It’s been hard to find winners in the stock market this year.

It’s been hard to find winners in the stock market this year.

Luckily, this gives investors with cash on hand an opportunity to pick up some quality Blue Chip stocks on a dip.

Here’s five of my favorite conservative stocks from our Conservative Growth Portfolio that investors can get on a discount.

Thse stocks will show ten-year charts so you can get the long-term view of the stock’s history, and my Fair Values of where I feel the stocks should be trading at in the upcoming year.

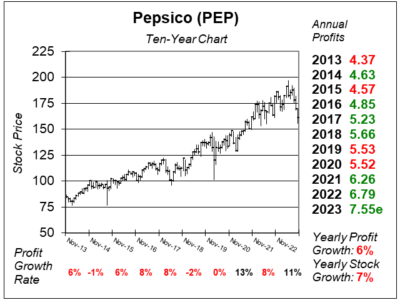

PepsiCo (PEP) is one of the world’s largest food and beverage companies with more than $70 billion in annual sales.

PepsiCo (PEP) is one of the world’s largest food and beverage companies with more than $70 billion in annual sales.

Its worldwide brands include Pepsi, Frito-Lay, Tropicana, Quaker, and Gatorade, with each generating more than $1 billion in annual sales.

While the company serves customers in more than 200 countries and territories worldwide, approximately more than 60% of its revenue comes from North America.

Most of the company brands occupy the #1 and #2 spots in their respective categories.

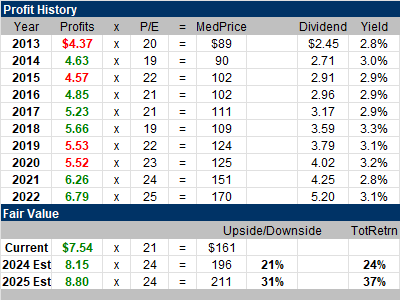

Domino’s (DPZ) is the world’s #2 pizza chain and #1 pizza delivery chain, with more than 18,800 locations in over 90 markets around the world. Approximately 98% of its stores are owned and operated by franchisees.

Domino’s (DPZ) is the world’s #2 pizza chain and #1 pizza delivery chain, with more than 18,800 locations in over 90 markets around the world. Approximately 98% of its stores are owned and operated by franchisees.

It generates sales and profits by charging franchisees royalties and fees, as well as by selling them food, equipment, and supplies.

Based on global retail sales, Domino’s is the largest pizza company in the world.

The company has the biggest electric fleet of pizza delivery vehicles in the country, with at least 800 vehicles.

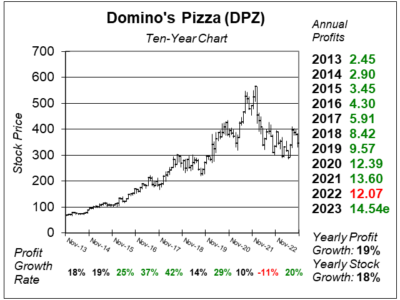

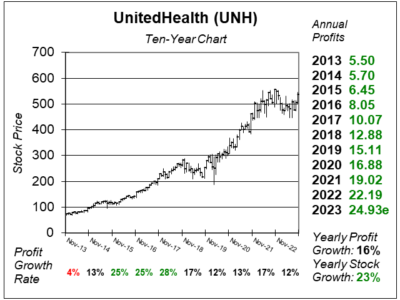

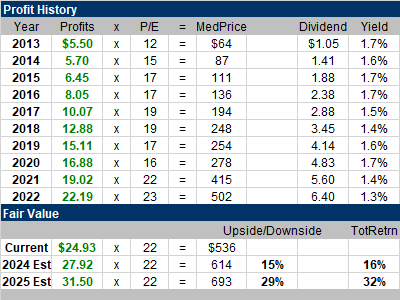

UnitedHealth (UNH), the nation’s leading health insurer, is comprised of two main divisions, UnitedHealthcare and Optum.

UnitedHealth (UNH), the nation’s leading health insurer, is comprised of two main divisions, UnitedHealthcare and Optum.

UnitedHealthcare is responsible for the provision of health insurance, while Optum aims to take preventive measures to improve a people’s health.

UnitedHealthcare is the larger of the two. Optum, however, is believed to be a catalyst for the company in the coming years as organizations take preventative measures to keep employees healthy.

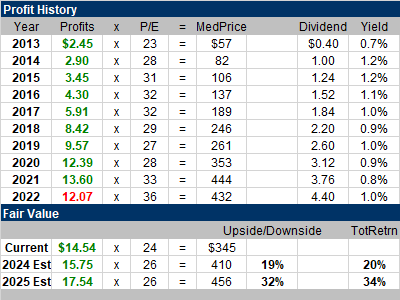

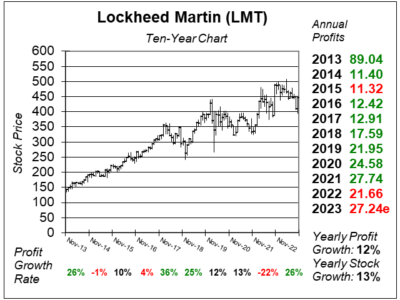

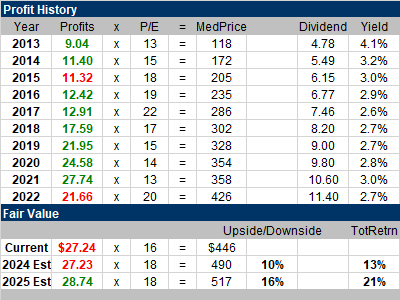

Lockheed Martin (LMT) is one of the largest defense contractors in the world.

Lockheed Martin (LMT) is one of the largest defense contractors in the world.

It operates four business segments, namely: Aeronautics; Missiles and Fire Control; Rotary and Mission Systems; and Space.

The F-35 fighter is part of the Aeronautics segment.

LMT stock has been rising recently with countries looking to improve their national defense. Especially with fighting going on in the Middle East.

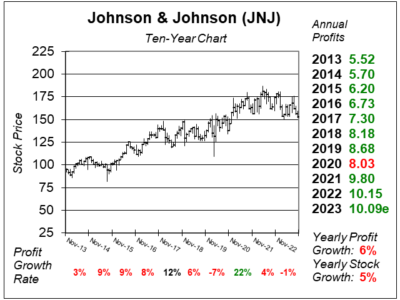

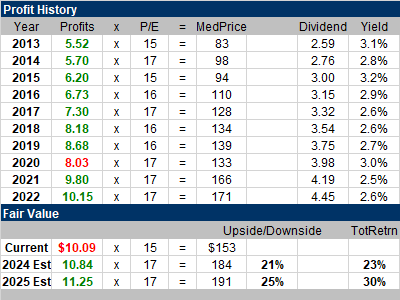

Johnson & Johnson (JNJ) is the world’s largest healthcare company.

Johnson & Johnson (JNJ) is the world’s largest healthcare company.

The company used to have three operating segments: Consumer Health, Pharmeceutical, and Medical Devices. JNJ recently spun off the Consumer Health division, Kenvue.

Johnson & Johnson has been facing around 50,000 lawsuits from plantifs claiming they developed ovarian cancer from asbestos in J&J’s talcum powder products including Baby Powder & Shower-to-Shower.

J&J has offered to pay $8.9 billion to settle the lawsuits, but this was rejected. This has caused investors to shy away from the stock.