Stock (Symbol) |

Floor & Decor (FND) |

Price |

$78 |

Sector |

| Retail & Travel |

Data is as of |

| November 16, 2022 |

Expected to Report |

| February 2 |

Company Description |

Floor & Decor Holdings is a multi-channel specialty retailer and commercial flooring distributor of hard surface flooring and related accessories. Floor & Decor Holdings is a multi-channel specialty retailer and commercial flooring distributor of hard surface flooring and related accessories.

The Company offers an assortment of in-stock hard-surface flooring, including tile, wood, laminate, vinyl, and natural stone along with decorative accessories and wall tile, and installation materials. The Company offers its products to various customers, including professional installers and commercial businesses (Pro), Do it Yourself customers (DIY), and customers who buy the products for professional installation (Buy it Yourself or BIY). Source: Refinitiv. |

Sharek’s Take |

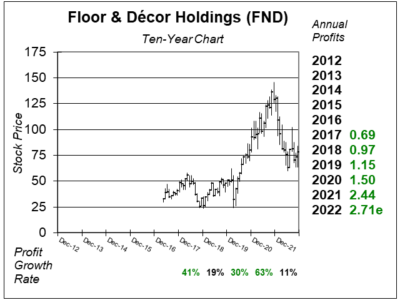

Flooring retailer Floor & Decor (FND) Floor & Decor (FND) continues to deliver solid sales growth even though the housing market is struggling. Last qtr the company delivered solid sales growth of 25% as same store sales jumped an impressive 12%. Profits grew just 17% due to high inflation, but inflation is simmering down so I’ll take it. Also, the company has now posted four consecutive quarters of accelerating profit growth. Flooring retailer Floor & Decor (FND) Floor & Decor (FND) continues to deliver solid sales growth even though the housing market is struggling. Last qtr the company delivered solid sales growth of 25% as same store sales jumped an impressive 12%. Profits grew just 17% due to high inflation, but inflation is simmering down so I’ll take it. Also, the company has now posted four consecutive quarters of accelerating profit growth.

Floor & Decor offers the flooring industry’s broadest assortment of tile, wood, laminate and stone flooring in huge 70,000 sq ft warehouse formats, compared to home improvement centers which dedicate only 3,000 to 5,000 ft. to hard surface flooring. Approximately 70% of company sales are generated from do-it-yourselfers (DIY) and 30% are from professional contractors (Pro), with the highest pro/customer mix in the industry.

The company has 5 pillars of growth to achieving long-term sales and profit growth targets:

Floor & Decor is on its way to its 14th consecutive year of same store sales growth. The stock has a robust Estimated Long-Term Growth Rate of 23% per year. For that type of growth, I wouldn’t mind if the P/E was 40-45. But since the housing sector is weak, I currently have a 35 P/E for my Fair Value. FND is part of the Growth Portfolio. It’s a great company. This qtr there’s 40% upside to my 2023 Fair Value of $118 a share. |

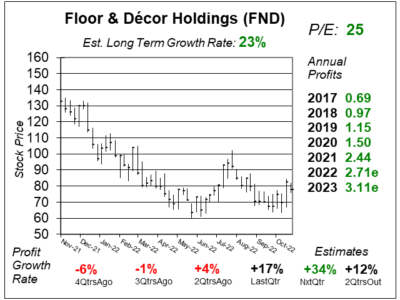

One Year Chart |

This stock was in a deep downtrend and is now basing. FND just recovered from a profit downturn when qtrly profit growth was just +7%, -6%, -1% and +4% during a four qtr period. Then last qtr the company delivered +17% growth. And with Estimates looking good for next qtr, this stock could be bottoming here. This stock was in a deep downtrend and is now basing. FND just recovered from a profit downturn when qtrly profit growth was just +7%, -6%, -1% and +4% during a four qtr period. Then last qtr the company delivered +17% growth. And with Estimates looking good for next qtr, this stock could be bottoming here.

