In just three short months, Artificial Intelligence has changed the world.

In just three short months, Artificial Intelligence has changed the world.

It started with ChatGPT revolutionizing the way articles are written — which is better than we can write them. The AI app has grown so fast it now gets 25 million visitors a day.

The brains behind AI is NVIDIA’s (NVDA) DGX, the world’s first AI supercomputer.

On the software side:

This month, Microsoft (MSFT) made news when it debut Microsoft 365 Copilot, a virtual robot that can perform tasks as an assistant in your office would.

Then news hit about Adobe’s (ADBE) Firefly, an AI image generator so advanced it can change an outdoor scene from summer to winter just by typing “change scene to winter day”.

But I think the best investments in the AI space are in hardware:

AI requires more data, which means advanced lightning fast hardware is required. Which leads us to my top two holdings, Supermicro Computer (SMCI) and Arista Networks (ANET).

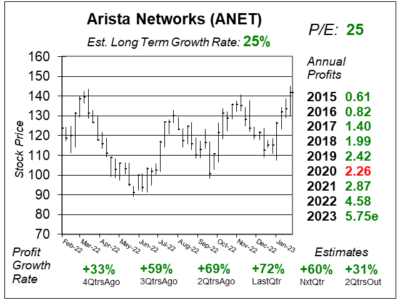

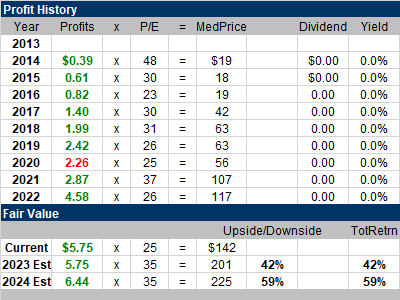

Arista Networks (ANET) could be the prime beneficiary of the advance in Artificial Intelligence (AI) because that means more data flowing. Cloud titans was Arista’s largest vertical last qtr, followed by enterprise, specialty cloud providers, financials, then service providers.

Arista Networks (ANET) could be the prime beneficiary of the advance in Artificial Intelligence (AI) because that means more data flowing. Cloud titans was Arista’s largest vertical last qtr, followed by enterprise, specialty cloud providers, financials, then service providers.

The company’s management said AI is very important to Cloud Titans, but is still a very small portion of use cases so far. The CEO added “We’re just beginning”. Still, this company is really rolling, with accelerating sales and profit growth in the last four quarters.

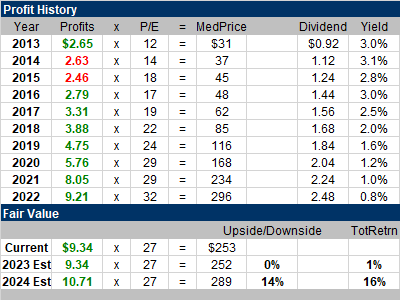

The Estimated Long-Term Growth Rate of 25% is modest. This figure was unchanged since last qtr. The P/E of 24 is really good.

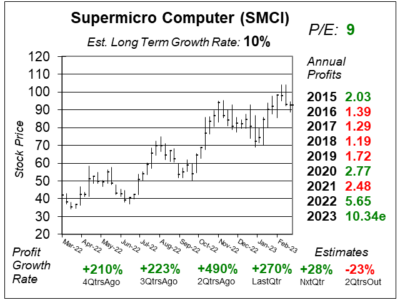

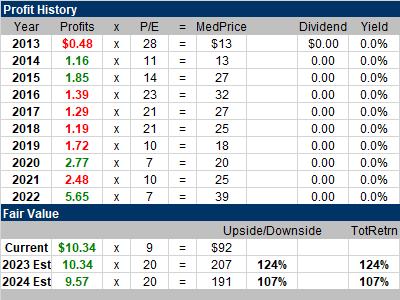

Supermicro Computer (SMCI) is one of the stock market’s top stocks as AI investments fuel growth. Last qtr, SMCI delivered EPS of $3.26 versus $0.88 a year ago, equating to 270% profit growth. Revenue climbed 54% year over year.

Supermicro Computer (SMCI) is one of the stock market’s top stocks as AI investments fuel growth. Last qtr, SMCI delivered EPS of $3.26 versus $0.88 a year ago, equating to 270% profit growth. Revenue climbed 54% year over year.

The company also announced that it is shipping its new top-of-the-line GPU servers with NVIDIA’s (NVDA) HGX H100 8-GPU system, the world’s AI supercomputer. This news helped SMCI stock to break out to new All-Time highs.

The Estimated Long-Term Growth Rate of 10% is low. This seems like a 20% grower at the very least. This stock has a P/E of only 9.

Of all the stocks I cover, SMCI has the most upside to my 2023 Fair Value.

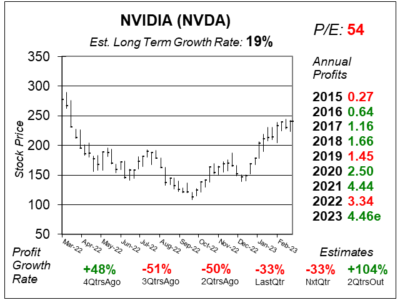

NVIDIA (NVDA) is ringing in a new era of computing with its AI capabilities. During the past few months, this advanced technology has become a reality. Now, AI is helping write articles, build life-like images and videos, perform scientific research and discover drugs. And at the center of this momentum is the NVIDIA DGX, the world’s AI supercomputer.

NVIDIA (NVDA) is ringing in a new era of computing with its AI capabilities. During the past few months, this advanced technology has become a reality. Now, AI is helping write articles, build life-like images and videos, perform scientific research and discover drugs. And at the center of this momentum is the NVIDIA DGX, the world’s AI supercomputer.

The DGX is the blueprint for AI factories worldwide. And this technology is already in full production.

- ChatGPT has gotten more than 100 million users in just a few months.

- NVIDIA partnered with Microsoft (MSFT) to bring AI to Office 365 and complete tasks like an office assistant would.

- NVIDIA also partnered with Adobe (ADBE) to bring AI to Photoshop, Premier Pro, and After Effects.

- NVIDIA also offers AI cloud services through cloud service providers including AWS and Google.

The Estimated Long-Term Growth Rate of 19% is just OK. It seems like investors expect profit growth to be much higher in the coming years. My Fair Value P/E is 45. The stock seems to be slightly overvalued. But profit estimates may rise in a big way due to AI spending.

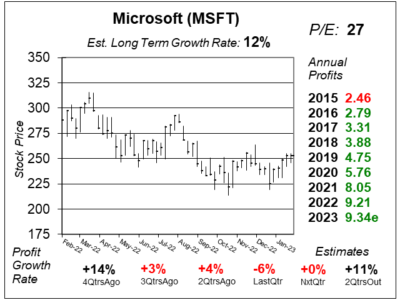

Microsoft (MSFT) was in the news the past month for its AI capabilities, but this took attention away from the fact the company’s not growing profits. Last qtr, MSFT delivered -6% profit growth on 2% revenue growth. Estimates for next qtr’s profit growth stand at 0%.

Microsoft (MSFT) was in the news the past month for its AI capabilities, but this took attention away from the fact the company’s not growing profits. Last qtr, MSFT delivered -6% profit growth on 2% revenue growth. Estimates for next qtr’s profit growth stand at 0%.

ChatGPT is a chatbot that uses vast amounts of data to answer complex questions. In January, Microsoft announced a $10 billion investment in ChatGPT maker OpenAI. It had previously invested in the company in 2019 and in 2021. Note that Microsoft is also the clue provider for OpenAI. In February, Microsoft’s management said it was going to use ChatGPT with its Bing search engine, and would shake up (and lower profit margins) throughout the industry.

This stock has been going lower, and that’s because profit growth has slowed and the stock market has been unforgiving. The Estimated Long-Term Growth Rate is 12% from 15% last qtr. Five qtrs ago, MSFT had a P/E of 36. Now, with a P/E of 27, this stock is a lot less expensive.

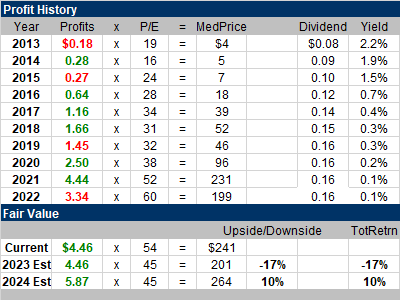

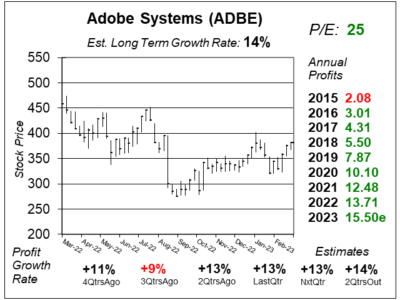

Adobe (ADBE) just launched an AI tool called Firefly that will let users type commands to quickly modify and videos.

Adobe (ADBE) just launched an AI tool called Firefly that will let users type commands to quickly modify and videos.

There are even AI movies being made that look like motion pictures. But at a fraction of the cost.

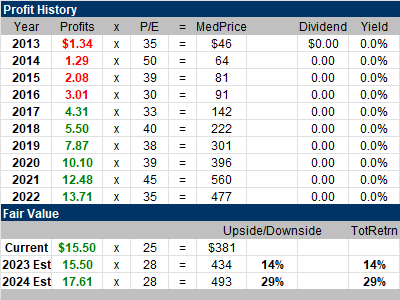

ADBE stock has been a laggard during the past year. Note in the Profit History table the P/E was 45 in 2021 as the stock had a median price of $560.

This quarter with the stock at $381 the P/E was just 25. So the valuation has been reduced, and that makes the stock more attractive in my opinion.