Stock (Symbol) |

Zscaler (ZS) |

Stock Price |

$216 |

Sector |

| Technology |

Data is as of |

| June 17, 2021 |

Expected to Report |

| September 7 |

Company Description |

Zscaler, Inc. is a cloud-based security company. The Company provides a platform that is built as a multi-tenant, distributed cloud service designed to scale and deliver real-time insights into security issues. Zscaler, Inc. is a cloud-based security company. The Company provides a platform that is built as a multi-tenant, distributed cloud service designed to scale and deliver real-time insights into security issues.

The Company offers two principal cloud services, such as Zscaler Internet Access (ZIA), and Zscaler Private Access (ZPA). The Company’s ZIA securely connects users to externally managed applications, including with software as a service (SaaS) applications and Internet destinations, regardless of device, location or network. ZPA offers authorized users secure and access to internally managed applications hosted in enterprise data centers or the public cloud. ZPA solution connects a specific user to a specific application, without bringing the user on the network, resulting in better security. Source: Thomson Financial |

Sharek’s Take |

Cybersecurity company Zscaler (ZS) continues to deliver excellent revenue growth. And it keeps getting better. Earlier this year, the company focused time and money on the Enterprise segment (organizations with 2000 to 6000 employees). Last qtr, Zscaler saw a higher mix of new business from Enterprises. Here are some quick stats from last qtr: Cybersecurity company Zscaler (ZS) continues to deliver excellent revenue growth. And it keeps getting better. Earlier this year, the company focused time and money on the Enterprise segment (organizations with 2000 to 6000 employees). Last qtr, Zscaler saw a higher mix of new business from Enterprises. Here are some quick stats from last qtr:

Zscaler is the largest in-line cloud security platform in the world, processing more than 140 billion transactions daily, while preventing 7 billion security incidents and policy violations. Zscaler was built on the cloud, for companies using the cloud, and securely connects users to apps regardless of device, location or network. Zscaler, the biggest provider of cloud-based web security gateways that inspect data traffic for malware, was incorporated in 2007 based on the vision the internet would be the new corporate network and the cloud would be the new data center. The company’s architecture is distributed across 150 data centers globally in 285 countries (source: 2019 Annual Report). As of the most recent annual report (February 26, 2021) the company had over 5000 customers including more than 500 of the Forbes Global 2000. Zscaler has the highest level of FedRAMP certifications to help the U.S. government keep its data secure. It’s approved to perform cybersecurity for the U.S. Defense Department. When compared to Crowdstrike, Zscaler protects traffic that’s flowing while Crowdstrike is about endpoint protection (computers, phones). Zscaler just launched a series of integrations with Crowdstrike to deliver end-to-end security protection. Zscaler’s Zero Trust Exchange has has 4 pillars or products. 50% of Zscaler’s revenue growth comes from upselling current customers with another service or “transformational bundle.” The 4 pillars are:

In my opinion, Zscaler and Crowdstrike are the top two cybersecurity stocks. Other investors are aware of this, and have priced up the stock in anticipation of better years ahead. On a price-to-sales basis, ZS sells for 45x 2021 sales estimates in an environment where 30x sales is the norm and only the cream-of-the-crop stocks earn price-to-sales multiples of 45x. ZS’s Estimated Long-Term Growth Rate of 67% a year is outstanding, but the P/E of 379 is super high. ZS is part of the Aggressive Growth Portfolio. Zscaler’s CEO thinks this new way of tackling security is leaving other cyberstocks behind like Netflix did to Blockbuster with movie rentals. |

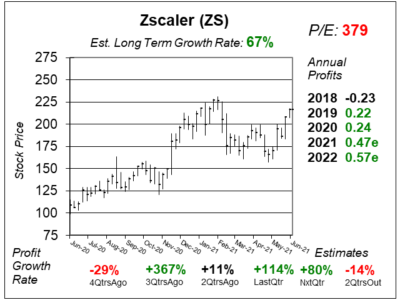

One Year Chart |

ZS is about to break out. Crowdstrike broke out yesterday, so this stock might follow. I think it will. ZS is about to break out. Crowdstrike broke out yesterday, so this stock might follow. I think it will.

