Stock (Symbol) |

Alphabet (GOOGL) |

Stock Price |

$126 |

Sector |

| Technology |

Data is as of |

| October 25, 2023 |

Expected to Report |

| January 23 |

Company Description |

Alphabet’s segments include Google Services, Google Cloud, and Other Bets. Alphabet’s segments include Google Services, Google Cloud, and Other Bets.

The Google Services segment includes products and services such as ads, Android, Chrome, hardware, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment includes Google’s infrastructure and platform services, collaboration tools, and other services for enterprise customers. The Other Bets segment includes earlier stage technologies that are further afield from its core Google business, and it includes the sale of health technology and Internet services. Its Google Cloud provides enterprise-ready cloud services, including Google Cloud Platform and Google Workspace. Google Cloud Platform enables developers to build, test, and deploy applications on its infrastructure. Google Workspace collaboration tools include applications, such as Gmail, Docs, Drive, Calendar, Meet, and various others. The Company also has various hardware products. Source: Refinitiv |

Sharek’s Take |

Alphabet (GOOGL) enjoyed an advertising rebound last qtr, but Google Cloud revenue slowed, and that news has been bringing down the stock. Google Search, which is the company’s largest segment making up 57% of its revenues, delivered 11% revenue growth versus 5% 2QtrsAgo. That’s great! Cloud is just 11% of total revenue, but growth slowed to 22% from 28% a quarter earlier. Meanwhile, Microsoft’s Cloud offering Azure had revenue growth accelerate slightly to 28% last quarter versus 27% a quarter earlier. During the past four quarters, growth in Search has been accelerating, from -2% to +2%, +5% and now +11%. AI is driving growth in Search through solutions like Performance Max campaigns, which combines Google AI technologies for performance-based advertisers. Alphabet is also working to make AI front and center of every search through the Search Generative Experience. Under Cloud, the number of active AI projects on the Vertex AI platform grew 7 times last qtr. Vertex AI provides machine learning tools to help customers deploy and scale AI-powered applications. Overall, I think Alphabet delivered an impressive qtr, with 47% profit growth on 11% revenue growth. Investors felt otherwise. Alphabet (GOOGL) enjoyed an advertising rebound last qtr, but Google Cloud revenue slowed, and that news has been bringing down the stock. Google Search, which is the company’s largest segment making up 57% of its revenues, delivered 11% revenue growth versus 5% 2QtrsAgo. That’s great! Cloud is just 11% of total revenue, but growth slowed to 22% from 28% a quarter earlier. Meanwhile, Microsoft’s Cloud offering Azure had revenue growth accelerate slightly to 28% last quarter versus 27% a quarter earlier. During the past four quarters, growth in Search has been accelerating, from -2% to +2%, +5% and now +11%. AI is driving growth in Search through solutions like Performance Max campaigns, which combines Google AI technologies for performance-based advertisers. Alphabet is also working to make AI front and center of every search through the Search Generative Experience. Under Cloud, the number of active AI projects on the Vertex AI platform grew 7 times last qtr. Vertex AI provides machine learning tools to help customers deploy and scale AI-powered applications. Overall, I think Alphabet delivered an impressive qtr, with 47% profit growth on 11% revenue growth. Investors felt otherwise.

Founded in 1998, Alphabet’s mission is to organize the world’s information and make it universally accessible. The company’s main division, Google Search, performs more than a trillion searches per year. Alphabet’s brands include:

Here’s Alphabet’s main divisions:

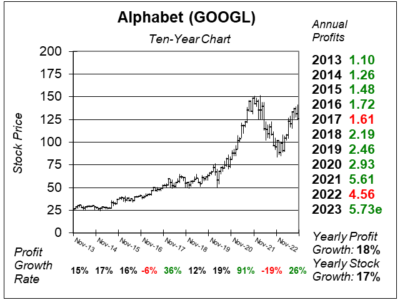

Alphabet is a conservative growth stock that is also had a good growth rate. Prior to 2022, the company had profits up every year since its IPO in outside of 2017 (which was only down as it switched its accounting practices to a more conservative stance). The stock has a Est. LTG of 19% a year, and a P/E of 19, which is undervalued as I think the P/E should be 25. That implies ~34% upside by the end of 2024. Management doesn’t pay a dividend, but does buyback stock. GOOGL is part of my Growth Portfolio, Conservative Growth Portfolio, and Aggressive Growth Portfolio. |

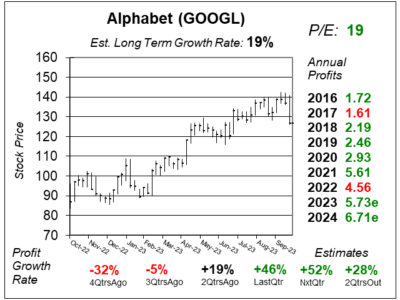

One Year Chart |

Note the stock’s drop after earnings came out. I think earnings were fine. Note the stock’s drop after earnings came out. I think earnings were fine.

