The stock market closed higher on Friday and posted its 5th straight winning week. Federal Reserve Chair Jerome Powell gave a signal that the central bank is likely done raising interest rates.

The stock market closed higher on Friday and posted its 5th straight winning week. Federal Reserve Chair Jerome Powell gave a signal that the central bank is likely done raising interest rates.

Overall, S&P 500 and NASDAQ both grew 0.6% to 4,595 and 14,305, respectively.

Tweet of the Day

The Magnificent 7 stocks — Alphabet $GOOGL, Amazon $AMZN, Apple $AAPL, Meta $META, Microsoft $MSFT, NVIDIA $NVDA and Tesla $TSLA — have done well. Can they climb higher?

— SchoolofHardStocks (@SchoolHardStock) December 1, 2023

Chart of the Day

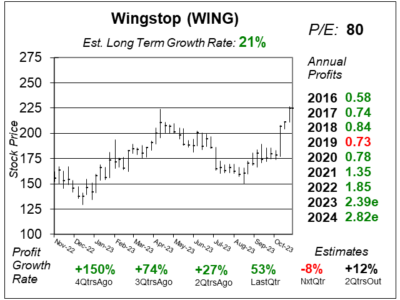

Here is the one-year chart of Wingstop (WING) as of November 15, 2023, when the stock was at $224.

Here is the one-year chart of Wingstop (WING) as of November 15, 2023, when the stock was at $224.

Wingstop is the largest fast-casual chicken wing-focused restaurant chain in the world. As of December 2022, the company had 1959 restaurants in operation with 98% of them being franchises. Management’s vision is to become a top 10 global restaurant brand, with a goal of 4000 restaurants in the U.S. and another 3000 internationally.

Wingstop delivered blowout results last quarter that whipped analyst estimates. The restaurant delivered 53% profit growth that beat analyst estimates of 13%, while revenue jumped 26% and beat estimates of 17%. Domestic same-store sales surged 15%. If a retailer has same-store sales growth of 10% or greater, David Sharek feels that stock is top-tier. The notable drivers of sales include the successful launch of Uber Eats and the chicken sandwich. Profit growth was primarily fueled by increased transactions. This strong momentum has prompted an upward revision in guidance, with management now targeting around 16% domestic same-store sales growth for 2023.

WING is part of the Growth Portfolio. The big picture here is that the company has less than 2000 locations now, with a potential of 7000 locations long-term.