In our March growth stock newsletter, we talked about AI, how it is changing society as we know it, and the stocks to watch out for to get on the AI hype train. Related to all this is cybersecurity.

With AI generative chatbots like ChatGPT making any piece of information readily comprehensible to the majority of people, cybersecurity has never been more needed.

Here’s my top five cybersecurity stocks at this time. We oen each of these stocks for clients, but not all clients oen each stock. Note the charts and tables are as of the last qtr, and the stock prices have since changed:

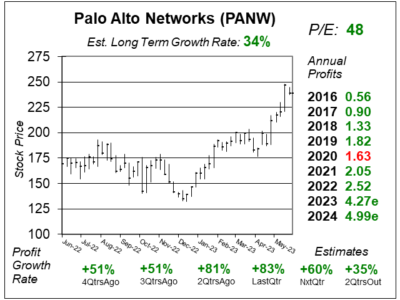

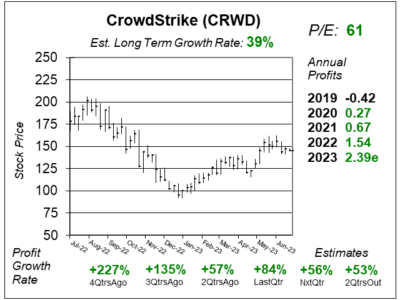

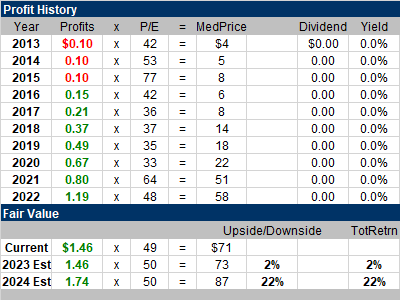

Palo Alto Networks (PANW) is the top cyber-security provider within the Network Security business, and has recently broadened its spectrum to develop next-generation security platforms in cloud security as well as data analysis. Whereas some cybersecurity companies focus on the network, and others on the devices, Palo Alto seems to have all the bases covered.

The company is on track to capitalize on new advancements in AI, especially with Cortex XSIAM, the company’s next-generation security operations center. Made Generally available on Q4 of 2022, management now believes that XSIAM is set to become their fastest-growing new offering with quarterly bookings having doubled from two quarters ago.

In my opinion, Palo Alto stock is worthy of a $299 price within the next 12 months.

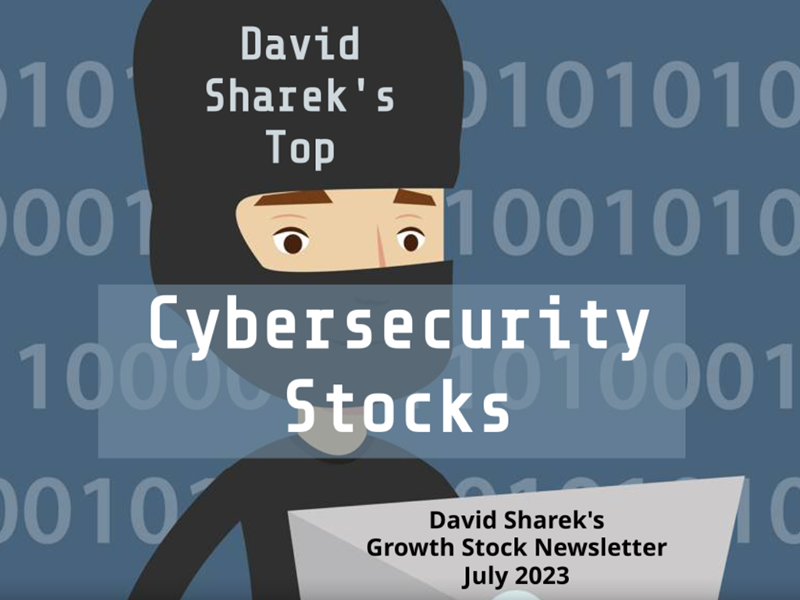

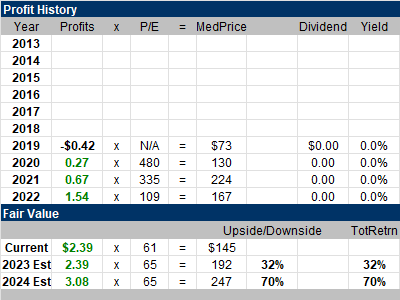

CrowdStrike (CRWD) is one of the world’s largest cybersecurity companies. It offers the Falcon platform which provides cloud-delivered solutions for endpoint and cloud workload protection via a software-as-a-service (SaaS) subscription model. Falcon is so successful that CrowdStrike became the second fastest cloud-native SaaS company to reach over $2 billion in Annual Recurring Revenue, just behind Zoom (ZI).

