Software stocks were the rage of the stock market back in 2020 and 2021. Then the 2022 Bear Market brought these high-flyers back to reality.

Software stocks were the rage of the stock market back in 2020 and 2021. Then the 2022 Bear Market brought these high-flyers back to reality.

Now it looks like these stocks are ready to go on another run higher. Some of my optimism is from advancements in AI. But a lot of my reasoning is from valuations. These stocks look like great values going into 2024. And I’m thinking the stocks might rally into the new year as smart investors get in before the year ends.

The reason these stocks might move higher prior to 2024 is when companies report their fiscal year ends in 2024 Q1, analysts will then update their numbers and start thinking about what the stock prices could be that year. So I always like to get a jump on things, and think ahead.

Here’s what I believe are six of the top rapid growers in the software space:

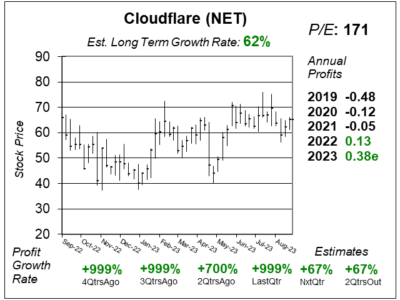

Cloudflare (NET) speeds up data across your network and has cybersecurity functions. It utilizes edge computing that entails placing edge servers around the world. The decrease in the distance between the server and the user makes it quicker for data storage and computations.

Cloudflare (NET) speeds up data across your network and has cybersecurity functions. It utilizes edge computing that entails placing edge servers around the world. The decrease in the distance between the server and the user makes it quicker for data storage and computations.

Workers could be a catalyst for Cloudflare in terms of AI development. Workers is a serverless computer platform that allows developers deploy new applications anywhere in the world. Most serverless platforms are located at centralized data centers that may be far away from the developer. With Cloudflare, the code is deployed in more than 200 locations, making the program super fast. Workers now has 10 million active workers applications as of the last quarter, an increase of 490% from a year ago. Management claims. that Workers is the preeminent developer platform for AI companies.

My Fair Value P/E for NET is 17x sales, or $85 a share in 2024.

NET is part of my Aggressive Growth Portfolio. I’m looking to add it to my Growth Portfolio by year end.

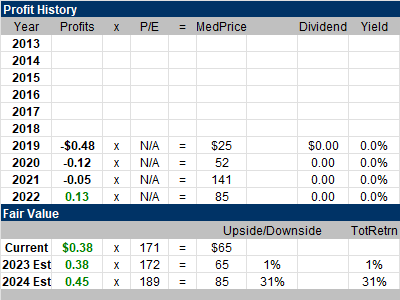

Crowdstrike (CRWD) is one of the largest cybersecurity companies in the world. It provides a crowdsourced security – a software that learns from cyberattacks. It has a threat intel platform that spies on customer traffic. When one customer gets hit by an attempted cyberattack, Crowdstrike sees this and strikes the threat for all its customers.

Crowdstrike (CRWD) is one of the largest cybersecurity companies in the world. It provides a crowdsourced security – a software that learns from cyberattacks. It has a threat intel platform that spies on customer traffic. When one customer gets hit by an attempted cyberattack, Crowdstrike sees this and strikes the threat for all its customers.

Crowdstrike delivered a strong quarter amid continuing scrutiny of IT spending among enterprises. In relation to AI, the company is hosting its Falcon customer conference to introduce its Charlotte generative AI addition to its platform. This is expected to reduce the time needed to sniff out a security threat. Charlotte will also automate workflows that is expected to fuel module adoption.

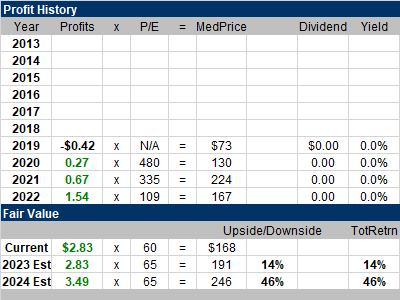

My Fair Value P/E for this stock is 15x revenue estimates, or $246 in 2024.

CRWD is part of my Growth Portfolio and Aggressive Growth Portfolio,

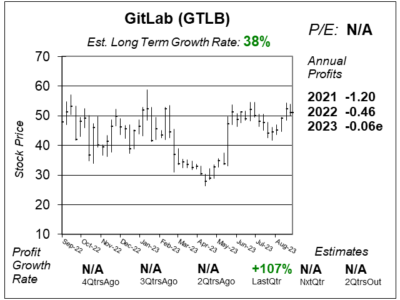

GitLab (GTLB) has a software platform that helps organizations develop software while including employees from different divisions within that company. It operates under a DevSecOps Platform. The company is a single end-to-end unified application that brings together development, operations, information technology, security, and business teams. It is for developers, security people, and operations staff.

GitLab (GTLB) has a software platform that helps organizations develop software while including employees from different divisions within that company. It operates under a DevSecOps Platform. The company is a single end-to-end unified application that brings together development, operations, information technology, security, and business teams. It is for developers, security people, and operations staff.

GitLab delivered great results last quarter as the company posted a profit for the first time as a public company. Its revenue likewise climbed a solid 38%, despite continuous slow growth. Overall, David Sharek was extremely impressed with this quarter. However, a short-sellers’ report has given him a pause.

My Fair Value P/E rises from 12x annual revenue to 15x. GTLB stock sells for 14x 2023 revenue this quarter or $51 a share. My Fair Value is $70 in 2024.

GTLB is on the radar for the Growth Portfolio.

