Stock (Symbol) |

Zscaler (ZS) |

Stock Price |

$195 |

Sector |

| Technology |

Data is as of |

| March 19, 2024 |

Expected to Report |

| May 30 |

Company Description |

Zscaler, Inc. (Zscaler) is a cloud security company that has developed a platform incorporating security functionalities needed to enable access to cloud resources based on identity, context, and organization policies. Zscaler, Inc. (Zscaler) is a cloud security company that has developed a platform incorporating security functionalities needed to enable access to cloud resources based on identity, context, and organization policies.

Its solution is a multi-tenant, distributed cloud platform that secures user-to-app, app-to-app, and machine-to-machine communications over various networks and locations. The Company delivers its solutions using a software-as-a-service (SaaS) business model and sells subscriptions to customers to access its cloud platform, together with related support services. Its Zero Trust Exchange is a cloud-native security platform that protects various customers from cyberattacks and data loss by connecting users, devices, and applications in any location. The Company’s cloud services include Zscaler Internet Access (ZIA), Zscaler Private Access (ZPA), and Zscaler Digital Experience (ZDX). Source: Refinitiv |

Sharek’s Take |

Just a quarter ago Zscaler (ZS) was talked about as a peer to Crowdstrike and Palo Alto Networks in terms of cloud cybersecurity. But this past quarter Palo Alto management said customers are getting fatigue from increasing cybersecurity costs, and its stock fell on the news. Crowdstrike delivered an excellent quarter, and is now seen as THE premier cybersecurity company. Zscaler? The company delivered a solid quarter, but revenue growth decelerated slightly. ZS’s revenue growth decelerated to 35% last qtr from 40% 2QtrsAgo. Estimates are for 28% next quarter. Still, last qtr’s sales growth was a tad better than Crowdstrike’s 33%. ZS’s management really doesn’t see spending fatigue among its customers, with many CIOs telling them cyber is a priority for spend. So to me ZS is fine. In fact, I like the stock better than Crowdstrike’s right now as ZS is cheaper when I value the two companies. Just a quarter ago Zscaler (ZS) was talked about as a peer to Crowdstrike and Palo Alto Networks in terms of cloud cybersecurity. But this past quarter Palo Alto management said customers are getting fatigue from increasing cybersecurity costs, and its stock fell on the news. Crowdstrike delivered an excellent quarter, and is now seen as THE premier cybersecurity company. Zscaler? The company delivered a solid quarter, but revenue growth decelerated slightly. ZS’s revenue growth decelerated to 35% last qtr from 40% 2QtrsAgo. Estimates are for 28% next quarter. Still, last qtr’s sales growth was a tad better than Crowdstrike’s 33%. ZS’s management really doesn’t see spending fatigue among its customers, with many CIOs telling them cyber is a priority for spend. So to me ZS is fine. In fact, I like the stock better than Crowdstrike’s right now as ZS is cheaper when I value the two companies.

Zscaler is the largest in-line cloud security platform in the world, securing 40 millions users from the largest global brands, and processing more than 300 billion transactions daily, while working with 40 million users from some of the largest global brands. The company is also delivering strong growth within US government agencies. One reason for this is Zscaler is the only cloud security service to have 2 products at the highest level of FedRAMP certification, Zscaler Internet Access (ZIA) and Zscaler Private Access (ZPA). 12 of the 15 federal cabinet-level agencies are customers. And as of June 2023, Zscaler served 8 out of the 10 largest financial services and insurance companies in the world outside of China. ZS’s key products are:

Here are some other facts about the company:

Zscaler’s is more focused on time-to-market and growth rate than optimizing for gross margins. Thus, the company is “spending to grow” and the stock has a high P/E of 70. But operating margins have been increasing, so the profits are coming along. The stock’s Estimated Long-Term Growth Rate of 38% a year is nice and high. Last quarter I noted “the stock climbing so rapidly it seems fairly valued around this price”. This quarter, I see nice upside. ZS is part of the Aggressive Growth Portfolio and Growth Portfolio. |

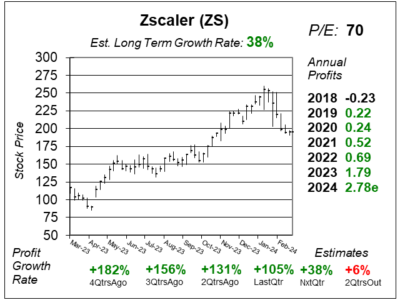

One Year Chart |

This stock fell after earnings. That’s fine with me, as I feel its a buying opportunity. This stock fell after earnings. That’s fine with me, as I feel its a buying opportunity.

