The stock market contracted on Wednesday as inflation data for March was hotter than expected. Consumer Price Index rose 0.4% from last month and 3.5% year-over-year. This was against expectations of 0.3% monthly and 3.4% yearly increase. Following this, investors sentiment toned down and they are not expecting fewer rate cuts this year.

The stock market contracted on Wednesday as inflation data for March was hotter than expected. Consumer Price Index rose 0.4% from last month and 3.5% year-over-year. This was against expectations of 0.3% monthly and 3.4% yearly increase. Following this, investors sentiment toned down and they are not expecting fewer rate cuts this year.

Overall, S&P 500 declined 1.0% to 5,161, while NASDAQ fell 0.8% to 16,170.

Tweet of the Day

Broadcom’s $AVGO Alternative #AI Solution Could Be Stiff Competition for NVIDIA $NVDA

— SchoolofHardStocks (@SchoolHardStock) April 8, 2024

Chart of the Day

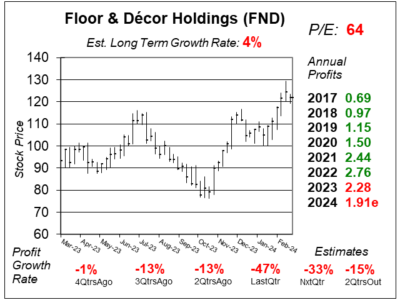

Here is the one-year chart of Floor & Decor (FND) as of March 12, 2024, when the stock was at $122.

Here is the one-year chart of Floor & Decor (FND) as of March 12, 2024, when the stock was at $122.

Flooring retailer Floor & Decor is still suffering from high mortgage rates, which are causing housing demand to remain low. Last quarter, the company had -47% profit growth on flat revenue growth. Profit growth, however, was 45% in the year-ago period, so comparisons were tough.

Looking ahead, the company anticipates continued challenges in the first half of 2024 due to low existing home sales and tough comparisons from last year. Additionally, bad weather impacted store hours in January and affected California stores with strong winds and rain in early February.

2022 was a strong year with Floor & Decor delivering 9.2% same-store sales growth while 30-year mortgages averaged 5.5%. Mortgage rates peaked at 8% in October 2023, and are now around 7%. In 2022, monthly annualized existing home sales averaged 5.1 million units, while in December 2023 existing home sales declined to a seasonally adjusted annualized rate of 3.8 million units.

FND is part of the Growth Portfolio. Management previously stated that 80% of homes are above 20 years old and millennials are entering their home buying years. These factors give the company growth opportunity for the future. Also, America is getting a flood of immigrants entering the country and this will create further housing demand.