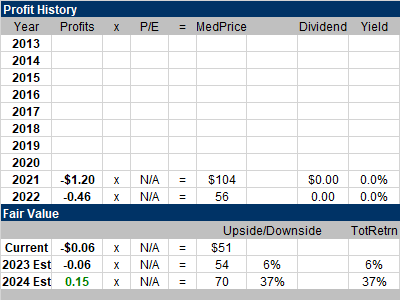

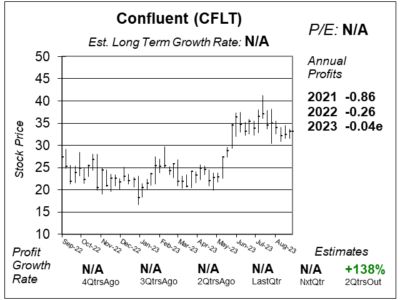

Confluent (CFLT) is the heart of “data in motion” which utilizes data in real time. With Confluent, organizations can see what is currently going on, then immediately react to changes in its business.

Confluent (CFLT) is the heart of “data in motion” which utilizes data in real time. With Confluent, organizations can see what is currently going on, then immediately react to changes in its business.

Confluent is on the cusp of becoming profitable. If profits begin to come in, this could cause the stock to go on a run higher. The company had been delivering losses every quarter since its IPO in June 2021. Then last quarter, it broke even with EPS of $0.00 per share (on a non-GAAP basis). Analysts think profits will be $0.00 next quarter, then $0.05 two quarters from now. David Sharek thinks that a profit will be made this quarter as Confluent has been beating estimates. Since comparisons from the year-ago periods are losses, a profit would be recorded as triple-digit revenue growth, a key characteristic top stocks possess. Thus, a profit could cause the stock to make a run higher.

My Fair Value is 15x revenue, giving us a Fair Value of $38 for 2023 and $49 for 2024.

CFLT was recently added to the Growth Portfolio.

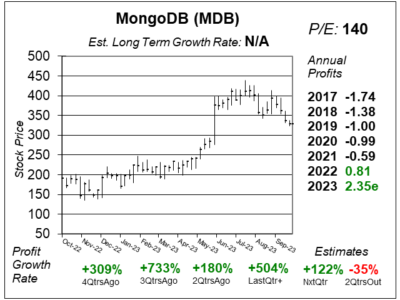

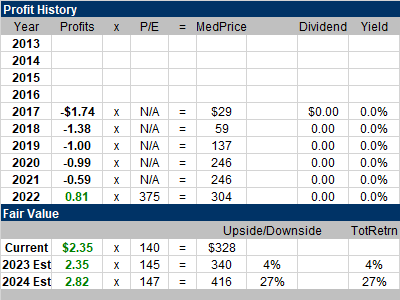

MongoDB (MDB) is a database platform that helps software developers build internet applications that utilize vast volumes of data, while improving developer productivity. The company’s architecture makes it easy for developers to manage data, and to build and maintain applications. As such, companies might decide to use this software at the IT guy’s request – it makes their job easier.

MongoDB (MDB) is a database platform that helps software developers build internet applications that utilize vast volumes of data, while improving developer productivity. The company’s architecture makes it easy for developers to manage data, and to build and maintain applications. As such, companies might decide to use this software at the IT guy’s request – it makes their job easier.

MongoDB saw more companies choose their platform to run new AI applications. Management believes that MongoDB is expected to be a net beneficiary of new AI advancements. With AI increasing developer productivity, the volume of new applications is likely to increase, driving further demand for MongoDB. Profit grew 180% and blew away expectations of -5%, while revenue grew 29% driven by record-number additions of new workloads from existing customers. Management is seeing new business and growth within existing customers.

This quarter MDB sells for 17x 2023 revenue estimates. David Sharek’s Fair Value is 15x revenue, or $416 in 2024.

MDB is on the radar for the Growth Portfolio. I may purchase the stock this week.

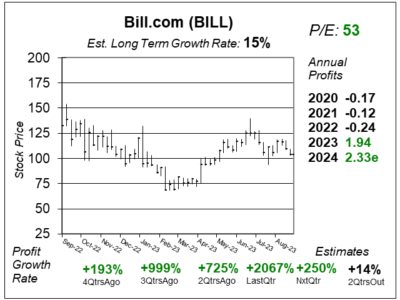

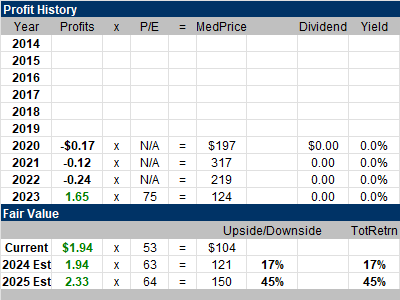

Bill.com (BILL) is a leading provider of cloud-based software company that digitally automates complex back office financial operations for small and medium businesses (SMB). Its customers use the platform to generate and process invoices, streamline approvals, make and receive payments, sync with their accounting system, and manage their cash.

Bill.com (BILL) is a leading provider of cloud-based software company that digitally automates complex back office financial operations for small and medium businesses (SMB). Its customers use the platform to generate and process invoices, streamline approvals, make and receive payments, sync with their accounting system, and manage their cash.

Bill.com delivered excellent results last quarter, as the stock jumped higher. These results took investors by surprise, as management previously said it was seeing weakness due to the economy. BILL was $84 in our last quarter report as investors were concerned that revenue was going to decline on a sequential basis. Last quarter, however, Bill.com delivered sequential growth ($27 million) and also whipped profit estimates (EPS) of $0.24 with a $0.50 number. In the earnings call, management stated that “the deterioration that we had seen at the end of the last quarter did not continue as strongly into this quarter“.

My Fair Value is 10x annual revenue, or $150 in 2024.

I am looking to add BILL to the Growth Portfolio any day.