The stock market finished mixed on Tuesday, as latest retail sales data exceeded estimates.

The stock market finished mixed on Tuesday, as latest retail sales data exceeded estimates.

Retail sales rose 0.7% in September from the previous month, more than the 0.3% estimate. The growth was driven by consumers’ expenditure on gas despite rising oil prices, showing resilience.

Overall, S&P 500 was flat at 4,373, while NASDAQ declined 0.3% to 13,534.

Tweet of the Day

BREAKING: The United States has just restricted sales of Nvidia, $NVDA, chips to China.

The Commerce Department said exports of AI chips would be "significantly" restricted.

The goal is to limit China's "access to advanced semiconductors that could fuel breakthroughs in AI."… pic.twitter.com/mocZJSzgVv

— The Kobeissi Letter (@KobeissiLetter) October 17, 2023

Chart of the Day

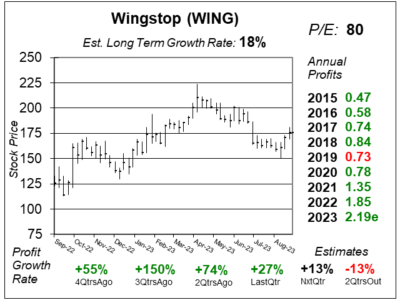

Here is the one-year chart of Wingstop (WING) as of September 20, 2023, when the stock was at $175.

Here is the one-year chart of Wingstop (WING) as of September 20, 2023, when the stock was at $175.

Wingstop is the largest fast-casual chicken wing-focused restaurant chain in the world. As of December 2022, the company had 1,959 restaurants in operation with 98% of them being franchises. Management’s vision is to become a top 10 global restaurant brand, with a goal of 4,000 restaurants in the U.S. and another 3,000 internationally.

Wingstop recorded impressive results last quarter, with profits up 28% on 28% sales growth. Domestic same-store sales (SSS) grew 17%. Management says all of its SSS growth last quarter was led by transaction growth.

Afterwards, management upped 2023 estimates SSS growth to 10% to 12%. What is boosting store growth is delivery, where the company sees the potential to boost its deliveries from 30% of sales to greater than 50%. In addition, the strong sales growth is pushing up individual restaurant sales. The company’s domestic Average Univ Volume (AUV) was $1.61 million in 2022. This increased to $1.7 Million last quarter, and management has its sights on $2 million shortly.

WING is part of the Growth Portfolio. The big picture here is the company has less than 2000 locations now, with a potential of 7000 locations long-term.