The stock market closed lower on Thursday as recession fears rose following the Fed’s aggressive rate hike. The central bank maintained its aggressive stance on fighting inflation that many expect another 75 basis point hike in November.

The stock market closed lower on Thursday as recession fears rose following the Fed’s aggressive rate hike. The central bank maintained its aggressive stance on fighting inflation that many expect another 75 basis point hike in November.

Overall, S&P 500 fell 0.8% to 3,758, while NASDAQ declined 1.4% to 11,067.

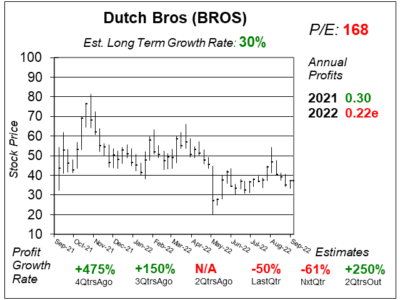

Meanwhile, Dutch Bros (BROS) was growing revenue fast, but inflation hurt profits.

Tweet of the Day

S&P 500 futures net positioning is quite bearish reaching levels only seen during the downturns of 2008, 2011, 2015, and 2020. This is often viewed as a contrarian indicator so is a rally coming soon? pic.twitter.com/HQSMZPBI05

— Barchart (@Barchart) September 22, 2022

Bearishness is very high right now, which hints that we could be near a market bottom.

Chart of the Day

Our chart of the day is the one-year chart of BROS as of September 10, 2022, when stock was at $37.

Our chart of the day is the one-year chart of BROS as of September 10, 2022, when stock was at $37.

Dutch Bros is an operator and franchisor of drive-thru shops that focus on serving hand-crafted beverages. It offers a variety of customizable cold and hot beverages to its customers.

BROS was down as higher ingredient costs was hurting profits. Last qtr, sales growth was 44%, an impressive figure. However, profits were down due to higher ingredient, packaging, and labor costs.

BROS used to be part of the Aggressive Growth Portfolio, but I sold the stock earlier this year. Now its on the radar.

The stock currently sells for 8x 2022 revenue, and David Sharek’s Fair Value is 6x.