The stock market dropped on Thursday as indices are trying to find their footing after a higher-than-expected August’s inflation report.

The stock market dropped on Thursday as indices are trying to find their footing after a higher-than-expected August’s inflation report.

Overall, S&P 500 fell 1.1%t to 3,901, while NASDAQ declined 1.4% to 11,552.

The big news of the day was Adobe (ADBE) acquiring design software Figma for $20 billion in cash and stock. Figma allows design teams to collaborate on designs, such as images ans websites.

Tweet of the Day

Our Tweet of the Day is denom David Sharek, who thinks ADBE is a deal now.

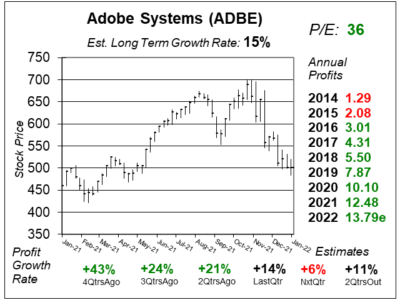

Yes, I agree a P/E of 20 is attractive. I would know, I'm an expert on the stock.

I bought in for clients in my Growth Portfolio ~$100 in Jan 2016 and sold ~$500 in Jan 2022.

Here's my Fair Value on the stock as of last qtr (will update spreadsheets later this month). $ADBE pic.twitter.com/hhU5S7yJOq

— David Sharek (@GrowthStockGuy) September 15, 2022

Charts of the Day

Our charts of the day are one-year charts of Adobe (ADBE) on:

- January 24, 2016 when the stock was around $94

- January 26, 2022 when the stock was around $501

These are the charts around when David Sharek bought and sold the ADBE stock in his Growth Portfolio. That was a great trade, and the stock went up 5x in six years.

But not all his moves are good, as he want on to add ADBE in his Conservative Growth Portfolio on the same day he sold it from the other portfolio.

ADBE’s software is making the internet work from videos, images, movies, eCommerce to marketing. On Thursday, ADBE announced plans for a $20 billion acquisition of online design startup Figma to expand its hybrid-work-friendly platforms.

Figma is design platform that allows team members all around the world to see — and make — the design changes going on in image or video in real time. It’s one of the best software companies around. Microsoft employees love it.

So instead of having one file on one computer, Figma has control of the file and allows everyone to change it at the same time. Figma will link with other Adobe products and make them better as it will allow everyone to colaberate.

Seriously, Figma was serious competition for Adobe. I think this is a great buy long-term as it took away an Adobe competitor. Basically, ADBE said “if you can’t beat ’em, join ’em”.

Its estimated that Figma is doing around $400 million in sales this year, so the company was sold for 50x revenue, an extremely high valuation. At this time (in a Bear Market after a rally) top software stocks are selling for around 20x revenue. That tells me Figma wasn’t interested in selling, but Adobe’s offer blew them away. But on the other hand, Figma was estimated to be doubling sales every year, so did it sell for 25x 2023 revenue estimates of $800 million? That’s a more reasonable valuation.

— David Sharek, Stock Portfolio Manager, Sharek’s Stock Portfolios

ADBE is currently part of the Conservative Growth Portfolio.

David Sharek’s Fair Value P/E moved down from 38 last qtr to 32 this qtr, which is $433 a share for 2022.

ADBE stock fell from $372 to $309 today. It now has a P/E of only 20.