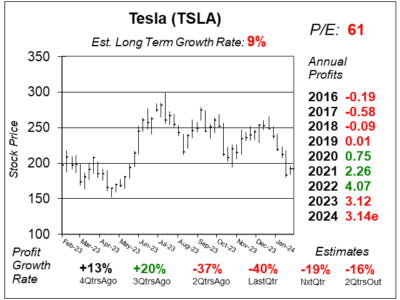

Here is the one-year chart of Tesla (TSLA) as of January 30, 2024, when the stock was at $192.

Here is the one-year chart of Tesla (TSLA) as of January 30, 2024, when the stock was at $192.

Tesla is having a tough time growing profits, and the stock is suffering. Last quarter, the company delivered -40% profit growth from the year ago period, while revenue increased just 4% year-over-year. Management is focused on growing their output, cost reduction efforts an increasing investments to their future growth initiatives. Furthermore, vehicle price reductions brought operating margin down to 8.2% from 16.0% a year ago. Overall, the company doesn’t have any catalysts right now to push the stock higher.

TSLA is part of our Growth Portfolio. David Sharek, Founder of School of Hard Stocks, recently sold the stock from our Aggressive Growth Portfolio. He thinks the future of the stock really depends on Full Self-Driving. If that can be mastered, profits could grow exponentially.