The stock market finished Monday higher, as investors hoped that the Federal Reserve will pause its rate-hiking campaign when it decides on policy on Wednesday. Meanwhile, S&P 500 jumped to a new 52-week high.

The stock market finished Monday higher, as investors hoped that the Federal Reserve will pause its rate-hiking campaign when it decides on policy on Wednesday. Meanwhile, S&P 500 jumped to a new 52-week high.

Overall, S&P 500 rose 0.9% to 4,339, while NASDAQ increased 1.5% to 13,462.

Tweet of the Day

If you own $FND, or home improvement names like $HD or $LOW, Floor Covering Weekly is an excellent resource for industry data on the flooring industry

FCW recently put out its 2023 Top 50 Retailers report which had some great data points

Some key noteshttps://t.co/ych8Ar7aKE pic.twitter.com/jxUmWVvlS6

— Brandon Dietz (@EquiCompound) June 12, 2023

Floor & Decor (FND) continues to dramatically outperform its competitors across all retailer types. Here are the key takeaways from the tweet:

- FND remains the 3rd largest retailer. However, it is likely to surpass Lowe’s (LOW) in 2024, which is just 15% larger.

- FND is larger than the combined size of the next five biggest retailers.

- FND is also larger than all the other top 78 retailers combined, excluding the five biggest retailers mentioned above.

- FND outperformed Home Depot (HD) and LOW. Floor Covering Weekly (FCW) estimated flooring department sales growth of just +1% for $HD with $LOW sales est. flat y/y. FND recorded +24% growth & a +$831 million sales increase.

- In terms of market share, FND increased 2.3%, while HD and LOW lost 1.9% and 1.3%, respectively.

- FND stores generate, 6x more revenue/store against HD, 9x more revenue/store versus LOW, and 3x more revenue/store vs. the remaining top 75.

Chart of the Day

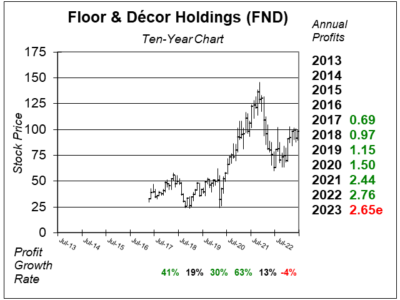

Here is the ten-year chart of FND as of June 7, 2023, when the stock was at $98.

Here is the ten-year chart of FND as of June 7, 2023, when the stock was at $98.

Floor & Decor offers the flooring industry’s broadest assortment of tile, wood, laminate, and stone flooring in huge 70,000 sq ft warehouse formats, compared to home improvement centers which dedicate only 3,000 to 5,000 ft. to hard surface flooring.

The company aims to continue its expansion efforts, with plans to open 35 to 38 warehouse locations this year. It opened three warehouse stores last quarter, and ended the quarter with 194 in operation. Still, profits are not-great right now due to decreasing number of existing home sales. Last quarter, profits were down 3% but sales increased a solid 9%. Same store sales declined 3%. Management sees results bottoming next quarter as it anticipates sequential improvements in existing home sales throughout the year.

FND is poised to break out and move higher before profit growth does. David Sharek, Founder of School of Hard Stocks, thinks that you just have to buy and hold as an investor. Housing stocks are hot right now, and his guess is this stock will break out of the current base and head to 52-week highs this quarter.

FND is part of the Growth Portfolio and Aggressive Growth Portfolio.