The stock market rose on Tuesday as the Federal Reserve began its two-day policy meeting. The central bank is expected to keep rates unchanged on Wednesday. However, investors were concerned on keeping higher interest rates for an extended period due to recent hotter inflation reports.

The stock market rose on Tuesday as the Federal Reserve began its two-day policy meeting. The central bank is expected to keep rates unchanged on Wednesday. However, investors were concerned on keeping higher interest rates for an extended period due to recent hotter inflation reports.

Overall, S&P 500 grew 0.6% to 5,179, while NASDAQ increased 0.4% to 16,167.

Tweet of the Day

Wingstop $WING Stock Soars as Same-Store Sales Rise for 20th Straight Year

— SchoolofHardStocks (@SchoolHardStock) March 17, 2024

Chart of the Day

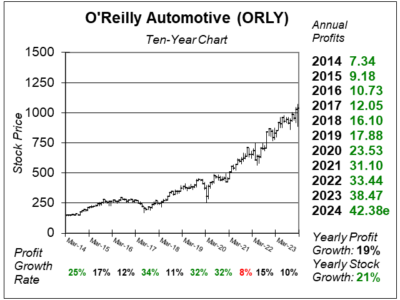

Here is the ten-year chart of O’Reilly Automotive (ORLY) as of February 20, 2024, when the stock was at $1,036.

Here is the ten-year chart of O’Reilly Automotive (ORLY) as of February 20, 2024, when the stock was at $1,036.

O’Reilly Automotive went into Fiscal 2024 warning investors business would come in lighter than 2023. That’s logical, as the auto parts store had been benefiting from higher auto parts prices due to inflation. Looking ahead, the company expects just 1% inflation in terms of product prices (SKUs) and analysts powered profit estimates a bit. Profit estimates for 2024 are now $42.38, down from $42.63 a quarter ago. Still, profit growth is expected to average 11% a quarter the next four quarters, which is good. Perhaps, the company can beat the street and deliver 13-15% profit growth in 2024.

ORLY is part of the Conservative Growth Portfolio.