The P/E of 379 is super high. The reason is the company is plowing money into Sales and Marketing. S&M was 66% of reveneu last qtr, up from 61% a year-ago. I feel 40% is good for a software company, with that still being super high. I’m not paying much attention to qtrly profit growth (bottom) as ZS really sells on a multiple of sales. The Estimated Long-Term Growth Rate of 67% is exceptional. I think this company has the potential to grow profits 50% to 75% a year or more in the coming years. |

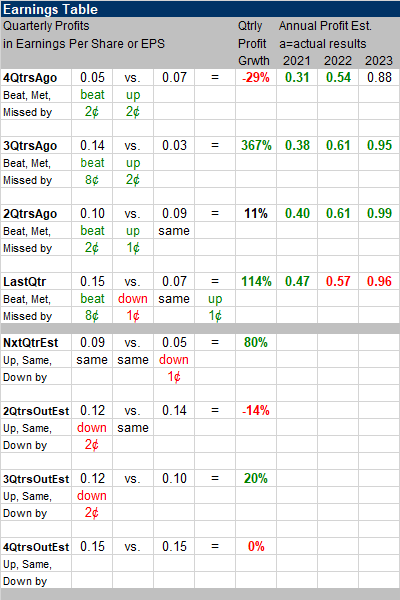

Earnings Table |

Last qtr ZS delivered 114% profit growth which beat estimates of 0%. Revenue increased 60%, up from 55% 2QtrsAgo. Last qtr ZS delivered 114% profit growth which beat estimates of 0%. Revenue increased 60%, up from 55% 2QtrsAgo.

Annual Profit Estimates increased slightly. Revenue numbers increased more. 2021 revenue estimate increased from ~$640 million to ~$660 million. 2022’s revenue estimate increased from ~$840 million to ~$900 million. Qtrly profit Estimates for the next 4 qtrs are mixed. But ZS has been beating the street, so I’m not too concerned. |

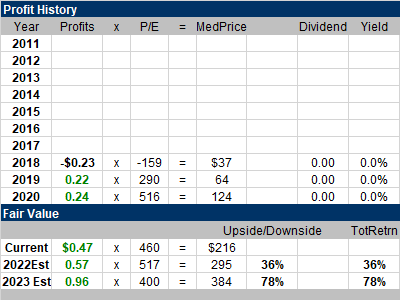

Fair Value |

My price-to-sales multiple is going up from 40x to 45x annual sales estimates. ZS has a fiscal year-end July 31, which is just a month away, so I’m now looking ahead to 2022 and 2023 to calculate my Fair Values: My price-to-sales multiple is going up from 40x to 45x annual sales estimates. ZS has a fiscal year-end July 31, which is just a month away, so I’m now looking ahead to 2022 and 2023 to calculate my Fair Values:

Current: 2021 Fair Value: 2022 Fair Value: |

Bottom Line |

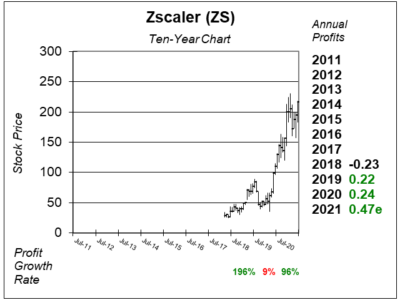

Zscaler (ZS) has been great since its IPO. but note this hasn’t been a smooth ride. The stock has had two deep corrections the past two years. Zscaler (ZS) has been great since its IPO. but note this hasn’t been a smooth ride. The stock has had two deep corrections the past two years.

This company is clearly hitting on all cylinders right now, and with Crowdstrike breaking out, Zscaler stock might do so as well in the up coming days. ZS moves up from 17th to 10th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio 10 of 32Conservative Stock Portfolio N/A |