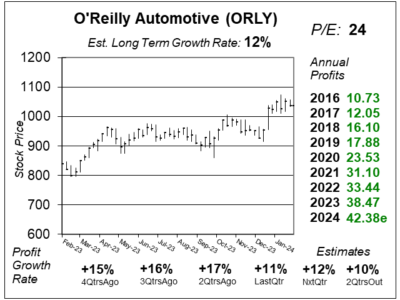

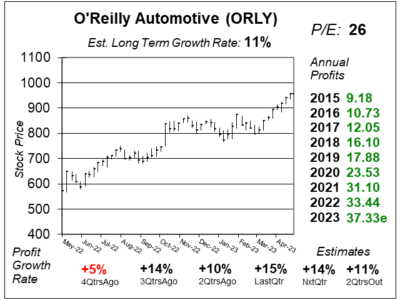

O’Reilly Automotive (ORLY) Lowers Profit Estimates Heading into Fiscal 2024

O’Reilly Automotive (ORLY) lowered profit estimates heading into 2024, as inflation on auto parts isn’t what it used to be.

O’Reilly Automotive (ORLY) lowered profit estimates heading into 2024, as inflation on auto parts isn’t what it used to be.

High interest rates are causing consumers to hang onto their old cars longer, which is good for O’Reilly Automotive (ORLY).

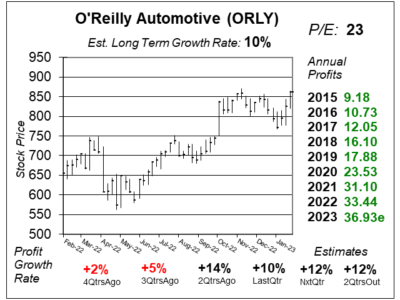

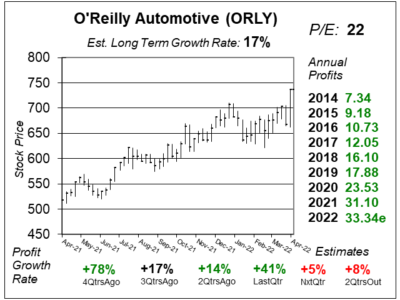

O’Reilly (ORLY) delivered a solid quarter with 16% profit growth on 11% sales growth, and has opened 100 new stores so far this year.

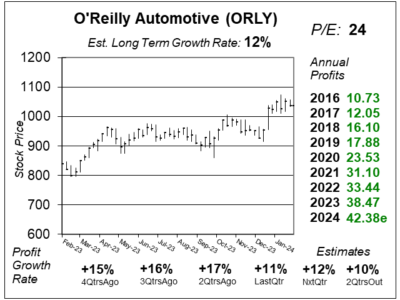

O’Reilly Automotive (ORLY) continues to deliver doubld-digit growth as the average age of US vehicles is greater than 13 years.

With the economy tight, new car sales are sluggish. Maybe its better to repair the existing car with parts from O’Reilly (ORLY).

O’Reilly Automotive (ORLY) beat the street last qtr as warm Summer weather makes it easier for do-it-yourselfers to fix their cars.

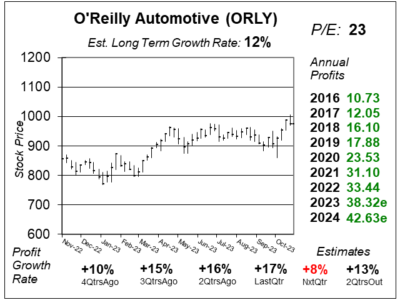

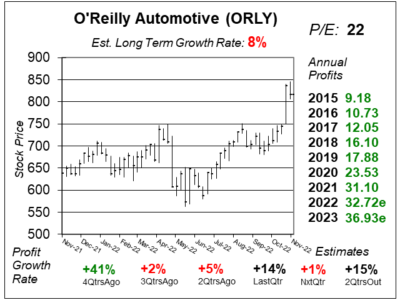

High inflation and fuel prices have hurt O’Reilly Automotive’s (ORLY) do-it-yourself (DIY) customers, and in turn ORLY’s profits.

O’Reilly Automotive (ORLY) is expected to do well during recessions. So why did the company miss profit estimates last qtr?

O’Reilly Automotive (ORLY) broke out to a new All-Time high this week as recession fears could lead to people fixing their old cars.

