Stock (Symbol) |

Alphabet (GOOGL) |

Stock Price |

$128 |

Sector |

| Technology |

Data is as of |

| August 2, 2023 |

Expected to Report |

| October 23 |

Company Description |

Alphabet’s segments include Google Services, Google Cloud, and Other Bets. Alphabet’s segments include Google Services, Google Cloud, and Other Bets.

The Google Services segment includes products and services such as ads, Android, Chrome, hardware, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment includes Google’s infrastructure and platform services, collaboration tools, and other services for enterprise customers. The Other Bets segment includes earlier stage technologies that are further afield from its core Google business, and it includes the sale of health technology and Internet services. Its Google Cloud provides enterprise-ready cloud services, including Google Cloud Platform and Google Workspace. Google Cloud Platform enables developers to build, test, and deploy applications on its infrastructure. Google Workspace collaboration tools include applications, such as Gmail, Docs, Drive, Calendar, Meet, and various others. The Company also has various hardware products. Source: Refinitiv |

Sharek’s Take |

Aplhabet (GOOGL) delivered solid results last quarter that makes me think the stock is going higher. The biggest plus is Google Search Ads — which make up 57% of company revenue — have turned the corner and is showing accelerating revenue growth. During the past four quarters, this operating segment has had revenue growth go from +4% to -2%, +2%, and most recently +5%. YouTube subscripitions (Music and Premium) were also strong, as are sales of the new Pixel 7a Phone. Overall, profit grew 19% which was much better than the -5% Alphabet delivered three months earlier. Moving on to Artificial Intelligence. In last quarter’s research report, I noted Alphabet was seen as laggerd in the AI boom. With Microsoft in bed with OpenAI, the developer of ChatGPT, Alphabet was set up for an uphill battle. This quarter, GOOGL’s earnings call is littered with AI successes, including:

Founded in 1998, Alphabet’s mission is to organize the world’s information and make it universally accessible. The company’s main division, Google Search, performs more than a trillion searches per year. Alphabet’s brands include:

Here’s Alphabet’s main divisions:

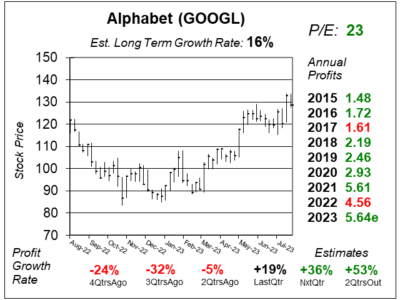

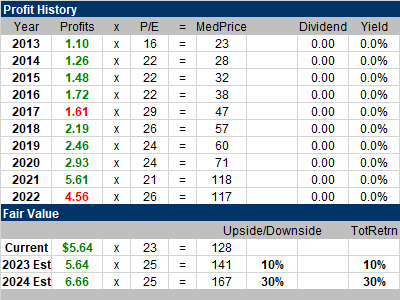

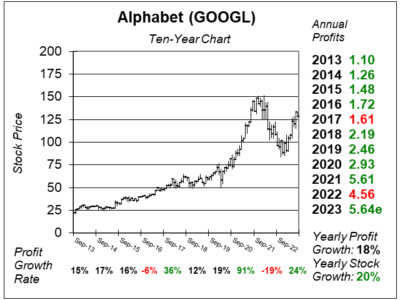

Google is a conservative growth stock that is also had a good growth rate. Prior to 2022, the company had profits up every year since its IPO in outside of 2017 (which was only down as it switched its accounting practices to a more conservative stance). The stock has a Est. LTG of 16% a year, and a P/E of 23, which is slightly undervalued as I think the P/E should be 25. That implies ~10% upside by the end of 2023. Management doesn’t pay a dividend, but does buyback stock. GOOGL is part of my Growth Portfolio and Conservative Growth Portfolio. |

One Year Chart |

This stock has had two breakouts since May. Volume has been good each time. Notice qtrly profit growth is accelerating, with the trent expected to continue. There’s a lot to like about this chart. The P/E of 23 makes the stock undervalued in my opinion. My Fair Value for is a P/E of 25. I imagine the P/E might get upto 27 or 28. The Estimated Long-Term Growth Rate fell to 16% from 18% last qtr. I consider this to be a 15% grower long-term unless advances in AI boost profits more than anticipated. |

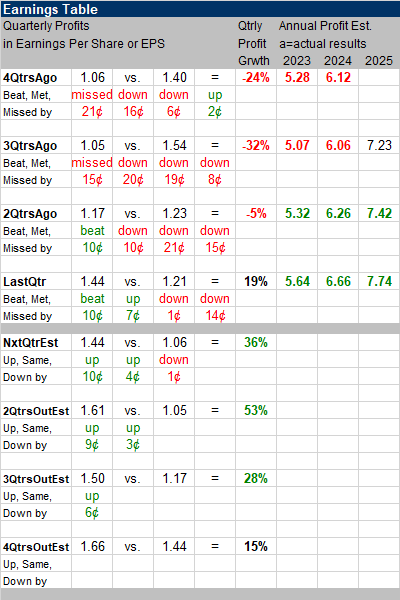

Earnings Table |

Last qtr, Alphabet delivered 19% profit growth and beat expectations of 11% growth. Revenue increased 7% and beat estimates of 4%. Excluding FX impact, revenue should have increased 9%. Operating Expenses rose just 4% year-over-year as the company lays off employees, and getting rid of office space. Here are the regional sales results during the qtr:

Growth was driven by the solid delivery of Search and Youtube and the ongoing momentum of Cloud. Annual Profit Estimates jumped this qtr. Here’s profit estimates for the upcoming years: Qtrly Profit Estimates for the next 4 qtrs are 36%, 53%, 28%, and 15%. That’s great! Analysts think revenue will grow 10% next quarter, which would be continued acceleration in revenue growth. |

Fair Value |

My Fair Value P/E is 25. I have 10% upside for 2023 and 30% for 2024. But these new AI features and the acceleration of Search revenue will likely make my adjust my Fair Value higher next quarter. My Fair Value P/E is 25. I have 10% upside for 2023 and 30% for 2024. But these new AI features and the acceleration of Search revenue will likely make my adjust my Fair Value higher next quarter.

In 2017, GOOGL changed its accounting practices to more conservative accounting, and that’s why profits declined that year. Note profits almost doubled in 2021. Had that $5.61 figure really been around $3.50, this picture would look better. |

Bottom Line |

Alphabet (GOOGL) has been a steady grower this past decade, but 2020’s-2021’s move higher (116%) was a big one, and the stock had to digest some gains. Now the stock is trending higher once again. Alphabet (GOOGL) has been a steady grower this past decade, but 2020’s-2021’s move higher (116%) was a big one, and the stock had to digest some gains. Now the stock is trending higher once again.

Wow, this was an impressive report. From Google Search accelerating, to Google Cloud growing revenue 28%, and Google Other growing 24%. To accelerated growth in many areas. And of course Aphabelt is a prime benificiary of AI. GOOGL ranks 7th in the Conservative Portfolio Power Rankings. It’s got a great combo of growth and safety. In the Growth Portfolio, the stock makes a big jump up from 26th to 16th in the Power Rankings. I will look to add to my position in clients accounts. I will also add GOOGL to the Aggressive Growth Portfolio as the stock has 30% upside to 2024’s Fair Value. The stock will rank 14th in this Power Rankings. |

Power Rankings |

Growth Stock Portfolio

15 of 28Aggressive Growth Portfolio 14 of 18Conservative Stock Portfolio 7 of 31 |