The stock market closed mixed on Thursday to close their best month this year as investors continued to hope on a interest rate cut. Data also showed that October’s Personal Consumption Expenditure (PCE) index, the Federal Reserve’s preferred inflation measure, rose 3.5% year-on-year. This was slower than the 3.7% annual gain recorded in the previous month.

The stock market closed mixed on Thursday to close their best month this year as investors continued to hope on a interest rate cut. Data also showed that October’s Personal Consumption Expenditure (PCE) index, the Federal Reserve’s preferred inflation measure, rose 3.5% year-on-year. This was slower than the 3.7% annual gain recorded in the previous month.

Overall, S&P 500 grew 0.4% to 4,568, while NASDAQ fell 0.2% to 14,226.

Tweet of the Day

The QQQ reversal yesterday and the continuation today is telling that the best of the rally is over. Time to take profits and reduce your invested position.

— David Ryan (@dryan310) November 30, 2023

Chart of the Day

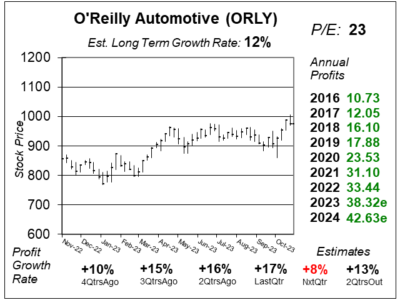

Here is the one-year chart of O’Reilly Automotive (ORLY) as of November 15, 2023, when the stock was at $973.

Here is the one-year chart of O’Reilly Automotive (ORLY) as of November 15, 2023, when the stock was at $973.

O’Reilly Automotive is an automotive parts chain that was founded in 1957 from a single store in Missouri. As of end-2022, the company had a total of 5,929 domestic stores and 42 stores in Mexico. Domestic stores are served primarily by the nearest distribution centers but also have same-day access to the inventory available at Hub stores that redistribute products to surrounding stores. Customers are both do-it-yourself (DIY) and professional service provider.

With consumers having less money to spend these days due to high interest rates, O’Reilly Automotive (ORLY) delivered an impressive performance last quarter with 17% profit growth on 11% sales growth. Same-store sales increased an impressive 9% during the quarter. O’Reilly Automotive also continued to deliver profit growth at mid-teens rate as it got more sales store, coupled with increasing store count. The company is on track to achieve its goal of 180-190 new store openings (net) for 2023. It also announced a target of 190-200 new store openings (net) for 2024. These include expansion projects in Guadalajara, Mexico, as well as distribution centers in Atlanta and Stafford, Virginia.

ORLY is part of the Growth Portfolio and Conservative Growth Portfolio.