Cloudfare (NET) is Seeing Robust Momentum with Large Customers

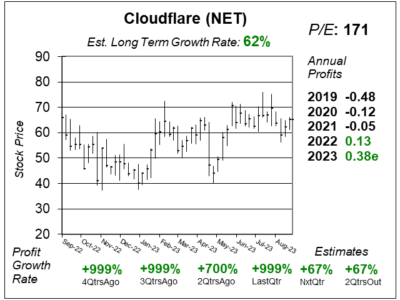

CLoudflare (NET) closed out 2023 with robust momentum as is landed a slew of large customers, including government deals.

CLoudflare (NET) closed out 2023 with robust momentum as is landed a slew of large customers, including government deals.

Cloudflare (NET) could be a leader in the AI space with its Workers AI platform which allows users to run machine learning models.

Cloudflare’s (NET) development platform, Cloudfare Workers, is seeing massive growth with 10 million active workers applications.

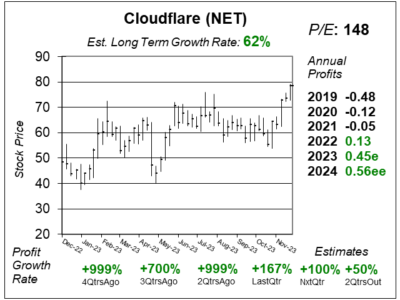

Cloudflare (NET) is going through a volitile year as it goes back-and-forth between $40 and $70, What’s it worth? Maybe $58.

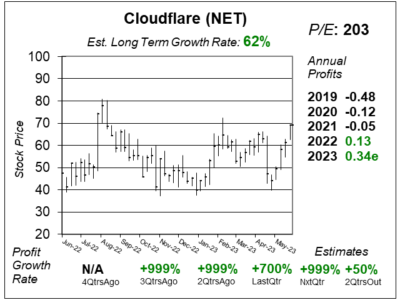

Cloudflre (NET) continues to show solid revenue growth (42% last qtr) as $500,000 clients rose to 222, up 83% year-over-year.

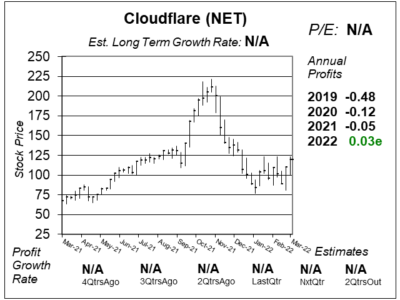

Cloudflare (NET) is a consistent rapid grower, with revenue growth of around 50% the past five years. Last qtr, growth was only 47%.

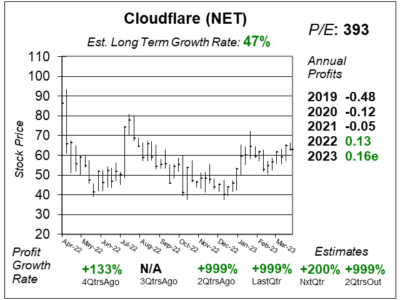

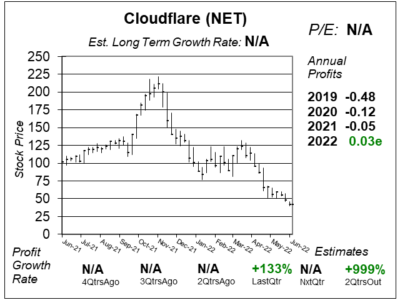

Cloudflare (NET) the stock is well off its highs from last year. Cloudflare the company continues to perform magnificently well.

Cloudflare (NET) has been one of the worst stocks since last November. But here’s a thesis on how it could climb 50% a year for years.

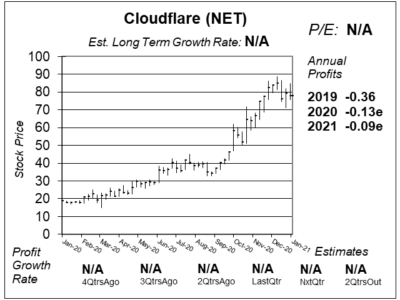

Cloudflare (NET) is an amazing company that’s grown revenue +50% for 5 straight years. But NET’s pricey. It seems to be worth $72.