In one of my biggest bone-headed moves ever, I sold O’Reilly Automotive (ORLY). Then the stock doubled.

O’Reilly Automotive (ORLY) has tanked after it reported earnings the past two qtrs. The P/E is now just 17, way below the 28 it used to be. But is this industry done?

O’Reilly Auto Parts (ORLY) tanked after it missed last qtr’s profit estimates badly. Now investors are questioning the entire industry.

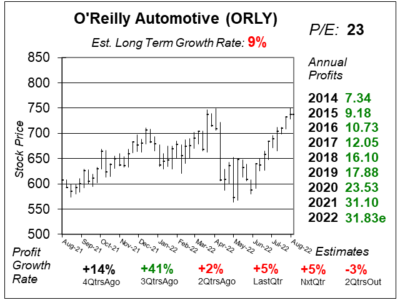

Although the stock hasn’t gone anywhere for a year, O’Reilly Automotive (ORLY) continues to post solid results in a good environment for auto parts.

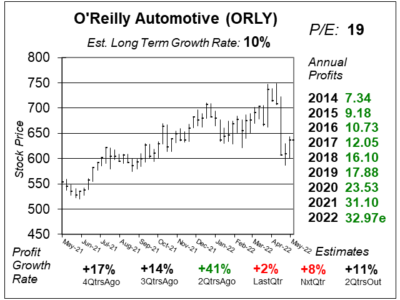

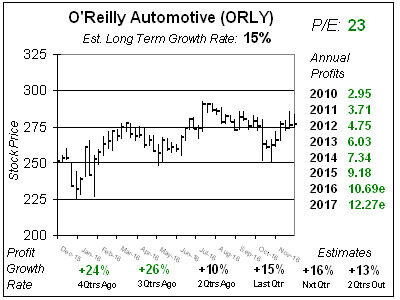

O’Reilly Automotive (ORLY) had been a superior stock since 2009 as profits grew more than 20% a year annually. Now I expect more normalized growth from ORLY.

My research shows O’Reilly Automotive (ORLY) profits grew just 10% last qtr, but the company claims 16%. Let’s see if growth is truly slowing.

With Summer driving Season upon us, low gas prices and hot weather should mean continued success for O’Reilly Automotive (ORLY).

O’Reilly Automotive (ORLY) has a secret sauce that’s helped the company grow profits 20% of more for the past seven years.

O’Reilly Automotive (ORLY) is as solid as they come, and I will add it to the Conservative Portfolio on this dip.

O’Reilly Automotive (ORLY) is clicking on all cylinders, and is a safe play on long-term growth if you get it on a dip.

O’Reilly Automotive (ORLY) is having continued success, and it shows in ORLY’s stock price.

With low gas prices this Summer will be great to travel, leading to more parts sales for O’Reilly Automotive (ORLY).

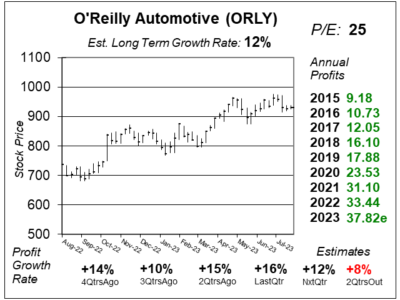

Shares of O’Reilly Auto (ORLY) continued to perform better than I ever expected. Here’s my 2015 outlook.

O’Reilly Automotive (ORLY) is clicking in all cylinders, but is 20% upside to 2015’s Fair Value worth holding ORLY?

O’Reilly Automotive (ORLY) is at the top o’ its trading range and I don’t think it has enough juice to push higher.

O’Reily Automotive (ORLY) is benefiting from these snowstorms we have been having. Here’s what I think about ORLY stock.

Shares of O’Reilly Automotive (ORLY) keep rollin down the highway. Here’s my take on where the destination lies:

O’Reilly Automotive (ORLY) is clicking on all cylinders right now. The problem with ORLY is the stock is selling at historic highs.

O’Reilly Automotive (ORLY) is at all-time highs as the company keeps growing its store base, same store sales, and buys back stock.

Today I will buy O’Reilly Automotive (ORLY) for the Growth Portfolio. ORLY is set to report tonight, and whipped est last qtr.

O’Reilly Automotive (ORLY) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $9.24 vs. $8.28 = +12%

Revenue Est: +7%