ZoomInfo (ZI) Plunges to an All-Time Low as Sales Teams are Getting Cut

ZoomInfo’s (ZI) is dealing with horrible economic conditions for its sales software. ZI is a stock to watch when advertising picks up.

ZoomInfo’s (ZI) is dealing with horrible economic conditions for its sales software. ZI is a stock to watch when advertising picks up.

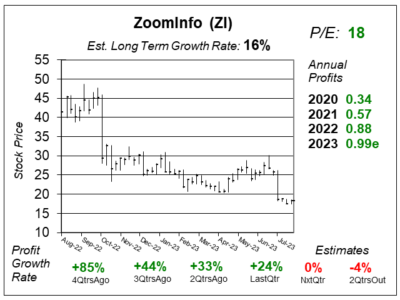

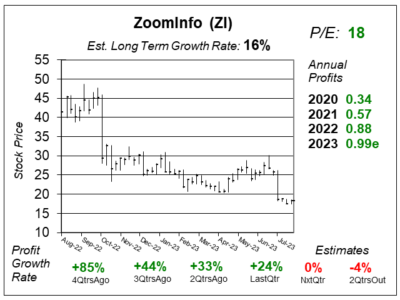

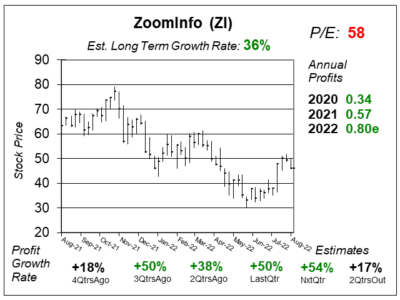

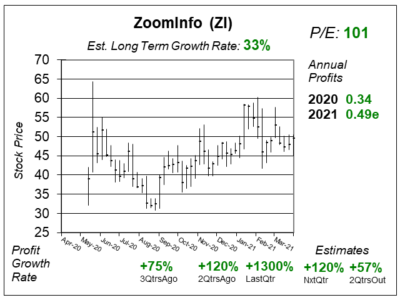

ZoomInfo’s (ZI) sales and profit growth has been simmering down due to a weak economy forcing customers to layoff employees.

ZoomInfo’s (ZI) customers are laying off sales staff as they cut spending, so there may be less demand for ZI’s marketing software.

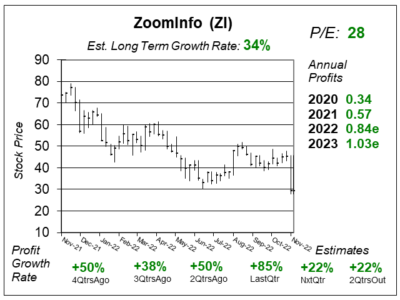

ZoomInfo (ZI) stock dropped lowered 2023 revenue estimates as it sees macro pressure on deals. Software is a weak sector (now).

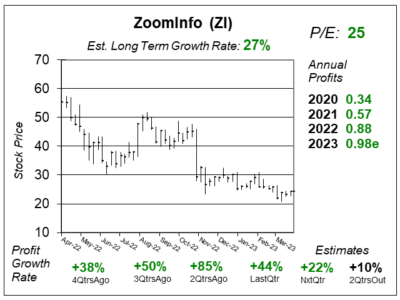

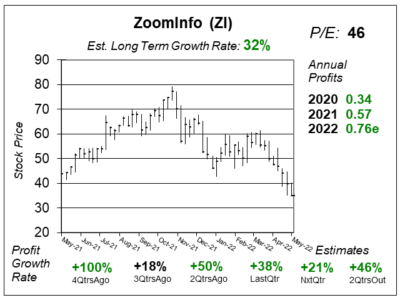

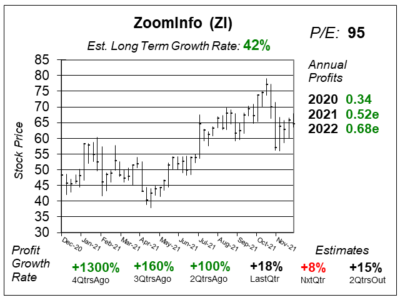

We’ve covered ZoomInfo (ZI) since 2020 Q4, and every quarter since then the company has delivered at least 50% revenue growth.

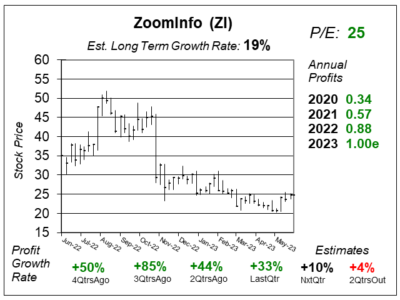

ZoomInfo (ZI) just delivered a solid quarter, but the stock’s gotten hammered as the Bear Market is punishing software stocks.

ZoomInfo (ZI) is setting up nicely to become a leader in the next Bull Market. A close above $60 would be a buy signal.

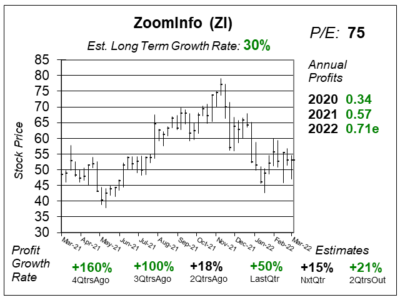

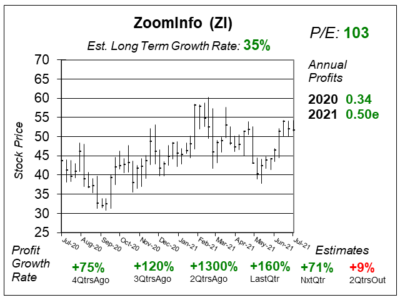

ZoomInfo’s (ZI) software platform provides info on organizations and those who work in them, perfect for making sales calls.

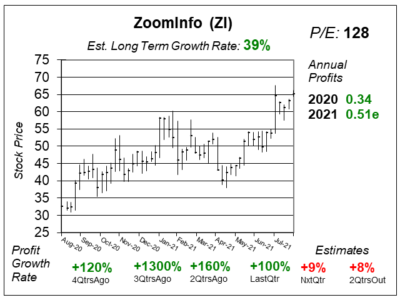

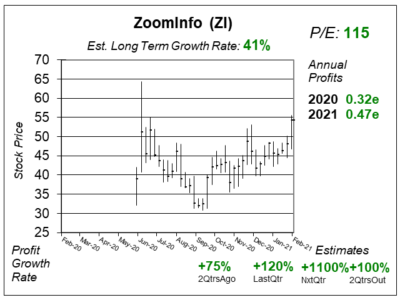

ZoomInfo (ZI) is emerging as a young stock market leader, as its software for locating business contacts is in high demand.

Contact info company ZoomInfo (ZI), a little-known stock in the investment world, is growing 50% a year. Impressive.

ZoomInfo (ZI) is the NEW way to market as the company utilizes AI to derive information on organizations and employees.

ZoomInfo (ZI) might be the missing peice that organizations need to get for thier marketing teams to be successful.