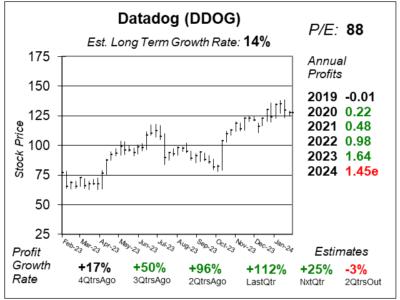

Datadog (DDOG) Management Lowers 2024 Profit Estimates as Billings Climb

Datadog (DDOG) cut 2024 profit estimates. But investors didn’t seem to mind. Let’s take a look into this tech stock’s situation.

Datadog (DDOG) cut 2024 profit estimates. But investors didn’t seem to mind. Let’s take a look into this tech stock’s situation.

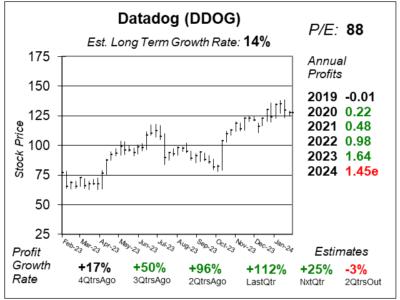

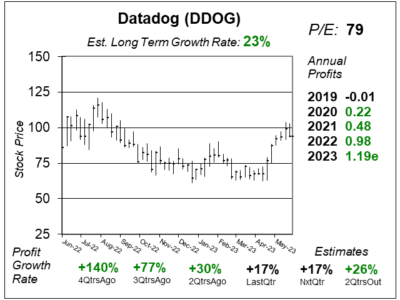

Datadog’s (DDOG) stock rebounded as consumption trends from existing customers accelerated last quarter.

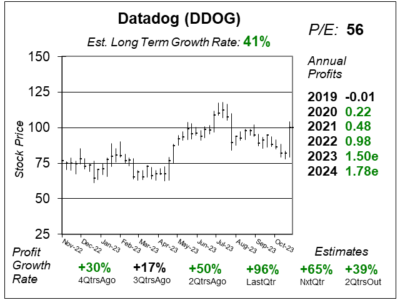

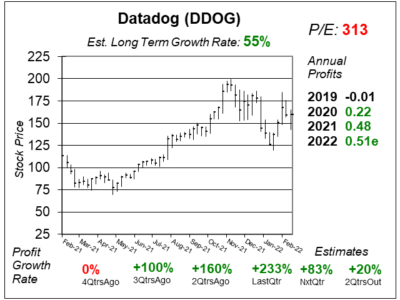

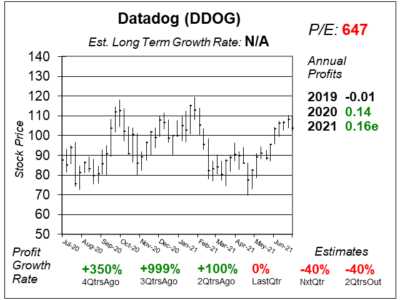

Datadog’s (DDOG) stock is hanging around $100 as the company grows revenue & profits well, but not as fast as investors expect.

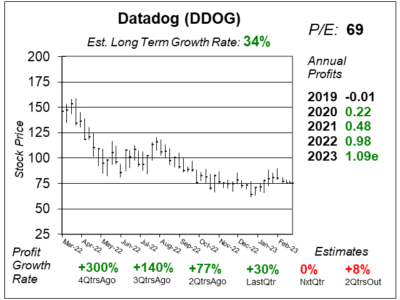

Datadog (DDOG) is now trending upwards, attaining stock prive levels it had a year ago. But sales and Profit growth are slowing.

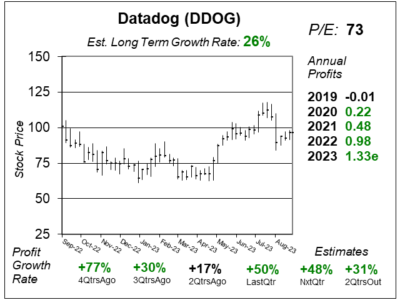

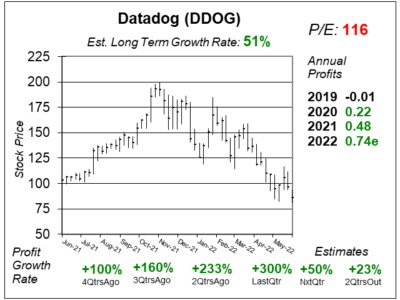

Datadog (DDOG) just lowered its revenue and profit outlook as companies try to cut back on IT spending in a tough economy.

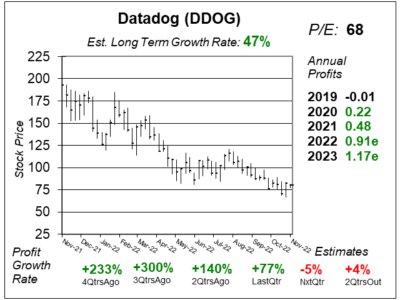

Datadog (DDOG) stock seems so tempting to buy here. But the stock could continue to slide lower as growth is expected to slow.

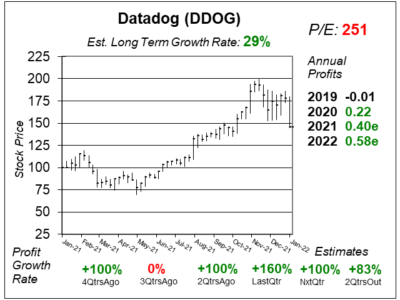

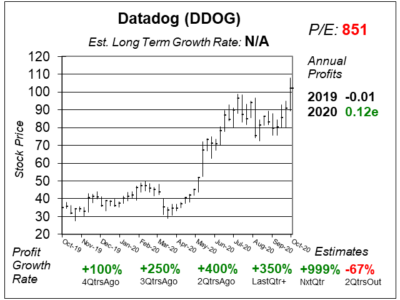

Datagod (DDOG) is one of the top speculative stocks around. But what is it worth? We look at past qtrs and try to derive a fair price.

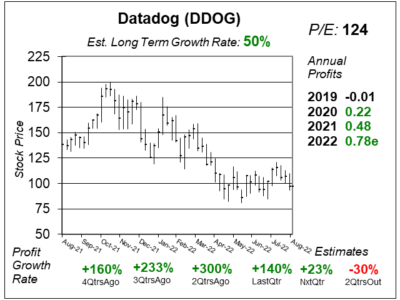

Data monitoring & analytics company Datadog’s (DDOG) numbwers look great! But the valuation seems high. Let’s take a look.

Datagod (DDOG) is one of the stock market’s fastest growing companies. But the stock is expensive at 33x 2022 sales estimates.

Datadog (DDOG) would normally be one of the top stocks to own, but the stock is expensive at 32x expected 2022 revenue.

Datadog (DDOG) just delivered a fantastic quarter that helped the stock break out and run higher. Now it seems too-high to buy.

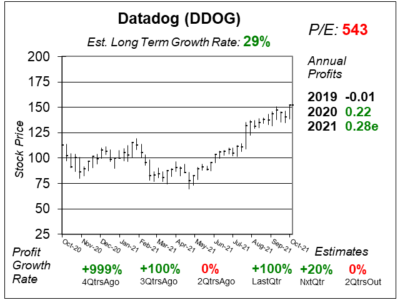

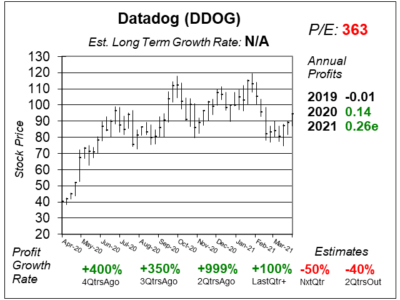

Data monitoring & analytics company Datadog (DDOG) was a darling in 2020, but 201 is rough because the high valuation.

Data analysis company Datadog’s (DDOG) qtrly profit estimates look “ruff” and the stock is expensive at 35x revenue.

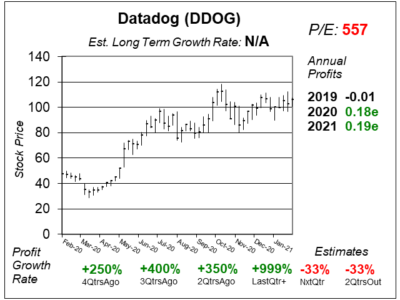

Datatog (DDOG) sells for more than 40x revenue. That’s high. Especially when revenue growth might slow from 60% to 40%.

Data monitoring stock Datadog (DDOG) is one of the hottest stocks in the world, but I’m passing on buying. Here’s why.

Datadog (DDOG) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $0.35 vs. $0.28 = +25%

Revenue Est: +23%