CrowdStrike introduced Charlotte AI last quarter which is a new generative AI security analyst that take advantage of the company’s high-fidelity security data. Charlotte AI helps deliver advanced results regardless of the user’s skill level. The company also released a new module, Falcon Insight for IoT, which is the world’s first endpoint detection and response (EDR) and extended detection and response (XDR) solution for Extended Internet of Things assets, an aspect of cybersecurity gaining traction as more of everyday things get connected to the net.

CRWD stock seems like one of our most undervalued cyber plays. I think the stock could reach $192 this year.

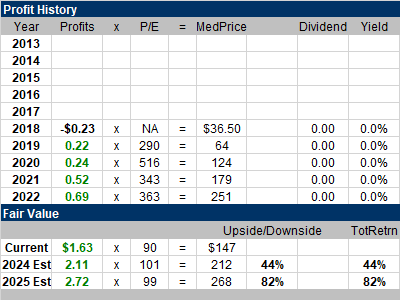

Zscaler (ZS) is the largest in-line cloud security platform in the world, securing 40 million users from the largest global brands.

This company delivered the highest profit growth among these five stocks last quarter with 182%.

The difference between Zscaler and Crowdstroke is Zscaler protects data in the networks, while Crowdstrike is more focused on devices (like PCs, tablets and phones).

I just added to our ZS position, as I felt it was very undervalued. My Fair Value for the next year is $212.

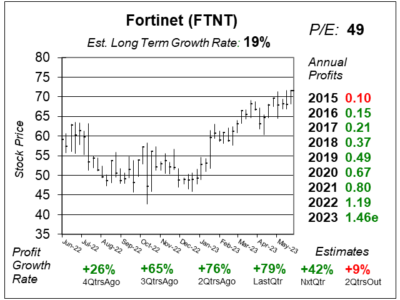

Fortinet (FTNT) delivers hardware, software, and technical support for a range of cybersecurity offerings.

Fortinet (FTNT) delivers hardware, software, and technical support for a range of cybersecurity offerings.

Fortigate is its main hardware application and runs on FortiOS to deliver a firewall, anti-malware, VPN and anti-spam functions.

In recent years, FTNT spent heavily on adjusting its products for a cloud computing environment. This caused annual profits to suffer from 2013 to 2015. Now those investments are paying off. Profits hit new All-Time highs in 2016 and haven’t looked back since.

PANW and FTNT are what I believe to be well-rounded cybersecurty companies, with CRWD and ZS suited for more of a loud based world.

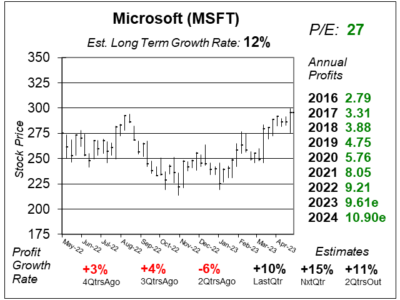

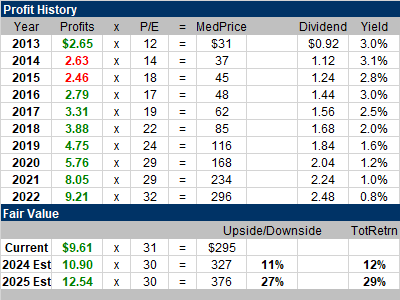

Microsoft (MSFT) is not immediately synonymous with cybersecurity but its cybersecurity business has been gaining steam, a lot actually.

Microsoft Security now makes up 10% of its total revenues as of the close of 2022 with revenues surpassing $20 billion. Its lineup consists of six product families dealing with various uses such as threat prevention, identity management, endpoint management, and data governance.

Just recently, Microsoft announced an AI cybersecurity bot called Microsoft Security Copilot which runs on GPT-4, the latest version of OpenAI’s world-changing language model. This AI bot works like ChatGPT and helps users understand and fix security issues.

This is the safest stock in the bunch, with a diversified array of offerings, including Azure, Xbox, LinkedIn, Office products, Windows operating systems, and now the company is set to acquire video game maker Activision.

My MSFT Fair Values have been wrong on thi stock recently. I’ve underestimated the power of this great franchise.