Stock (Symbol) |

Wingstop (WING) |

Stock Price |

$365 |

Sector |

| Food & Necessities |

Data is as of |

| March 5, 2024 |

Expected to Report |

| May 1 |

Company Description |

Wingstop Inc. is a fast-casual chicken wings-focused restaurant chain, with over 1,600 locations across the world. Wingstop Inc. is a fast-casual chicken wings-focused restaurant chain, with over 1,600 locations across the world.

The Company is in the business of franchising and operating Wingstop restaurants. The Company is primarily a franchisor, with approximately 98% of its restaurants owned and operated by independent franchisees. It offers classic wings, boneless wings, and tenders, always cooked to order, and hand-sauced-and-tossed in about 11 distinctive flavors. It offers various order options, including eat-in, to-go, individual, combo meals, and family packs. It also developed a custom Website and mobile ordering application. It has approximately 1,461 domestic franchised restaurants and 180 international franchised restaurants. It owns and operates approximately 32 restaurants. Source: Refinitiv |

Sharek’s Take |

Wingstop (WING) stock has doubled in just six months as investors love what the company has been cooking up. What’s cooking is same store sales, which clocked in at an impressive 21% last quarter. The company is benefiting from a new relationship with Uber Eats for delivery and the new chicken sandwich with eleven tasty flavors. What differentiates it from other restaurants is is can be dipped in a sause after frying, and it comes with a side of sauce. I like hot chicken and cheese sauce on the side. Customers like Wingstop’s boneless items, which now make up 47% company sales. Wingstop (WING) stock has doubled in just six months as investors love what the company has been cooking up. What’s cooking is same store sales, which clocked in at an impressive 21% last quarter. The company is benefiting from a new relationship with Uber Eats for delivery and the new chicken sandwich with eleven tasty flavors. What differentiates it from other restaurants is is can be dipped in a sause after frying, and it comes with a side of sauce. I like hot chicken and cheese sauce on the side. Customers like Wingstop’s boneless items, which now make up 47% company sales.

Here are some stats from last qtr:

Wingstop is the largest fast-casual chicken wing-focused restaurant chain in the world. As of December 2023, the company has 2,214 restaurants in operation with 98% of them being franchises. Wingstop grew its restaurants 13% in 2023, and opened 255 new units. Management’s vision is to become a top 10 global restaurant brand, with a goal of 4000 restaurants in the U.S. and another 3000 Internationally. Management is determined to become one of the world’s largest restaurant chains and has been spending on International consultants to do it correctly. WING recently launched in two new International markets: Canada and South Korea. The company previously entered the UK. Here are some company stats as of Fiscal 2023:

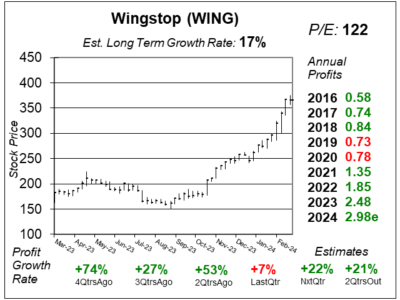

WING stock has an Estimated Long-Term Growth Rate of 17% a year, but the company seems to have the ability to grow profits by 25% to 35% a year. Investors certainly think the growth opportunity is big as they have given the stock a lofty P/E of 122. Management tries to return 40% of free cash flow to investors via quarterly dividends. WING also pays occasional big one-time dividends and does stock buybacks. WING is part of the Growth Portfolio. The big picture here is the company has around 2200 locations now, with a potential of 7000 locations long-term. |

One Year Chart |

This stock surged after the company announced profits two quarters ago. Now the stock has gone parabolic, and it would be dangerous to buy now. This stock surged after the company announced profits two quarters ago. Now the stock has gone parabolic, and it would be dangerous to buy now.

