The stock market today closed lower due to inflation and recession concerns. S&P 500 fell 1.2% at 3854, while NASDAQ was down 2.3% at 11373.

The stock market today closed lower due to inflation and recession concerns. S&P 500 fell 1.2% at 3854, while NASDAQ was down 2.3% at 11373.

For the Founder of The School of Hard Stocks, David Sharek:

We’ve had a lot of commodity costs decline, but the big thing that continues to hurt the economy is gasoline prices, especially with e-commerce companies.

Tweet of the Day

To put into perspective how much trouble $AMZN is in, this was the march projection from Morgan Stanley on fuel cost increases yoy. They had a $13b increase on diesel costs of $3.96 per gallon. Guess how much diesel is today?

$5.63 nationally

AWS can't save that pic.twitter.com/TccofwPmyQ

— James Bulltard (@amazonholder1) July 10, 2022

Chart of the Day

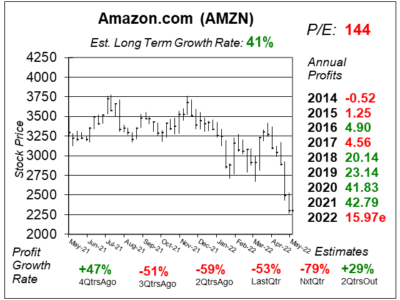

Our chart of the day is Amazon’s (AMZN) one-year chart from May 7 when the stock was $2295.

Our chart of the day is Amazon’s (AMZN) one-year chart from May 7 when the stock was $2295.

Founded in 1994, AMZN serves customers through its online and physical stores with a focus on selection, price, and convenience. The company with more than 1 million full-time and part-time employees work to deliver hundreds of millions of unique products that are sold by Amazon itself and third party sellers.

AMZN broke down in April, and the declined continued into May. There’s no bottom which I can see. Qtrly profit growth were -51%, -59%, -53% for the last three qtrs.

I sold AMZN stock from my Conservative Growth Portfolio and Growth Portfolio on March 11, 2022 ~$2910. I have the stock on my radar, but its a tough stock for me to own. As a growth stock, profits aren’t growing and sales growth is slow, so that’s a no-go. As a conservative stock, there’s little certainty in profitability, the stock isn’t trustworthy, and management has a paltry $10 billion buyback program while it issued $10 billion in stock the past 12 months. Still, the stock has a robust Estimated Long-Term Growth Rate of 35% per year, which is one of the highest amongst large enterprises. The P/E of 144 is high because profits are expected to have a one-year decline to ~$16.