The stock market tumbled on Wednesday after the Federal Reserve raised its benchmark policy rate by 0.75% for a fourth straight time. The Fed Chair Jerome Powell remarked that the U.S. central bank has more rate hiking ahead as inflation was still too high.

The stock market tumbled on Wednesday after the Federal Reserve raised its benchmark policy rate by 0.75% for a fourth straight time. The Fed Chair Jerome Powell remarked that the U.S. central bank has more rate hiking ahead as inflation was still too high.

Overall, S&P 500 was down 2.5% to 3,760, while NASDAQ declined 3.4% to 10,525.

Tweet of the Day

Today is a great day to buy stocks: pic.twitter.com/YNsbqGGlhr

— Compounding Quality (@QCompounding) November 2, 2022

Chart of the Day

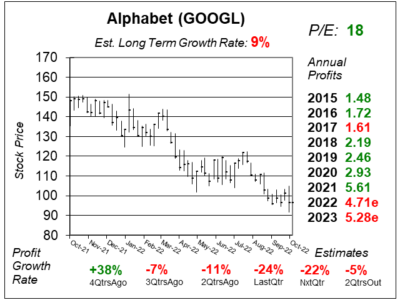

Our chart of the day is the one-year chart of Alphabet (GOOGL) as of October 29, 2022, when the stock was at $96.

Our chart of the day is the one-year chart of Alphabet (GOOGL) as of October 29, 2022, when the stock was at $96.

Founded in 1998, Alphabet’s mission is to organize the world’s information and make it universally accessible. The company’s segments include Google Services (ads, Android, Chrome, hardware, Google Maps, Google Play, Search, and YouTube), Google Cloud (Google Cloud Platform and Google Workspace), and Other Bets.

Last qtr, Alphabet delivered -24% profit growth and missed expectations of +2% growth. The qtrly profit growth highly declines, which shows why the stock is down. But with a P/E of only 18, it seems like a bargain for a long-term investment.

GOOGL is part of David Sharek’s Growth Portfolio, Conservative Growth Portfolio and Aggressive Growth Portfolio.