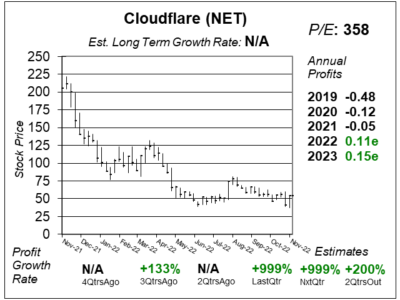

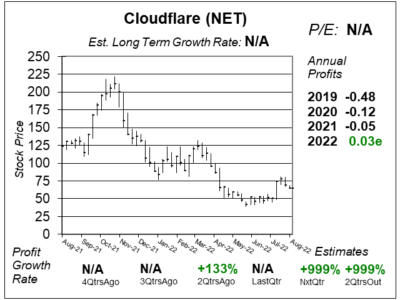

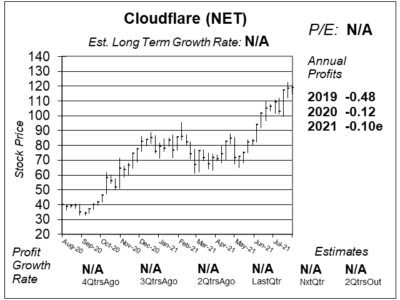

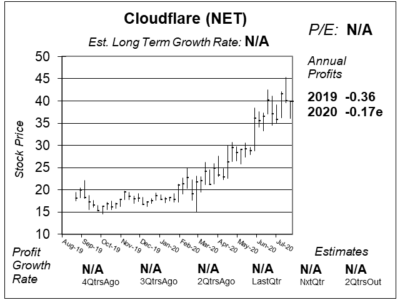

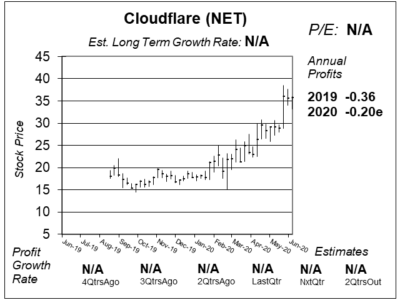

Cloudflare (NET) is taking the cloud computing world by storm, But NET is cascading lower as the company makes little profit.

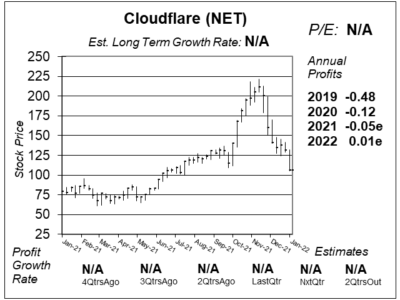

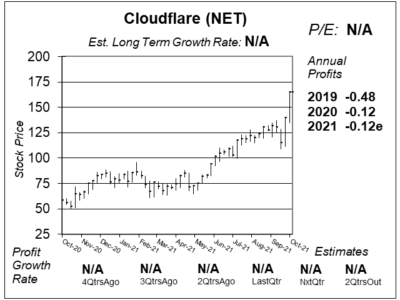

Cloudflare (NET) stock has been shooting higher as the company is winning the business of the largest companies in the world.

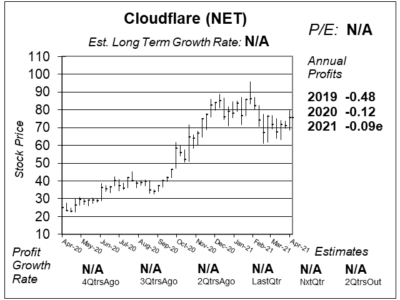

Cloudflare (NET) just got on the government’s FedRAMP marketplace. But now NET is very expensive, and sells for 60x revenue.

Cloudflare (NET) gives organizations better speed in networks and websites, while keeping data secure from hackers too.

Cloudflare (NET) is like Fastly in terms of edge computing, but with the added bonus of cybersecurity across the network.

Cloudflare (NET) gives companies a perfect combination of fast load time and cybersecurity all from one company.

Cloudfare (NET) is a network performance company and a cyber-security company all in one. NET stock is red-hot.

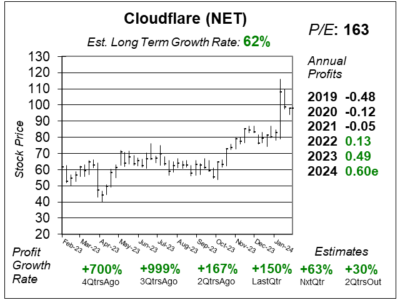

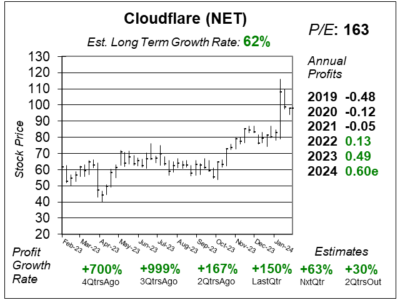

Cloudflare (NET) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $0.13 vs. $0.08 = +63%

Revenue Est: +29%