Low Housing Demand, High Mortgage Rates Countinue to Hurt Floor & Decor (FND)

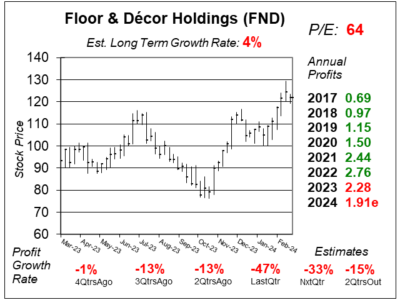

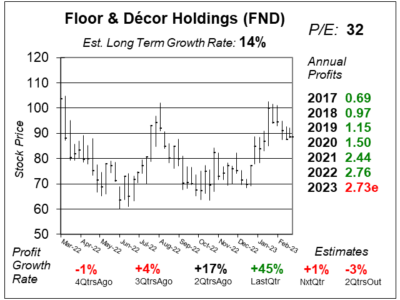

A slow housing market is causing slow demand for flooring, which continues to hurt Floor & Decor’s (FND) profits and sales.

A slow housing market is causing slow demand for flooring, which continues to hurt Floor & Decor’s (FND) profits and sales.

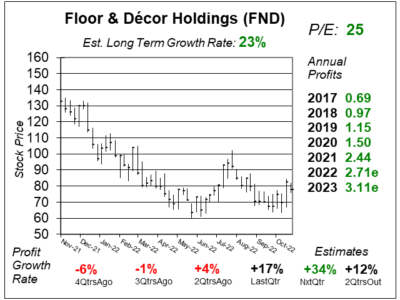

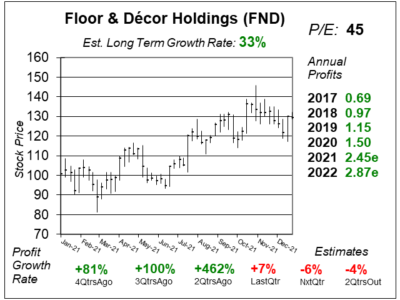

Floor & Decor’s (FND) business is hampered buy high mortgage rates which are hurting housing demand. Still, the stock flies higher.

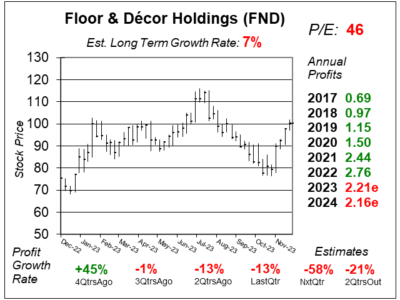

Floor & Decor (FND) has been deliving some poor revenue and profit growth. But investors are looking ahead to better times.

Floor & Decor’s (FND) results are being hampered by high mortgage rates & 22 consecutive months of declines in existing home sales.

Floor & Decor (FND) management sees buiness troughing next quarter. And the stock is anticipating better results ahead.

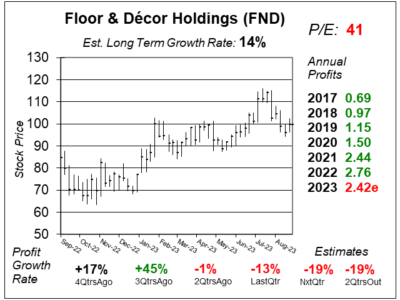

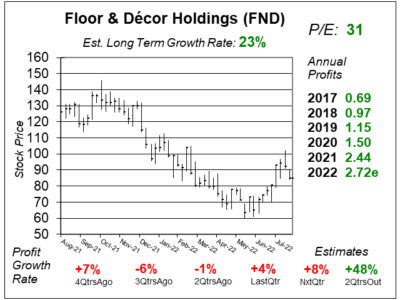

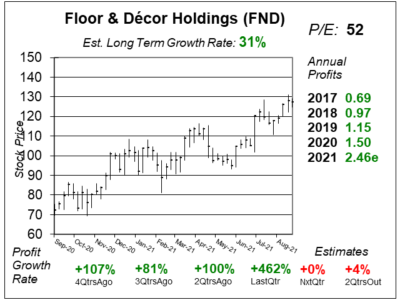

Flooring retailer Floor & Decor (FND) continues to grow in a tough housing market. Still, analysts expect slow growth ahead.

