The stock market tumbled on Monday driven by rising yields and increasing worries over the conflict in the Middle East. The benchmark 10-year Treasury yield spiked to 4.61%, which was the highest recorded since mid-November. On the other hand, on Saturday, Iran launched drones and missiles at Israel, which also impacted investors’ sentiment.

The stock market tumbled on Monday driven by rising yields and increasing worries over the conflict in the Middle East. The benchmark 10-year Treasury yield spiked to 4.61%, which was the highest recorded since mid-November. On the other hand, on Saturday, Iran launched drones and missiles at Israel, which also impacted investors’ sentiment.

Overall, S&P 500 was down 1.2% to 5,062, while NASDAQ declined 1.8% to 15,885.

Tweet of the Day

One of my favorite once per month features in @IBDinvestors (actually, the only once per month feature in the paper). Always helpful to see where the big money in top funds has been flowing lately. Highlighting is just various growth stocks that would be popping up in ones'… pic.twitter.com/7ZqPhu2OT7

— Greg Morton (@gmorton512) April 6, 2024

Chart of the Day

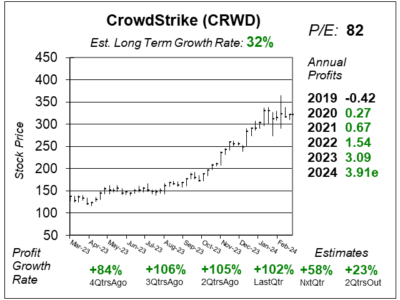

Here is the one-year chart of CrowdStrike (CRWD), as of March 19, 2024, when the stock was at $321.

Here is the one-year chart of CrowdStrike (CRWD), as of March 19, 2024, when the stock was at $321.

Last quarter, cybersecurity company CrowdStrike delivered a powerful quarter in terms of new clients. It closed more than 250 deals greater than $1 million in deal value, and more than 490 deals greater than $500,000 in deal value. This came after competitor Palo Alto Networks (PANW) claimed organizations were suffering from spending fatigue. Well, not with CrowdStrike. Deals count grew by more than 30% year-over-year across all segments.

In Falcon platform, deals with eight or more modules grew more than double year-over-year. CrowdStrike saw steadily rising win rates across the board. At the end of the day, CrowdStrike seperated itself as the true market leader in the cybersecurity space.

The stock’s Estimated Long-Term Growth Rate is a superior 32%. CRWD is part of the Aggressive Growth Portfolio and Growth Portfolio.