The stock market tumbled on Tuesday as bank stocks slumped ahead of the Federal Reserve’s rate decision. The central bank is widely expected to raise rates by a quarter point.

The stock market tumbled on Tuesday as bank stocks slumped ahead of the Federal Reserve’s rate decision. The central bank is widely expected to raise rates by a quarter point.

Prior to the Fed’s decision, regulators took possession of First Republic Bank and sold the bulk of its assets to JPMorgan Chase. Such was the third failure of an American bank since the collapse of Silicon Valley Bank and Signature Bank in March. This brought more worries on investors for the regional banking sector.

Overall, S&P 500 declined 1.2% to 4,120 to NASDAQ fell 1.1% to 12,081.

Tweet of the Day

Breakout trades are mixed at best with money gravitating defensively to the mega caps and rotating around in anticipation to what the FED has to say this week (imagine that… Lol!). Institutions are still unwilling to take much risk, and that's causing many breakouts to stall… pic.twitter.com/BH26sd3AIk

— Mark Minervini (@markminervini) May 1, 2023

Chart of the Day

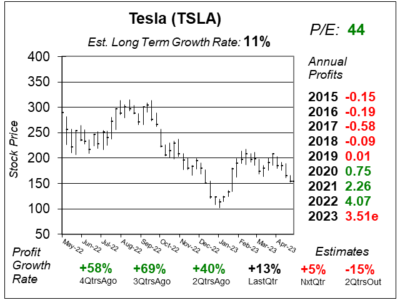

Our chart of the day is the one-year chart of Tesla (TSLA) as of April 26, 2023, when the stock was at $154.

Our chart of the day is the one-year chart of Tesla (TSLA) as of April 26, 2023, when the stock was at $154.

Tesla designs, develops, manufactures, sells, and leases high-performance fully electric vehicles (EVs), energy generation, and energy storage systems. Products are generally sold directly to consumer, which gives the company a great edge in auto manufacturing that it doesn’t have the overhead of dealerships.

The company has been cutting prices on some of its models to spur demand. But this is causing profit margins to decline. Last quarter, Total GAAP gross margin fell from 29.1% to 19.3% year-over-year. However, an 18% increase in automotive revenue helped profits climb 13% during the quarter.

Tesla could have the next big catalyst in the stock market with Megapack. Megapacks are big energy storage units that resemble shipping containers. They are used to help stabilize the energy grid and prevent outages, especially during natural disasters. Megapacks are also used by utility companies and large commercial projects. Tesla’s Megaplant in Lathrop, California is capable of producing 10,000 Megapacks per year. These units sell for $2 million each.

TSLA is part of our Growth Portfolio and Aggressive Growth Portfolio.