The stock market ended almost flat on Wednesday as the Federal Reserve put its rate hiking campaign on pause. However, the central bank projected to have two more rate hikes this year. In addition, Chair Jerome Powell commented that a rate cut is improbable.

The stock market ended almost flat on Wednesday as the Federal Reserve put its rate hiking campaign on pause. However, the central bank projected to have two more rate hikes this year. In addition, Chair Jerome Powell commented that a rate cut is improbable.

Overall, S&P 500 was slightly up 0.1% to 4,373, while NASDAQ closed 0.4% higher to 13,626.

Tweet of the Day

Business Insider drove the new Toyota bZ4X EV from New York to Washington DC, and back. The 9 hour drive involved 3 hours of charging. Even at 37%, the bZ4X refused to pull more than 35 kW charging speed.

A Model Y would need to charge a total of maybe ~30 mins the entire trip. pic.twitter.com/86F12HTgOX

— Sawyer Merritt (@SawyerMerritt) June 14, 2023

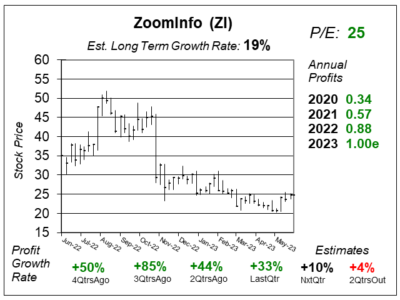

Chart of the Day

Here is the one-year chart of ZoomInfo (ZI) as of May 31, 2023, when the stock was at $25.

Here is the one-year chart of ZoomInfo (ZI) as of May 31, 2023, when the stock was at $25.

ZoomInfo’s cloud-based platform provides comprehensive sales and marketing information on organizations and professionals that work within them. It has data on over 100 million companies, including technologies used and decision maker contact information, and over 150 million professionals worldwide. This data is bought by large companies who can utilize the platform to make contact with others in the business world, i.e. make sales calls.

ZoomInfo continues to deliver strong (yet slowing) profit and revenue growth despite challenging macroeconomic conditions. Profit grew 33% last quarter, a noticeable slowdown from 44% growth two quarters ago, and 85% growth three quarters ago. Revenue increased 24% y.o.y. which was a slowdown from 36% two quarters ago, and 46% three quarters ago.

Management had anticipated lower revenues due to the layoffs in the software sector and increased customer scrutiny which has elongated sales cycles.

ZI used to be in the Aggressive Growth Portfolio, but David Sharek, Founder of School of Hard Stocks, sold the stock due to the weak environment for software. He would like to buy ZI for the Growth Portfolio when economic conditions improve.