The stock market closed higher on Friday to end best week so far this year as jobs growth cools.

The stock market closed higher on Friday to end best week so far this year as jobs growth cools.

The October jobs report came in weaker-than-expected with 150,000 additional jobs during the month, below the 170,000 estimates. This was also lower than the 297,000 added jobs in September. In relation to such, unemployment rate rose to 3.9%, compare to expectations of 3.8%.

Overall, S&P 500 grew 0.9% to 4,358, while NASDAQ was higher 1.4% to 13,478.

Tweet of the Day

Just one chart which shows we are at the October bear market bottom in terms of breadth suggesting a potential spot for a rally. Other charts show similar characteristics. It may fail but you don't get negative here. Bottoms do occur in the market when you don't want to buy. We… pic.twitter.com/kU7x2sO2s7

— Roy Mattox (@RoyLMattox) November 2, 2023

Chart of the Day

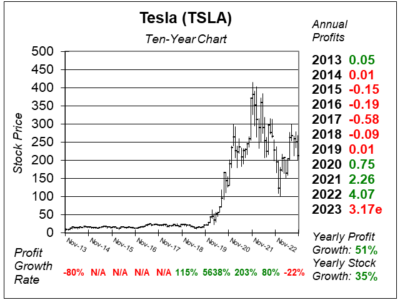

Here is the ten-year chart of Tesla (TSLA) as of October 25, 2023, when the stock was at $212.

Here is the ten-year chart of Tesla (TSLA) as of October 25, 2023, when the stock was at $212.

Tesla designs, develops, manufactures, sells, and leases high-performance fully electric vehicles (EVs), energy generation, and energy storage systems. Products are generally sold directly to consumers, which gives the company a great edge in auto manufacturing that it doesn’t have the overhead of dealerships. Tesla’s Full Self-Driving autopilot system for autos is expected to become a catalyst for the company.

Tesla’s profit growth was -37% last quarter as price cuts brought operating margin to 7.6%, from 17.2% a year ago. Although price cuts hurt profits, the cost of production was down to $37,500 per vehicle last quarter due to lower material and freight costs. R&D expenses, however, were higher due to Cybertruck builds, as well as AI expenses for the Optimus robot and Dojo supercomputer for self-driving.

Next quarter, profit growth is estimated to deliver another -37% as car prices must remain low to keep a lower monthly cost for consumers in this high interest rate environment. Overall, investors were not pleased with the earnings as the stock has tumbled lower since the release.

TSLA is part of our Growth Portfolio and Aggressive Growth Portfolio. David Sharek, Founder of School of Hard Stocks, thinks that the future of Tesla really depends on Full Self-Driving. If that can be mastered, profits could grow exponentially.