Artificial Intelligence (AI) stocks have been on quite a ride higher in 2023 and 2024. But for novice investors, learning the new technology — and which stocks to own — can be a daunting task.

Artificial Intelligence (AI) stocks have been on quite a ride higher in 2023 and 2024. But for novice investors, learning the new technology — and which stocks to own — can be a daunting task.

And its painful to to sit on the sidelines when some AI stocks are moving higher. But who has the time to do all the research?

That’s why I built this simple list of a handful of core holdings in the AI space. These are stocks I think investors can buy and hold while not having to keep up with all the earnings news.

But let’s be cautious here. Conservative investors might not feel comfrtable with stocks like this that can do down fast. So this list is for growth investors who are comfortable with volatility.

The charts and tables below are from our research done in 2024 Q1. The stocks have since moved in price.

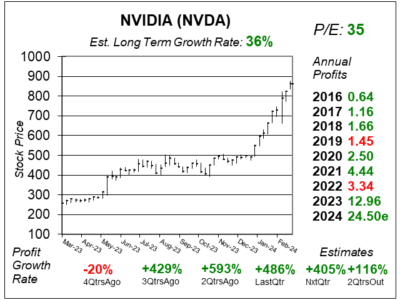

NVIDIA (NVDA) is reportedly the world leader in AI computing. Its NVIDIA GDX platform, the world’s first AI supercomputer, is the most robust AI platform today. AI applications built on NVIDIA include ChatGPT, Microsoft 365 Copilot, Now Assist and Adobe Firefly.

NVIDIA (NVDA) is reportedly the world leader in AI computing. Its NVIDIA GDX platform, the world’s first AI supercomputer, is the most robust AI platform today. AI applications built on NVIDIA include ChatGPT, Microsoft 365 Copilot, Now Assist and Adobe Firefly.

NVIDIA delivered spectacular results last quarter, sending shares higher. The company delivered profit growth of 486% as sales jumped 265%. Its stock has jumped from $481 to $860 since last quarter. NVIDIA continues to be one of the All-Time True Market Leaders (TML).

My Fair Value on NVDA is a P/E of 45, which works out to around $1100 for 2024.

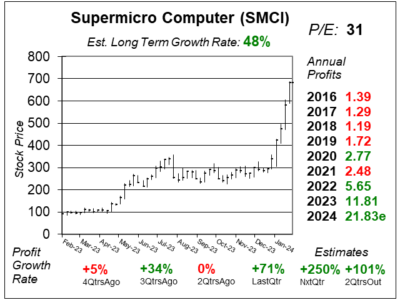

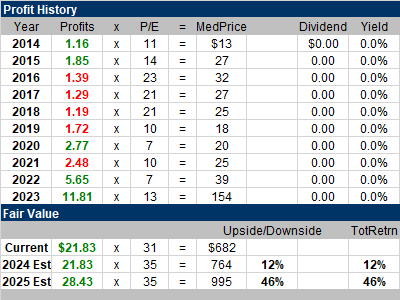

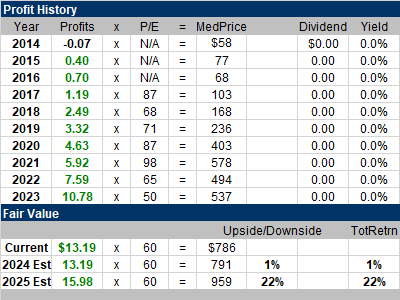

Supermicro Computers (SMCI) is one of the hottest stocks in the world as the shares have skyrocketed from around $100 to around $700 during the past year as its NVIDIA-based AI racks “rack up” sales. Now, management said that it is entering an accelerated demand phase. WOW! SMCI’s AI rack-scale solutions-based on the NVIDIA HGX H100 are gaining high popularity, with the demand for AI inferencing systems growing.

Supermicro Computers (SMCI) is one of the hottest stocks in the world as the shares have skyrocketed from around $100 to around $700 during the past year as its NVIDIA-based AI racks “rack up” sales. Now, management said that it is entering an accelerated demand phase. WOW! SMCI’s AI rack-scale solutions-based on the NVIDIA HGX H100 are gaining high popularity, with the demand for AI inferencing systems growing.