The P/E of 25 is low for this stock. The P/E was 31 last qtr. My Fair Value is a P/E of 35. Note, since we are in FND’s Fiscal Q4 I calculated the P/E in this chart using 2023 profit estimates. The Est. LTG of 23% per year is excellent for a retailer with physical locations. This figure is unchanged since last qtr. |

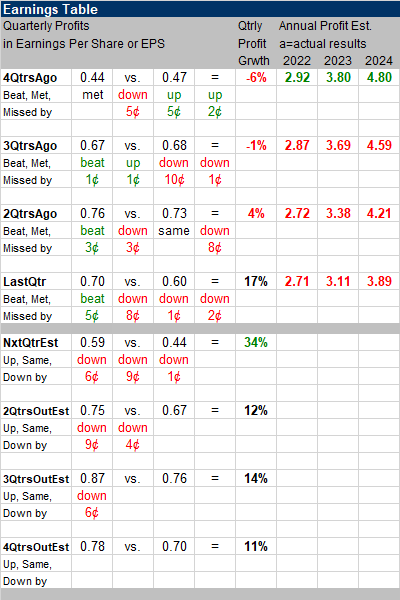

Earnings Table |

Last qtr, Floor & Decor Holdings generated 17% profit growth and beat expectations of 8% growth. Revenue increased 25% while same-store sales grew 12%. E-commerce sales grew 31% and represented 17% of company sales. Gross profit margin declined to 40.8% from 41.7% last year due to higher supply chain costs. Pro customers accounted for 41% of total sales, up from 39% in the year-ago period. Last qtr, Floor & Decor Holdings generated 17% profit growth and beat expectations of 8% growth. Revenue increased 25% while same-store sales grew 12%. E-commerce sales grew 31% and represented 17% of company sales. Gross profit margin declined to 40.8% from 41.7% last year due to higher supply chain costs. Pro customers accounted for 41% of total sales, up from 39% in the year-ago period.

Revenue growth was aided by strong ticket growth in Pro business, e-commerce, design business, and core vinyl business as well as retail price increases to mitigate effects of inflation. Management stated that their profit margin was impacted by slowdown in macroeconomic activities, weak housing demand due to interest rate hikes, and store closures due to Hurricane Ian. The company had lower supply chain costs. That’s a turn for the better as higher shipping costs have been hurting profits. Annual Profit Estimates declined for the 3rd straight qtr. Qtrly Profit Estimates are for 34%, 12%, 14%, and 11% growth the next 4 qtrs. Management said a weak housing market and slowing economy will weigh on transaction throughout 2023. |

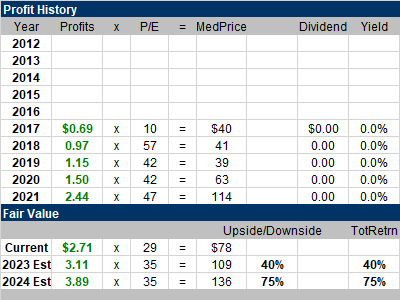

Fair Value |

This qtr, my Fair Value P/E remains at 35. This qtr, my Fair Value P/E remains at 35.

This stock has great when we look to 2023 and 2024. 75% upside to 2024’s Fair Value price of $136! Note, that’s not that big of a deal as the stock was around that price a year ago. |

Bottom Line |

Floor & Decor (FND) is one of the best retail concepts of today. But the stock has had a choppy trading history due to some issues including hurricanes, inflation, logistics costs, and port congestion. Now that those are behind us, profits might bounce back in a big way. Floor & Decor (FND) is one of the best retail concepts of today. But the stock has had a choppy trading history due to some issues including hurricanes, inflation, logistics costs, and port congestion. Now that those are behind us, profits might bounce back in a big way.

I am very impressed with the way this company continues to deliver 20%-or-better sales growth. That’s great considering the poor housing market. And the P/E of 25 is very reasonable for what I consider to be a 25% grower. FND moves up from 17th to 11th in the Growth Portfolio Power Rankings. I will also add the stock to the Aggressive Growth Portfolio where it will rank 8th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

11 of 25Aggressive Growth Portfolio 8 of 18Conservative Stock Portfolio N/A |