Stock (Symbol) |

CrowdStrike (CRWD) |

Stock Price |

$145 |

Sector |

| Technology |

Data is as of |

| July 7, 2023 |

Expected to Report |

| August 28 |

Company Description |

CrowdStrike provides cloud-delivered solutions for endpoint and cloud workload protection via a software-as-a-service (SaaS) subscription-based model. CrowdStrike provides cloud-delivered solutions for endpoint and cloud workload protection via a software-as-a-service (SaaS) subscription-based model.

The Company offers Falcon platform in a SaaS subscription-based model, which delivers integrated, technologies that deliver protection and performance, while reducing customer complexity. The Company’s Falcon platform leverages a single lightweight-agent architecture with integrated cloud modules spanning multiple security markets, including corporate workload security, managed security services, security and vulnerability management, information technology (IT) operations management, threat intelligence services, identity protection and log management. It also offers approximately 22 cloud modules on its Falcon platform, which include Falcon Prevent, Falcon Insight, Falcon Device Control, Falcon Firewall Management, Falcon XDR, Falcon Discover, Falcon Spotlight and others. Source: Refinitiv |

Sharek’s Take |

Crowdstrike (CRWD) delivered results last quarter with profit growth of 57% on 42% revenue growth. But investors weren’t impressed. One reason for this might be because the stock’s moved up around 50% from its lows set last December. Still, the stock’s not overly expensive, as I’ll get into later. Another reason the stock hasn’t moved up much since the company reported earnings is decelerated revenue growth, which has slowed from 58% to 53%, 48% and 42% during the past four qtrs. Still, in the earnings call, management said the demand environment remains resilient. CrowdStrike is one of the world’s largest cybersecurity companies, serving 556 of the Global 2000, 271 of the Fortune 500, and 15 of the top US banks as of January 21, 2023. Of the top 25 managed detection and response (MDR) vendors identified by research firm Gartner, 88% have built their services on CRWD’s Falcon platform. CrowdStrike also han an Impact Level 5 Provisional Authorization from the US Department of Defense. The company provices is a crowd-sourced security, which is software that learns from cyber attacks. The company has a threat intel platform that is spying on customer traffic. When one customer gets hit by an attempted cyber attack, CRWD sees this first attack and can strike the threat for all its customers. CRWD is about endpoint protection for PCs, laptops, iPads and mobile phones. This is defending the hardware at the end of the internet, like when Norton made famous with PC protection. On the other hand, Zscaler protects the traffic that flows. CRWD recently acquired Preempt Security and Humio. These new acquisitions put the company in two new arenas for growth: zero-trust security and data analysis. CRWD’s products are modules that can be packaged or bought separately:

Here are some of the important business highlights from last qtr:

CRWD is one of the fastest growing publicly-traded companies with great growth opportunity ahead. CRWD was the second fastest cloud-native software as a service company (SaaS) to reach over $2 billion in Annual Recurring Revenue (ARR), behind Zoom (ZI). The Estimated Long-Term Growth Rate of 39% is one of the highest in the market. And this company is profitable. CRWD is delivering cash flow, and management expects free cash flow margin to be 30% of revenue in 2023. CRWD is part of the Aggressive Growth Portfolio and Growth Portfolio. |

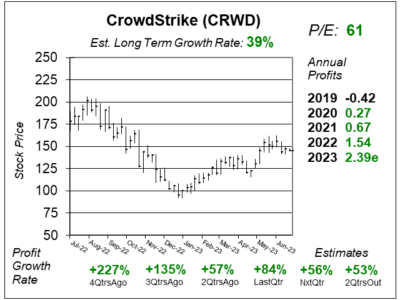

One Year Chart |

This stock is at an upwards trend after it bottomed as the year started. This stock is at an upwards trend after it bottomed as the year started.