In last quarter’s earnings call, management said that this AI boom will continue for several quarters, if not many years. Together with inferencing and other computer requirements, demand could last for decades to come in this AI revolution.

The stock has been wild recently. I think SMCI has a Fair Value of $764 right now.

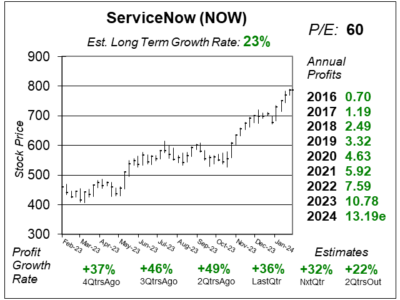

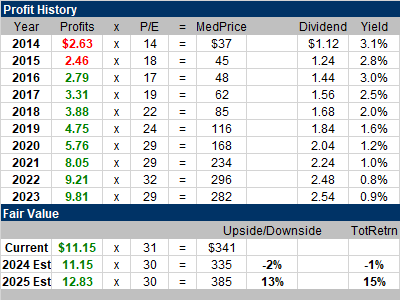

ServiceNow (NOW) stock is flying high as Generative AI is injecting new life into the company’s business. The company is a prime beneficiary of the power of Generative AI as that will assist them in improving efficiency within organizations by accomplishing tasks workers would normally do (like customer service).

ServiceNow (NOW) stock is flying high as Generative AI is injecting new life into the company’s business. The company is a prime beneficiary of the power of Generative AI as that will assist them in improving efficiency within organizations by accomplishing tasks workers would normally do (like customer service).

Management claimed that ServiceNow is well-positioned, not only to lead AI movement, but also to define it. Last September, the company launched the Vancouver release which integrates generative AI across all workflows in the Now Platform.

My Fair Value is a P/E of 60, or $786 a share. The stock was around that price when these charts and tables were done.

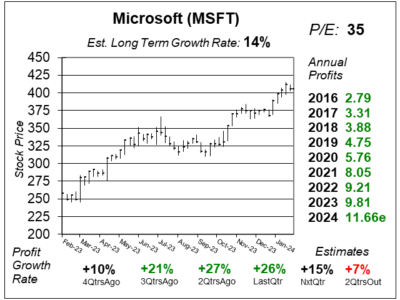

Microsoft (MSFT) is delivering very good sales and profit growth as the stock continues to climb.

Microsoft (MSFT) is delivering very good sales and profit growth as the stock continues to climb.

Last quarter, the company delivered 26% profit growth on 8% revenue growth. Azure was the highlight of last quarter’s news as revenue grew by 28%. Azure is Microsoft’s public cloud platform that lets users manage cloud services such as storing data and transforming it.

Management is seeing larger and more strategic Azure deals with an increase in the number of billion-dollar-plus Azure commitments.

My Fair Value is a P/E of 30, or $335 a share.

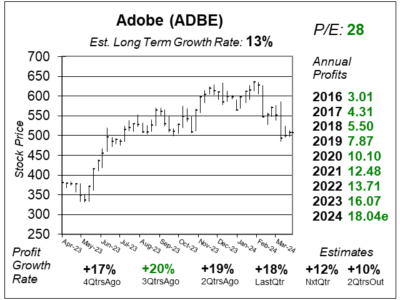

Adobe (ADBE) has become one of the big benefactors of Generative AI. In last quarter’s earnings release, the CEO stated that the company has “done an incredible job harnessing the power of Generative AI to deliver groundbreaking innovation across the product portfolio.” Adobe’s AI model is named Firefly.

Adobe (ADBE) has become one of the big benefactors of Generative AI. In last quarter’s earnings release, the CEO stated that the company has “done an incredible job harnessing the power of Generative AI to deliver groundbreaking innovation across the product portfolio.” Adobe’s AI model is named Firefly.

Despite its success, Adobe must be wary of its competitor, Canva, as its growth has accelerated since 2022. There are a considerable number of new companies which utilize Canva teams in their workplace.

ADBE currently had a P/E of 28 last qtr. My Fair Value is a P/E of 32 so I think the stock is undervalued by 14%.