The stock market ended its three-day losing streak on Wednesday as Federal Reserve Chair Jerome Powell confirmed a slower rate hike in December.

The stock market ended its three-day losing streak on Wednesday as Federal Reserve Chair Jerome Powell confirmed a slower rate hike in December.

The central bank is expected to deliver a 50-basis-point rate hike at its next meeting on December 14.

Overall, S&P 500 increased 3.1% to 4,080, while NASDAQ was up 4.4% to 11,468.

Tweet of the Day

A #MysteryBroker update. To recap: MB in recent months has been firmly in the peak-inflation/peak-yield camp, seeing value in Treasuries, believing the Fed was in the process of overtightening into a recession, while seeing the makings of a tactical equity rally in mid-Oct.

— Michael Santoli (@michaelsantoli) November 30, 2022

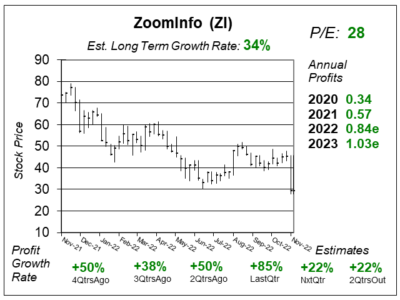

Chart of the Day

Our chart of the day is the one-year chart of ZoomInfo (ZI) as of November 5, 2022, when the stock was at $29.

ZoomInfo’s cloud-based platform provides comprehensive sales and marketing information on organizations and professionals that work within them. This data is bought by large companies who can utilize the platform to make contact with others in the business world, i.e. make sales calls.

ZI stock took a hit after the company reported last qtr’s earnings. The reason was management stated in the earnings call that its beginning to see macroeconomic pressure on deals, causing such to be reviewed more closely by management, and that sales cycles have elongated.

ZI stock had been in the mid-$40s prior to this news, and went down to high-$20s. Looking at the numbers, 2023 revenue growth is expected to slow to 26%, down from prior estimates of 31%. This “slowing growth” isn’t bad, but the software sector as a whole is suffering as businesses brace for a recession.

David Sharek, Founder of The School of Hard Stocks, is valuing the stock on a price-to-revenue basis since this is a young company. His Fair Value is 10x revenue.

ZI is part of the Aggressive Growth Portfolio, but he sold it today as software stocks could be weak for many months.