The Est. LTG of 39% is impressive, but that figure is down from 57% last qtr. The P/E of 61 is good. The P/E was 56 last qtr. Quarterly profit growth has been excellent! Estimates for the next two quarters are solid too. Notice CRWD’s Annual Profits. Record profits each year and nice growth rates as well. |

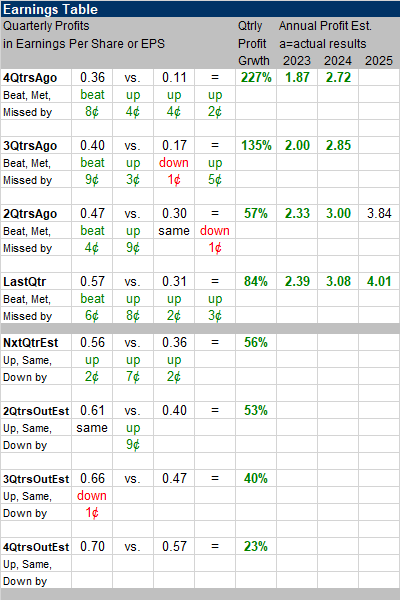

Earnings Table |

Last qtr, CrowdStrike posted 84% profit year-over-year growth and beat expectations of 42% growth. Revenue increased 42% and beat expectations of 39%, with international sales growing 53%. The company set some financial records last quarter:

Revenue growth was driven by strong demand with a great business mix between new logos and new annual recurring revenue (ARR) from cross-selling. Management highlighted various AI initiatives such as Charlotte AI, a new generative AI security analyst that uses high-fidelity security data to help lower-tier analysts deliver advanced results. The company also announced a deal with Amazon Web Services to develop new AI applications. Outside AI, CRWD released Falcon Insight for IoT, which is the world’s first endpoint detection and response (EDR) and extended detection and response (XDR) solution for Extended Internet of Things assets. Annual Profit Estimates have increased every quarter since I started covering the company in 2020 Q4. Management raised revenue guidance for this year. Qtrly Profit Estimates are for 56%, 53%, 40%, and 23% profit growth the next 4 qtrs. For next qtr, management projects revenue to grow 34% to 36%, in line with analysts’ estimates of 35%. Management said this qtr is generally the lowest for cash flow generation due to the timing of expenses, billing seasonality, and midyear purchases for employee stock purchase plan. |

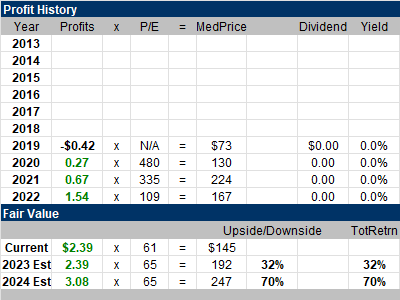

Fair Value |

The stock sells for 11x 2023 revenue estimates this qtr. My Fair Value is 15x revenue estimates. This upside is very good. The stock sells for 11x 2023 revenue estimates this qtr. My Fair Value is 15x revenue estimates. This upside is very good.

Current: 2023 Est: 2024 Est: |

Bottom Line |

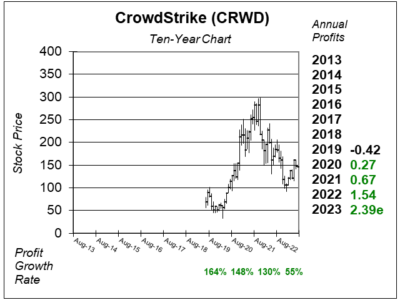

CrowdStrike (CRWD) stock has had a volatile history. But now it seems like it’s bottomed and the trend has turned up. When I look back to my CRWD 2021 Q3 research report when the shares were $271, the stock sold for 43x 2021 revenue estimates. In retrospect, forty-three times revenue was too much. CrowdStrike (CRWD) stock has had a volatile history. But now it seems like it’s bottomed and the trend has turned up. When I look back to my CRWD 2021 Q3 research report when the shares were $271, the stock sold for 43x 2021 revenue estimates. In retrospect, forty-three times revenue was too much.

Cybersecurity continues to be in strong demand. And with CrowdStrike selling at a very reasonable 11x revenue, the stock has solid upside. I’ve seen top-tier tech stocks like this have seen their valuations rise from 12x revenue to 15x revenue this past quarter as economic fears have faded. CRWD could be one of the next to make this move higher. CRWD moves up from 7th to 5th in the Aggressive Growth Portfolio Power Rankings and from 14th to 6th in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

6 of 29Aggressive Growth Portfolio 5 of 17Conservative Stock Portfolio N/A |