Today, April 28, 2022, the stock market jumped after good earnings were reported last night from Alphabet (GOOGL) , which was up 4% on the day, and Meta (FB), which surged 18%. Overall, the NASDAQ composite jumped 3.1% on the day, while the S&P 500 pushed 2.5% higher.

Today, April 28, 2022, the stock market jumped after good earnings were reported last night from Alphabet (GOOGL) , which was up 4% on the day, and Meta (FB), which surged 18%. Overall, the NASDAQ composite jumped 3.1% on the day, while the S&P 500 pushed 2.5% higher.

Note, even though FB jumped more than GOOGL did, I still like Alphabet better as an investment. I actually sold all my FB shares after the company reported earnings earlier this year. I feel the metaverse the company is investing in won’t be very popular as users will have to use goggles to enter the augmented reality world. With Facebook, Instagram and Whatsapp, people can use their phone, which means they can be on social media sites outside their homes.

Big Tech Names Have Low Valuations

Investors were happy with the earnings news. The stock market has been rough so far in 2022, but now many stocks have reasonable P/E ratios. I honestly think we are at a bottom here. Here’s my P/E ratios from big tech bellweathers:

- Alphabet (GOOGL) : 21

- Microsoft (MSFT): 27

- Meta (FB): 17

- Apple (AAPL): 25

Outside of Meta (which is blowing profits on a metaverse) I consider these stocks to be 15% profit growers. Not only are these reasonable valuations, I believe its “as low as they go” in a Bear Market. Thus, I think the bottom is in for this stock market correction, and although we might not go higher, at least we are past the days of deep decline.

Chart of the Day

Chart of the Day

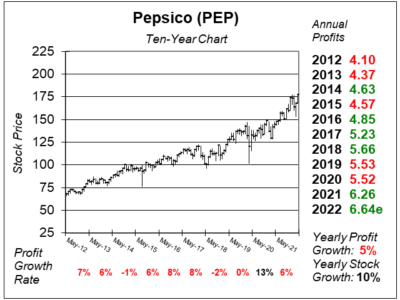

Our chart of the day is this ten-year chart of Pepsico (PEP). What’s nice about this stock is it provides safe growth while also delivering a dividend yield of close to 2.5%.

What I mean by safe growth is the company can raise prices when interest rates are high. Currently, most growth stocks are trending down due in part to higher rates. Pepsico stock is actually benefiting from higher rates as investment dollars are flowing its way.

PepsiCo’s one of the safest stocks in the world, with Standard & Poor’s credit rating of A+. Pepsico is a S&P Dividend Aristocrat and has raised the payout each year since 1973. 2022 will be the 50th year of dividend increases. Management recently announced they will implement a 7% dividend increase in June 2022 which will take the dividend from $4.30 to $4.60 per share, per year. Management also buys back stock to boost EPS.