Today in the stock market, aggressive growth stocks lost ground as the stock market was rather flat on the day. Overall, the S&P 500 and NASDAQ were down less than 1%.

High P/E stocks Take it on the Chin

Cloudflare (NET) was down 5% with MongoDB (MDB) down 4%. Both stocks are part of the high price-to-sales segment of the market.

Another last-year-leader Snowflake (SNOW) was weak today, as it was down 3%. SNOW and MBD are both in the database segment of technology.

Shares Crowdstrike (CRWD) were down 4% today as well. CWRD broke out of a cup-and-handle chart pattern last week — a bullish sign for the stock — but the stock failed to hold onto those gains today.

Shares of Zscaler (ZS) were down 3% on the say. Crowdstrike and Zscaler make a great tag-team in cybersecurity as one protects the computers people are working on (CRWD) and the other protects the flow of data through the Internet (ZS).

NET, MDB, CRWD, SNOW and ZS all have high price-to-sales ratios. These stocks were leaders in the 2020-2021 Bull Market, and have been selling off sInce November 2021. CRWD and MDB have looked like the strongest of the bunch recently.

Chart of the Day

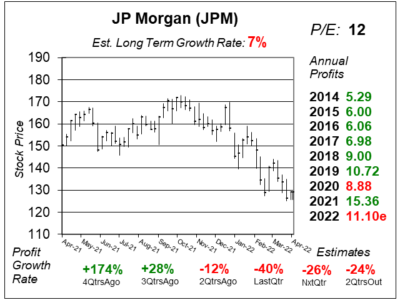

Our chart of the day today, April 18, 2022, is this one-year chart of JP Morgan (JPM).

Our chart of the day today, April 18, 2022, is this one-year chart of JP Morgan (JPM).

JPM reported quarterly earnings last week. Analysts expected -39% profit growth year-over-year and the company missed estimates slightly and delivered -40%.

JPM stock seems to be falling hard on fears of a recession ahead. But it could be that investors are not enamored with profits being down.

Analysts recently dropped 2022 profit estimates from $11.18 to $11.10 a share, which would be -28% profit growth for the year.

Our Fair Value on JP Morgan stock is $133 a share, 3% higher than where the stock traded today.