Note qtrly profit growth was +46% last quarter. Well, comparisons were easy as the company had -24% growth in the year-ago period. The P/E of 19 makes the stock undervalued in my opinion. My Fair Value is a P/E of 25. I imagine the P/E might get up to 27 or 28. Note this P/E in this chart.is being calculated on 2024 earnings estimates. The Estimated Long-Term Growth Rate rose to 19% from 16% last qtr. I consider this to be a 15% grower long-term unless advances in AI boost profits more than anticipated. |

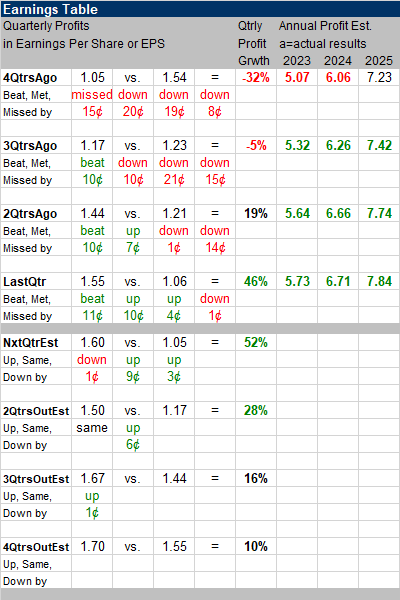

Earnings Table |

Last qtr, Alphabet delivered 46% profit growth and beat expectations of 36% growth. Revenue increased 11% and beat estimates of 10%. Operating Expenses rose 6% year-over-year driven by compensation for R&D, charges related to legal matters, and increase sales and marketing costs. Here are the regional sales results during the qtr: Last qtr, Alphabet delivered 46% profit growth and beat expectations of 36% growth. Revenue increased 11% and beat estimates of 10%. Operating Expenses rose 6% year-over-year driven by compensation for R&D, charges related to legal matters, and increase sales and marketing costs. Here are the regional sales results during the qtr:

Growth continued to be driven by the solid delivery of Search (+11%) and YouTube (+12% in its ad business) and the ongoing momentum of Cloud (+22%). Annual Profit Estimates jumped this qtr.Here’s profit estimates for the upcoming years: Qtrly Profit Estimates for the next 4 qtrs are 52%, 28%, 16%, and 10%. Analysts think revenue will grow 12% next quarter, which would be continued acceleration in revenue growth. |

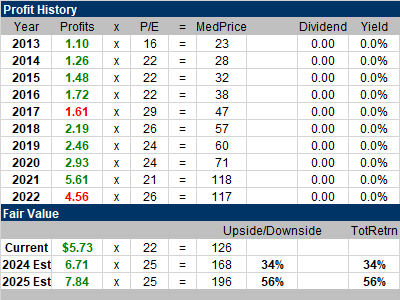

Fair Value |

My Fair Value P/E is 25. My Fair Value P/E is 25.

I believe this stock has 34% upside for 2024 and 56% for 2025. In 2017, GOOGL changed its accounting practices to more conservative accounting, and that’s why profits declined that year. Note profits almost doubled in 2021. Had that $5.61 figure really been around $3.50, this picture would look better. |

Bottom Line |

Alphabet (GOOGL) has been a steady grower this past decade, but 2020’s-2021’s move higher was a big one (116%) and the stock had to digest some gains. Now the stock is trending higher once again. Alphabet (GOOGL) has been a steady grower this past decade, but 2020’s-2021’s move higher was a big one (116%) and the stock had to digest some gains. Now the stock is trending higher once again.

Alphabet stock should have gotten some momentum as the acceleration in ad business means more than acceleration in Cloud. I think the stock will regain its momentum shortly. I really like this stock for the Conservative Portfolio. It’s got a great combo of growth and safety. I have it ranked 4th in the Power Rankings. In the Growth Portfolio, the stock stays at 16th in the Power Rankings. GOOGLE moves up from 15th to 14th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

16 of 30Aggressive Growth Portfolio 14 of 18Conservative Stock Portfolio 4 of 31 |