Stocks closed lower on Tuesday, rounding out a tough month of February for the stock market. Major indexes ended February in the red after a promising start in January.

Stocks closed lower on Tuesday, rounding out a tough month of February for the stock market. Major indexes ended February in the red after a promising start in January.

Overall, S&P 500 declined 0.3% to 3,970, while NASDAQ fell 0.1% to 11,456.

Meanwhile, O’Reilly Automotive (ORLY) is a well-oiled machine. It builds new stores, buys back stock, and makes acquisitions then goes into these old auto parts stores and makes them more efficient. Another company that buys back a lot of stock is AutoZone (AZO).

Tweet of the Day

We get a lot of praise for our charts, so we decided to compile 25 of our own favorites in a monster thread.

Let's dig in! 🧵

1. $AZO has over the last two decades repurchased ~80% of its shares outstanding. We have visualized the value creation on a per share basis: pic.twitter.com/x903PesUn1

— Quartr (@Quartr_App) February 28, 2023

Chart of the Day

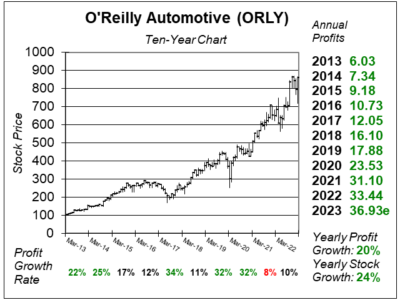

Here is the ten-year chart of ORLY as of February 15, 2023, when the stock was at $861.

Here is the ten-year chart of ORLY as of February 15, 2023, when the stock was at $861.

O’Reilly Automotive is an automotive parts chain that was founded in 1957 from a single store in Missouri. As of December 2022, the company had a total of 5,929 domestic stores and 42 stores in Mexico.

The company is in a good environment for growth, as Americans are tight on cash with (1) high food prices, (2) high credit card rates, and (3) the economy feels like we are in a slight recession. But ORLY doesn’t need a poor economy to grow, its grown same-store sales (SSS) in each of the last 30 years.

In 2022, O’Reilly grew SSS 6%. That’s a good number considering SSS rose 13% in 2021 and 11% in 2020.

ORLY is part of the Growth Portfolio.