The P/E of 70 is lower than the 87 P/E last qtr. But I value this stock on a price-to-revenue basis and we will get more into the valuation below. The Estimated Long-Term Growth Rate of 38% is great, a little bit higher than the 37% last quarter. Qtrly profit growth continues to look great, but is expected to decelerate in the upcoming qtrs. |

Earnings Table |

Last qtr, Zscaler delivered 105% profit growth and surpassed expectations of 57%. Revenue increased 35% against expectations of 31%. Billings grew 27% while the net retention rate was 117%. Notice in this table how profits have grown sequentially the past 8 quarters, from $0.17 to $0.76. The company grew its $1 million in Annual Recurring Revenue (ARR) customers 31% ending the quarter with nearly 500 such customers. Last qtr, Zscaler delivered 105% profit growth and surpassed expectations of 57%. Revenue increased 35% against expectations of 31%. Billings grew 27% while the net retention rate was 117%. Notice in this table how profits have grown sequentially the past 8 quarters, from $0.17 to $0.76. The company grew its $1 million in Annual Recurring Revenue (ARR) customers 31% ending the quarter with nearly 500 such customers.

Here are the regional highlights:

ZS ended Q2 with 497 customers with greater than $1 million in ARR, adding 29 such customers this quarter. ZS also saw strength in $100,00 ARR customers this quarter. Which grew to 2,820, adding 112 customers sequentially. This continued strong growth of large customers speaks to the strategic role of ZS in their customers’ transformation initiatives. ZS reached their goal of $5 billion in ARR this quarter. Driven by their solid progress on strategy to scale it’s go-to-market engine. ZS had a strong federal quarter with particular strength in upsells to cabinet-level agencies. Annual Profit Estimates increased for the 8th straight qtr. For Fiscal 2024, management expects revenue increase in the range of $2.55 billion to $2.57 billion, reflecting a year-over-year growth of 31%. Qtrly Profit Estimates for the next 4 qtrs are 38%, 6%, 10%, and 5%. For next qtr, analysts expect revenue to grow 28% year-over-year aligned with the management’s expectation. |

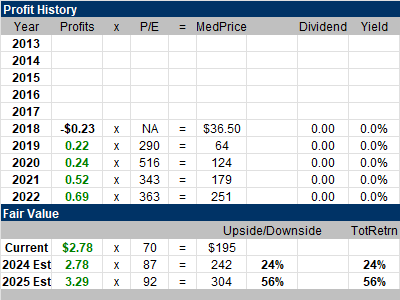

Fair Value |

ZS sells for 14x 2024 revenue estimates. My Fair Value is 17x revenue. Here are my Fair Values prices for this year and next year: ZS sells for 14x 2024 revenue estimates. My Fair Value is 17x revenue. Here are my Fair Values prices for this year and next year:

Current: 2024 Fair Value: 2025 Fair Value: ZS has a Fiscal Year end July 31st. So I will start looking ahead to 2025 next quarter. |

Bottom Line |

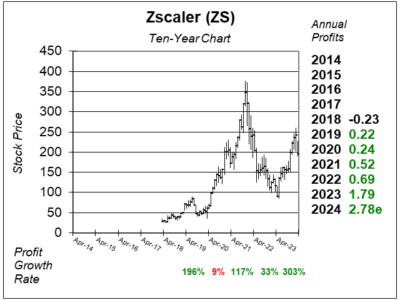

Zscaler (ZS) is one of the world’s best cybersecurity companies, but the stock got overheated last year, and came tumbling down during this Bear Market. In my ZS 2021 Q3 report, the stock sold for 51x 2022 revenue estimates. In retrospect that was WAY too high of a multiple. Zscaler (ZS) is one of the world’s best cybersecurity companies, but the stock got overheated last year, and came tumbling down during this Bear Market. In my ZS 2021 Q3 report, the stock sold for 51x 2022 revenue estimates. In retrospect that was WAY too high of a multiple.

In terms of “value” Zscaler sells for 2024 14x revenue estimates while Crowdstrike sells for 20x revenue. Now Crowdsrike did have a better quarter, but these stocks used to have a similar multiple. Now, Crowdstrike is around 50% more expensive than Zscaler. I see ZS stock as a deal this quarter, with nice upside of around +24% compared to Crowdstrike’s +2%. ZS moves up from 13th to 10th in the Growth Portfolio Power Rankings. The stock slides ahead of CRWD by moving from 10th to 9th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

10 of 33Aggressive Growth Portfolio 9 of 15Conservative Stock Portfolio N/A |