Today in the stock market, Monday May 9, 2022, speculative stocks tanked as the Bear Market shows no end in sight. Overall, the S&P 500 was down 3.2% as the NASDAQ slid 4.3%.

Positive Signs of a Bottom Forming

94% of the stock on the New York Stock Exchange were down on the day, the 2nd 94% downside volume reading in three business days. +90% DVOL days often occur at the bottom of market corrections. But before we can say the market is safe to buy, we should wait for a 90% upside volume day, which would mean savvy stock buyers are picking up stocks at unbelievably low prices.

But investors are afraid we are headed into a recession, which could be caused by the Federal Reserve increasing interest rates to the point the economy goes into a recession. But it seems like we are already in a recession now, as higher rents, food prices, and gasoline prices are taking away disposable income.

Speculative Growth Stocks Spiral Lower

Speculative Growth Stocks Spiral Lower

There were a ton of stocks down 10% or greater today, including:

- Celsius (CELH) -17%

- Cloudflare (NET) -14%

- Sweetgreen (SG) -15%

- Datadog (DDOG) -11%

- Bill.com (BILL) -11%

- MongoDB (MDB) -16%

- Sea (SE) -15%

- SentinelOne (S) -16%

- Unity Software (U) -12%

- AirBnb (ABNB) -12%

- Crowdstrike (CWRD) -13%

- Zscaler (ZS) -12%

- Mercadolibre (MELI) -17%

Chart of the Day

Chart of the Day

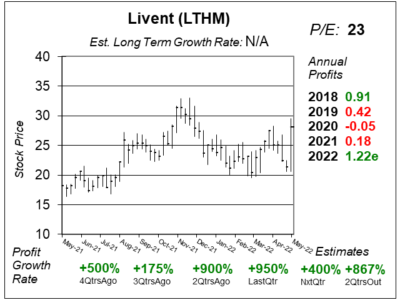

Livent (LVNT) might be a stock market leader of the next Bull Market as its lithium is desperately needed for lithium batteries used in electronic vehicles, or EVs. Livent is one of the five largest producers of lithium compounds in the world, along side SQM, Albermarle, Tianqi Lithium and Ganfelg Lithium.

Livent focuses on producing performance lithium compounds for application use in rapidly growing EV market and general energy storage battery market.

LTHM broke out on HUGE volume on Wednesday May 3rd. Then on Thursday, the stock market went into wicked decline, and that may have held this stock back. Today, the stock closed at $24. LTHM is a stock to keep on the radar, as Lithium ion cells are in short supply and auto manufacturers need totem to build electric cars.