Flooring retailer Floor & Decor (FND) looks to have already had its recession, as profit growth is back while logistics problems ease.

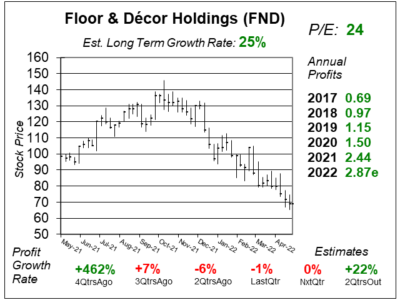

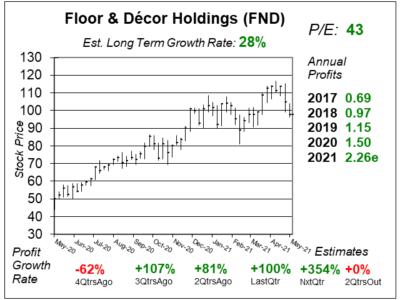

Flooring retailer Floor & Decor (FND) delivered solid sales growth of 27% last qtr. But profits grew just 4% due to high inflation.

Floor & Decor (FND) is still seeing strong demand for flooring. But profits are being hampered from higher shipping costs.

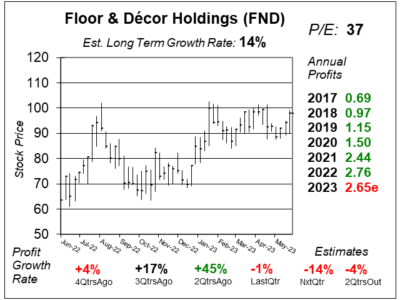

Floor & Decor (FND) is growing this store base 20% per year, which could mean 25% sales growth and perhaps 30% profit growth.

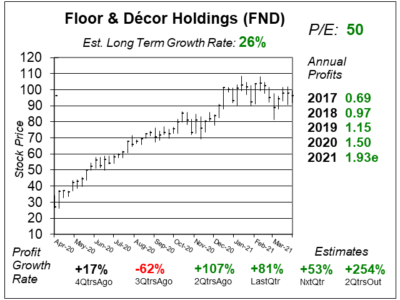

Floor & Decor (FND) has been fabulous as the housing market is red-hot. But higher container costs are now cutting profits.

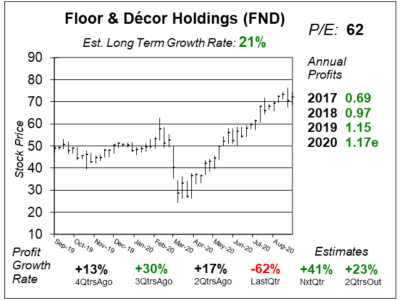

Floor & Decor (FND) has delivered amazing results the past four qtrs, now comparisons to the year-ago periods get tough.

Floor & Decor (FND) is achieving exceptional results as the homebuilding industry is blossoming, and people need floors.

Flood & Decor (FND) hit an All-Time high today as the homebuilding boom brings a need for flooring products.

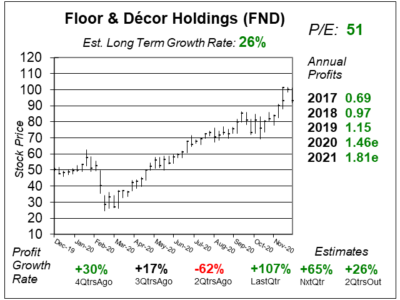

Floor & Decor (FND) just grew profits 107% last qtr as a strong housing market and home remodeling are boosting business.

Floor & Decor (FND) is rollin in the business and that’s expected to mean big profits in the upcoming qtrs.

Floor & Decor (FND) has a good environment to work in as people are staying-at-home and renovating them.

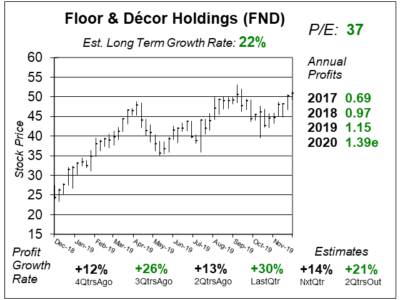

Floor & Decor (FND) has been growing stores 20% per year, thus the math says FND might grow 25-30% long-term.

