Stock Market’s No Longer Overvalued

On the day, Thursday May 12, 2022, the S&P 500 lost 0.1% as the NASDAQ erased some mid-day losses and closed up less than 0.1%.

The current market condition is a downtrend. But the market could get into rally mode quite quickly (as early as Wednesday). We’ve had two 94% downside volume days in the last week-or-so, and are awaiting a +90% up day which would signify institutional money jumping in to buy “the deals of the decade”.

The S&P 500 is down 13% since the end of March. So in a mong-and-a-half we’ve dropped 13%. The S&P 500 closed at 3935 yesterday, Wednesday May 11. My Fair Value on the S&P is 3955. So the market went from overvalued to fairly valued according to my analysis.

Big Tech Stocks Feeling the Heat

Large technology companies felt the brunt of today’s stock market decline, as the Bear Market takes out the generals. “Taking out the generals” is referred to stock market declines in which the low-quality stocks go down first, then the large more-stable stocks eventually fall as well.

Big tech stocks were taking heat during the day, then rallied at the end:

- Apple (AAPL) -3% to $142

- Microsoft (MSFT) -2% to $255

- Alphabet (GOOGL) -1% to $2257

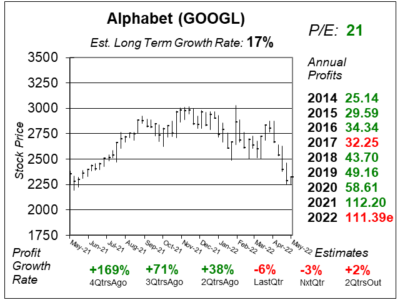

Chart of the Day

Our chart of the day is this one-year chart of Alphabet. The company had GREAT profit growth a year ago as government stimulus boosted business. Now, the company has entered a slow-growth phase.

Last qtr, profits fell 6% year-over-year. But this poor number is misleading as profit growth was a spectacular 166% in the year-ago period (not shown).

So we understand GOOGL is in a slower growth period. But the P/E of 21 makes the stock extremely inexpensive.

My Fair Value is a P/E of 28, or $3119 a share, 38% higher than where the stock closed today. GOOGL seems to have HUGE upside. But first, we need the stock market to finish its bottoming process so great stocks can get back to where they should be.