The stock market closed higher on Thursday amid latest sign that inflation is easing.

The stock market closed higher on Thursday amid latest sign that inflation is easing.

The March producer price index fell 0.5% in March and rose just 2.7% over the prior year. Such confirmed that inflation is easing based on March’s CPI report.

Overall, S&P 500 rose 1.3% to 4,146, while NASDAQ was up 2.0% to 12,166.

Tweet of the Day

The ISM Manufacturing Index has declined to 46.3, its lowest reading since May 2020.

In the past 70 years, whenever manufacturing ISM dropped below 45, recessions occurred on 11 out of 12 occasions (exception was 1967). $SPX $QQQ $DJIA $AAPL pic.twitter.com/NrZjKdxFxq

— David Marlin (@Marlin_Capital) April 13, 2023

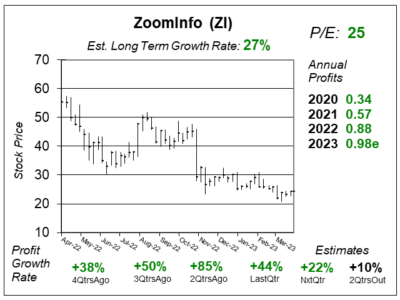

Chart of the Day

Our chart of the day is the one-year chart of ZoomInfo (ZI) as of March 29, 2023, when the stock was at $24.

ZoomInfo’s cloud-based platform provides comprehensive sales and marketing information on organizations and professionals that work within them. It has data on over 100 million companies, including technologies used and decision maker contact information, and over 150 million professionals worldwide. This data is bought by large companies who can utilize the platform to make contact with others in the business world, i.e. make sales calls.

ZoomInfo continues to grow at a brisk pace, but its tough sledding in this weak economy as companies are laying off employees. Less sales staff theoretically means fewer people would be available to utilize ZoomInfo’s marketing platform.

ZI stock is weak even though the numbers are good. The shares are still in a downtrend – not a good looking chart. However, David Sharek likes that profit growth was a solid 44% last quarter.

ZI used to be in the Aggressive Growth Portfolio, but he sold the stock due to the weak environment for software. He’d like to buy ZI for the Growth Portfolio when economic conditions improve.