This stock always has a high P/E. But this 122 P/E is out of the normal range, which you can see here. I was lucky to buy WING for investors on a “dip” during the COVID panic on March 20, 2020 at ~$64. The P/E was 71 at the time. The Est. LTG of 17% seems low. Store growth is around 12% a year and if same store sales grow 10% a year that would be revenue growth above 25%. Then efficiencies of having a larger brand could take profit growth above 30%. Qtrly profit growth is always erratic. Last quarter the company had some one-time expenses that took profit growth down to 7%, but I’m not concerned. |

Earnings Table |

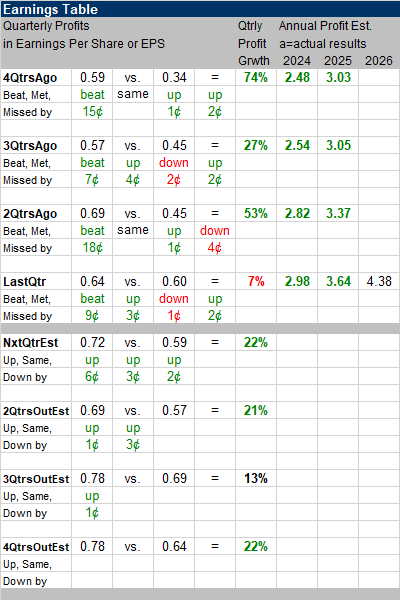

Last qtr, Wingstop delivered 7% profit growth beyond estimates of -8% growth. Revenue increased 21%, year-on-year and beat estimates of 13%. Sales increased 25% sparked by 21% domestic same store sales growth. Cost of sales decreased to 75.1% versus last year’s 76.4% due to lower costs for labor and operating expenses. Last qtr, Wingstop delivered 7% profit growth beyond estimates of -8% growth. Revenue increased 21%, year-on-year and beat estimates of 13%. Sales increased 25% sparked by 21% domestic same store sales growth. Cost of sales decreased to 75.1% versus last year’s 76.4% due to lower costs for labor and operating expenses.

SProfits were Weak because Selling, General, & Administrative expenses soared 54% due to increases in professional fees, stock options, and higher headcount due to rapid store openings. Revenue growth is driven by the momentum of growth in Uber Eats which helped transaction growth, brought new guests, and increased menu exploration. Boneless mix is now 47%. Annual Profit Estimates increased across the board. For 2024, management expects to open 270 new stores globally, representing 12% growth. Estimates are for 22%, 21%, 13%, and 22% profit growth in the next 4 qtrs. Analysts believe Wingstop revenue will grow 13% next quarter. |

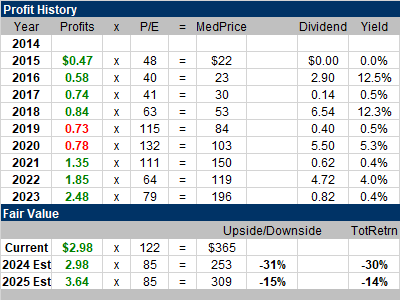

Fair Value |

WING has historically had a high P/E. It’s a young company with a huge market to penetrate (especially in Europe). WING has historically had a high P/E. It’s a young company with a huge market to penetrate (especially in Europe).

My Fair Value P/E is 85. My guess is the stock should be $253 in 2024. But the shares are $365 as the stock has been flying higher. WING has paid some HUGE one-time dividends. In the past, management issued debt and used part of the proceeds to reward shareholders with big dividends, in 2016, 2018, 2020, and 2022. The last special dividend was $4 a share paid on 4/7/2022. |

Bottom Line |

Wingstop (WING) has been an excellent investment since it opened for trading in $24 in June 2015. But the stock is prone to big swings in price. Wingstop (WING) has been an excellent investment since it opened for trading in $24 in June 2015. But the stock is prone to big swings in price.

This company has a lot of growth opportunity. But the shares have gone parabolic so I wouldn’t be a big buyer up here. WING dips from 27th to 29th in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

29 of 31Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |