Stock (Symbol) |

Salesforce.com (CRM) |

Stock Price |

$182 |

Sector |

| Technology |

Data is as of |

| January 14, 2020 |

Expected to Report |

| March 2 |

Company Description |

Salesforce.com, inc. is a provider of enterprise cloud computing solutions that include apps and platform services, as well as professional services. The Company focuses on customer relationship management (CRM). The Company offers six core cloud services that include sales force automation, customer service and support, marketing automation, community management, analytics and a cloud platform for building custom applications. Source: Thomson Financial Salesforce.com, inc. is a provider of enterprise cloud computing solutions that include apps and platform services, as well as professional services. The Company focuses on customer relationship management (CRM). The Company offers six core cloud services that include sales force automation, customer service and support, marketing automation, community management, analytics and a cloud platform for building custom applications. Source: Thomson Financial |

Sharek’s Take |

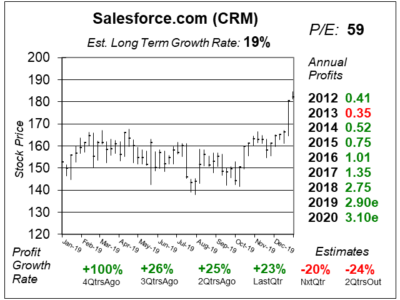

Salesforce (CRM) got an upgrade from a brokerage firm on January 6th, and since then the stock’s jumped from $165 to $182 (+10%). Meanwhile, back at the ranch, profits are expected to decline 20% and 24% the next 2 qtrs while the P/E of 59 is rich. I think the stock’s move higher on an upgrade is all-hype, and with profits expected to climb just 5% in 2020 this stock needs to sit back down. Salesforce (CRM) got an upgrade from a brokerage firm on January 6th, and since then the stock’s jumped from $165 to $182 (+10%). Meanwhile, back at the ranch, profits are expected to decline 20% and 24% the next 2 qtrs while the P/E of 59 is rich. I think the stock’s move higher on an upgrade is all-hype, and with profits expected to climb just 5% in 2020 this stock needs to sit back down.

Salesforce is the world’s leader in customer relationship management (CRM) software and connects more than 150,000 clients to their customers via the internet and stores this customer information in the cloud. The company boasts the #1 Sales Cloud, #1 Service Cloud, #1 Marketing Cloud, #1 CRM platform and #1 integration software in the recently acquired Mulesoft. There is also still good growth opportunity worldwide for Salesforce over the long-term as 71% of sales came from the U.S. in 2018. Last qtr, Salesforce had profit estimates decline across the board, and one reason why is its acquisition of Tableau software. In June 2019, Salesforce announced it was acquiring Tableau, which helps process data into a picture or graph, like when weathermen use heatmaps. Tableau did $1 billion in sales in 2018 while Salesforce did $10 billion, so sales growth did get a little boost. But Tableau didn’t produce the profits Salesforce does, thus the company expects fiscal 2020 profit margins to be down year-over-year. Last qtr 2020 profit growth estimates declined from 19% to 9%, and this qtr they fell even further to just 5%. In my book, profit growth leads to stock growth — with these figures often being similar over the long-term (say ten years). Therefore, a five percent boost in profits in a year should mean paltry stock growth. Salesforce used to be considered a 35% grower worthy of a 65 to 70 P/E. But last qtr analysts took their Estimated Long-Term Growth Rate down from 30% to 19%. In turn, the P/E ratio should be reduced as a result. My Fair Value for this stock is currently a P/E of 55, which equates to $171 in 2020 and $215 in 2021. That’s $215 figure is what the brokerage firm analyst has as a price target. But I don’t see the stock getting there until 2021 — that’s a year away. So this burst higher in the stock is quite laughable. It shows how eager investors are to jump all-aboard a stock without understanding the fundamentals. CRM is part of the Growth Portfolio. The stock’s overvalued right now, don’t believe the hype. |

One Year Chart |

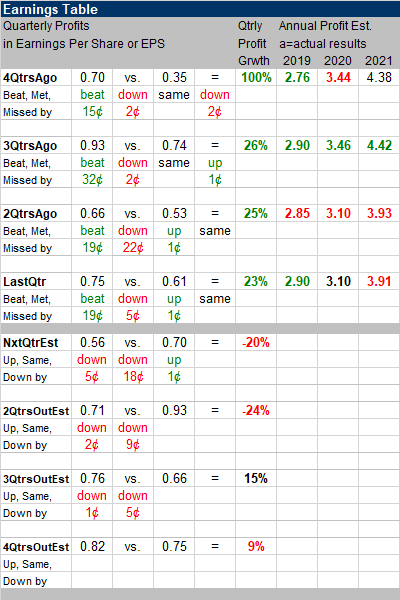

Tableau is a very nice addition to the Salesforce portfolio, but it comes with a price of low-profitability. Notice how CRM’s profit Estimates for the next 2 qtrs are negative. The company usually beats the street, so maybe the company will deliver 0% to 10% profit growth the next 2 qtrs (optimistically) but that’s slowing growth from the 25% or so growth the company was doing. Tableau is a very nice addition to the Salesforce portfolio, but it comes with a price of low-profitability. Notice how CRM’s profit Estimates for the next 2 qtrs are negative. The company usually beats the street, so maybe the company will deliver 0% to 10% profit growth the next 2 qtrs (optimistically) but that’s slowing growth from the 25% or so growth the company was doing.

The P/E of 59 is up from 52 last qtr. Meanwhile there hasn’t been anything that warrants a higher valuation. The Est. LTG of 19% is pretty good. But this figure used to be 30%. |

Earnings Table |

Last qtr CRM delivered 23% profit growth, which blew past estimates of 8%. That’s the 3rd consecutive qtr that profits were expected to decline but rose instead. Revenue increased a solid 33%, which is much better than the 22% 2QtrsAgo. Some of the boost in sales growth was due to the Tableau acquisition, as well as Salesforce.org. Without the impact of those two, revenue growth was 21%. Last qtr CRM delivered 23% profit growth, which blew past estimates of 8%. That’s the 3rd consecutive qtr that profits were expected to decline but rose instead. Revenue increased a solid 33%, which is much better than the 22% 2QtrsAgo. Some of the boost in sales growth was due to the Tableau acquisition, as well as Salesforce.org. Without the impact of those two, revenue growth was 21%.

Annual Profit Estimates are mixed this qtr. Notice that 2020 and 2021 estimates got slashed a qtr ago. Qtrly Estimates are for -20%, -24%, 15% and 9% profit growth the next 4 qtrs. I think CRM will continue to beat the street. If we add 19 cents to each of these profit figures it equates to 7%, -3%, 44% and 35% profit growth ahead (possibly). Thinking ~40% growth is coming may be overly optimistic as the company has lowered future estimates the last 2 qtrs. Also, when you look at profits for the last 4 qtrs, these figures were reduced a qtr before CRM beat estimates. |

Fair Value |

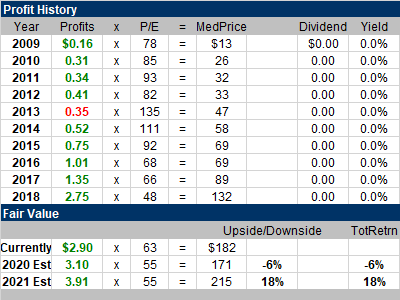

My Fair Value P/E is 55. That’s up from 50 last qtr. My Fair Value P/E is 55. That’s up from 50 last qtr.

Notice that my 2020 Fair Value is $171 a share, with 2021’s at $215. $215 was what the brokerage firm had as a price target as well. So we are on the same page with that. My point is the stock is now all-hyped up and has quickly shot past its 2020 Fair Value — just two weeks into the year. |

Bottom Line |

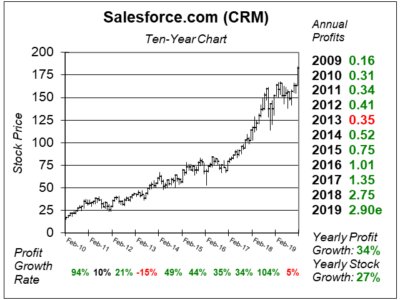

Salesforce (CRM) has been a stellar stock this last decade. Notice how Yearly Profit Growth is similar to Yearly Stock Growth. Salesforce is a much larger company than it was ten-years ago. It will be tough to get profits to grow 25% a year in the future. Thus this stock isn’t deserving of a 65-70 P/E anymore. I think the P/E should be 50-55. Until last week investors felt the same way. Salesforce (CRM) has been a stellar stock this last decade. Notice how Yearly Profit Growth is similar to Yearly Stock Growth. Salesforce is a much larger company than it was ten-years ago. It will be tough to get profits to grow 25% a year in the future. Thus this stock isn’t deserving of a 65-70 P/E anymore. I think the P/E should be 50-55. Until last week investors felt the same way.

This surge higher in CRM stock on an upgrade reminds me of the dot-com boom of the late 1990s when investors followed analyst upgrades. We were in a speculative market then, where making money in stocks was easy. That ended badly with a market crash in early-2000. I don’t think this stock will “crash”, but I would be leery of buying much at these levels. CRM ranks 32nd in the Growth Portfolio Power Rankings. That’s the same spot I had it in last qtr. The fundamental picture hasn’t changed. |

Power Rankings |

Growth Stock Portfolio

32 of 39Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |