Zscaler (ZS) Stock Seems Like a Better Deal Compared to Crowdstrike (CRWD)

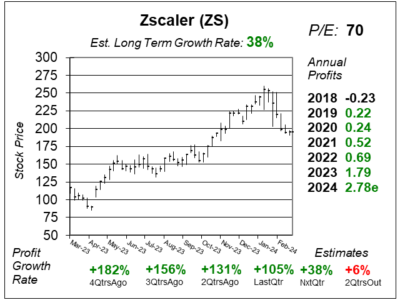

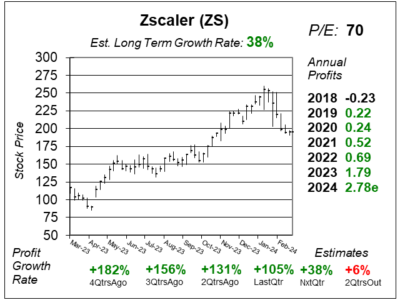

Zscaler (ZS) is considered a peer to Crowdstrike in the cybersecurity space. But this quarter, ZS is a better value with higher upside.

Zscaler (ZS) is considered a peer to Crowdstrike in the cybersecurity space. But this quarter, ZS is a better value with higher upside.

Generative AI is allowing loopholes that hackers can use to get to an organizations network. Zscaler (ZS) can help with that.

Zscaler (ZS) is clicking on all cylanders as the demand for cybersecurity remains high as profit and revenue growth is strong.

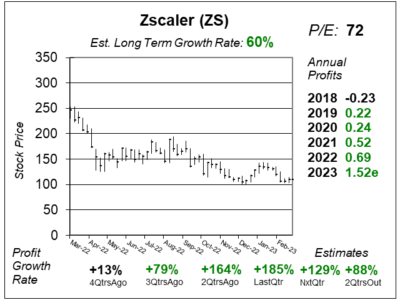

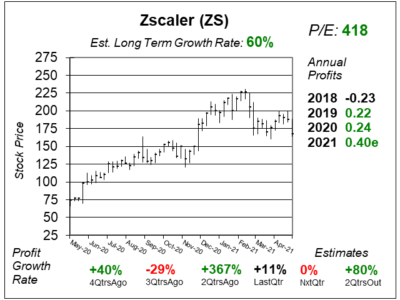

Zscaler’s (ZS) billing growth increased an impressive 40% last quarter, causing the stock to jump. We still see good upside ahead.

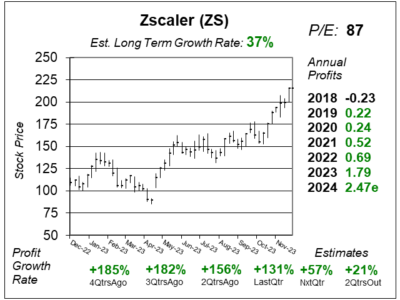

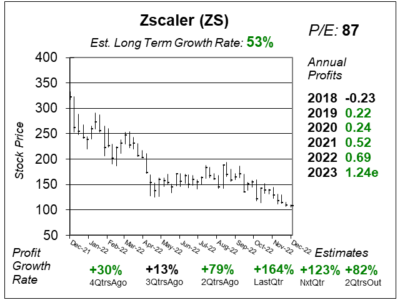

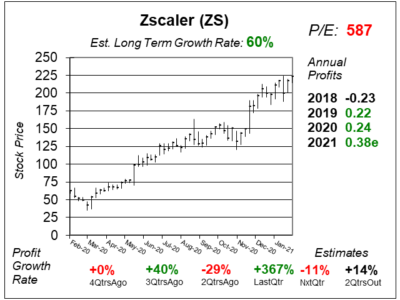

Zscaler (ZS) delivered a splendid quarter, and upped revenue and profit estimates. But ZS fell because billings growth is slowing.

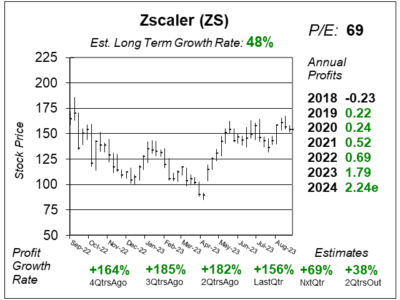

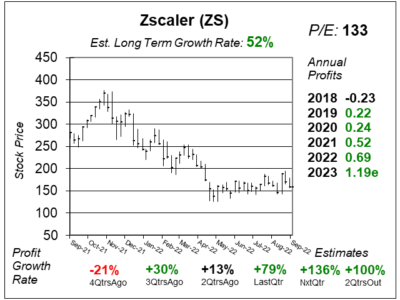

Zscaler (ZS) is seeing growth slow due to the economy. Billings growth fell to 37% last qtr from 57% just three months earlier.

Zscaler (ZS) has two products with FedRamp’s highest authorization, and is seeing strong growth from the US Government.

Zscaler (ZS) grew revenue an outstanding 63% last qtr. But Cloudflare says Zscaler slows computer speed, and that’s a bad thing.

Zscaler (ZS) management says no one comes close to the capabilities of its platform. Now, let’s look at what ZS stock is worth.

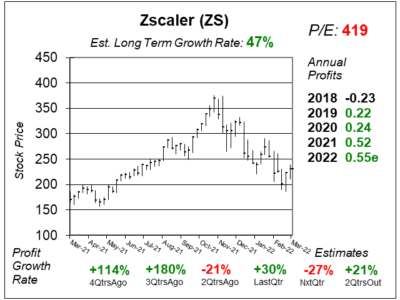

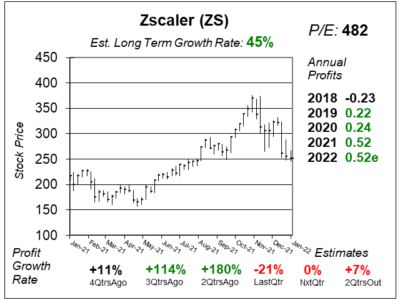

Sure, Zscaler (ZS) has a high P/E. But management is focused more on time to market and growth rate than margins (for now).

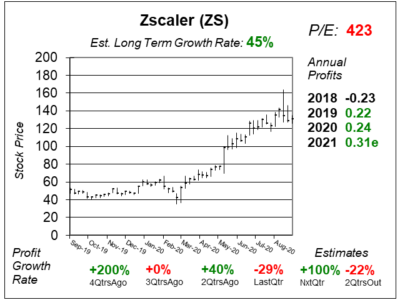

Cybersecurity company Zscaler (ZS) is reeling in the big customers, as those who spent $1 million a year rose 87% last qtr.

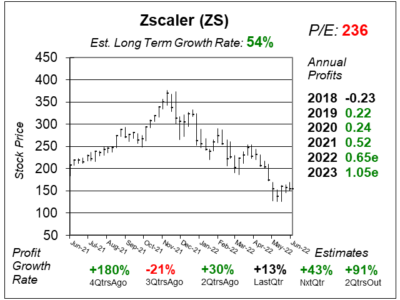

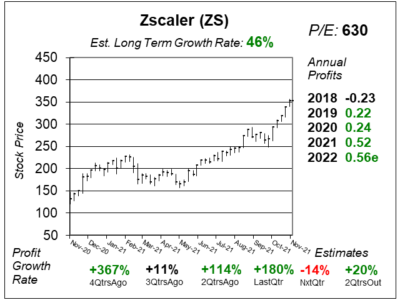

Cybersecurity company Zscaler’s (ZS) sales growth has accelerated the past five qtrs from 40% to 42%, 52%, 55% and now 60%.

Zscaler (ZS) is an expensive stock, selling for 36x 2021 revenue estimates. But this company is a top security stock to own.

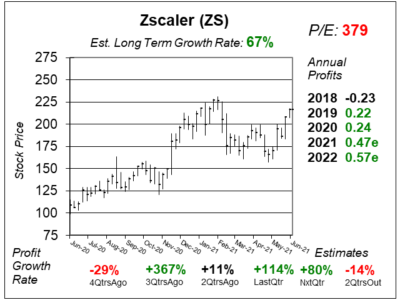

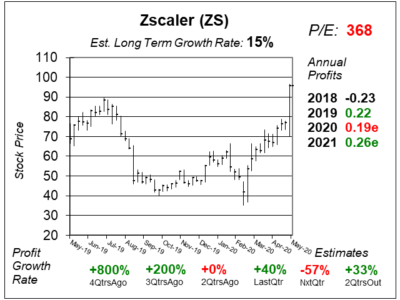

Cybersecurity company Zscaler (ZS) is thriving as companies try to protect apps employees use when they work from home.

Zscaler (ZS) is cybersecurity that was build for cloud computing. Organizations with employees working from home need this.

Zscaler (ZS) stock is on fire as it helps companies tackle cybersecurity while many company employees work from home.

Zscaler (ZS) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $0.66 vs. $0.48 = +38%

Revenue Est: +28%