The stock market slipped on Tuesday, as new economic data signaled that labor market could be cooling. The Job Openings and Labor Turnover Survey for February showed the number of job openings in February sank to below 10.0 million from 10.5 million.

The stock market slipped on Tuesday, as new economic data signaled that labor market could be cooling. The Job Openings and Labor Turnover Survey for February showed the number of job openings in February sank to below 10.0 million from 10.5 million.

Overall, S&P 500 declined 0.6% to 4,101, while NASDAQ fell 0.5% to 12,126.

Tweet of the Day

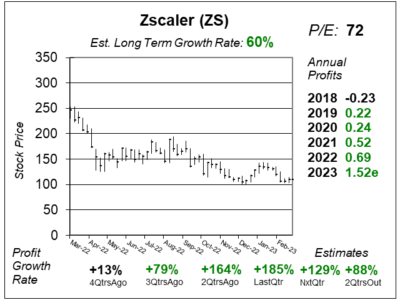

Zscaler $ZS stock has remained weak even though the NASDAQ has been rising.

I think ZS is doing well. Its grown profits sequentially the past six qtrs from $0.11 to $0.13, $0.17, $0.25, $0.29, & $0.37.

2023 EPS est up the past 5 qtrs from $0.96 to $1.05, $1.19, $1.24 and $1.52. pic.twitter.com/tgoPoWEkMJ

— David Sharek (@GrowthStockGuy) April 4, 2023

Chart of the Day

Here is the one-year chart of Zscaler (ZS) as of March 22, 2023, when the stock was at $109.

Here is the one-year chart of Zscaler (ZS) as of March 22, 2023, when the stock was at $109.

Zscaler is the largest in-line cloud security platform in the world, processing more than 210 billion transactions daily, while preventing greater than 7 billion security incidents and policy violations. The company is delivering strong growth within US government agencies.

Zscaler delivered a splendid quarter, and upped revenue and profit estimates. But it fell because billings growth is slowing. During the past three quarters, billings growth has slowed from 57% to 37% and now 34%. Last quarter, management predicted billings growth of around 30% for Fiscal 2023, so this shouldn’t have been such a negative surprise.

Revenue growth was solid at 52%, but that slowed from 52% from the prior qtr. On the bright side, the company delivered 185% profit growth which beat estimates of 123%. Next quarter’s profit estimates rises from 82% to 129%. Also, customers with an Annual Contract Value of $1 million or greater was up 51%, to a total of 378 clients.

The stock’s Estimated Long-Term Growth Rate of 60% a year is outstanding. ZS is part of the Aggressive Growth Portfolio.