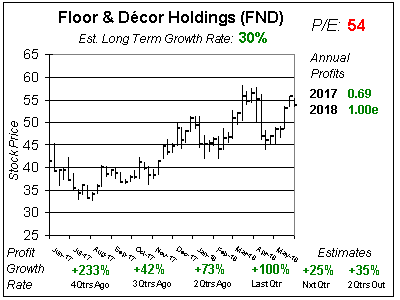

Flooring retailer Floor & Decor (FND) is one of the fastest growing retailers around, with 20% store growth for 7 years.

Flooring company Floor & Decor (FND) broke out yesterday on no real news. Let’s see what could have caused this.

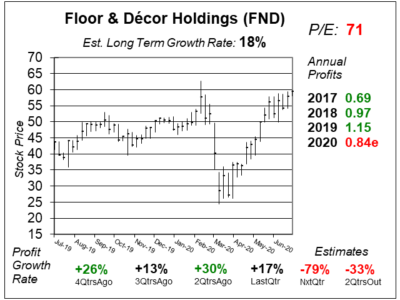

Big-box flooring retailer Floor & Decor (FND) just lowered same store sales estimates. Is business slowing for FND?

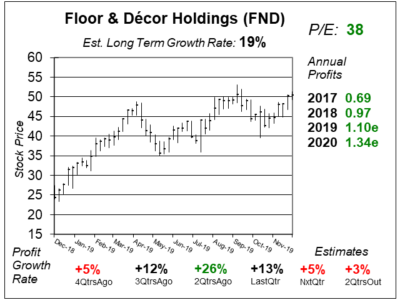

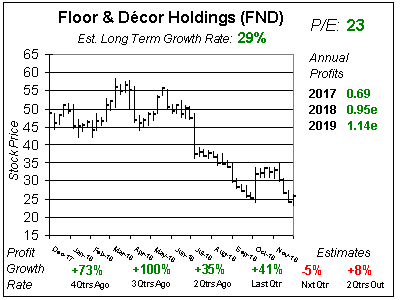

Floor & Decor (FND) had just 5% profit growth last qtr due to tough comparisons to a strong year-ago-period. But growth is expected to accelerate in the coming qtrs.

Floor & Decor (FND) delivered an impressive qtr with 27% sales growth and 41% profit growth. But this got ignored as FND lowered 4th qtr earnings estimates.

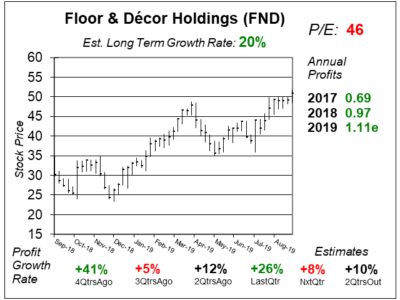

Shares of flooring retailer Floor & Decor (FND) have gone from the mid-$50s to the mid-$30s but the numbers still look good.

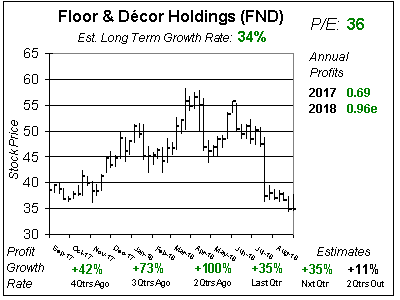

Wow! Floor & Decor (FND) is one of my top picks for being the next great stock market winner. But I may be too optimistic about FND, as it didn’t raise 2018 estimates this qtr.

Hard flooring retailer Floor & Decor (FND) rips higher as sales and profits surged last qtr. Now is this stock the next big thing in retail?

Floor & Decor (FND) is the hottest thing in bricks & mortar retail. FND stock tried to break out this week — and failed. Let’s take a closer look at Floor & Decor and see if now’s the time to buy.

Floor & Decor (FND) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $0.52 vs. $0.66 = -21%

Revenue Est: +2%