Stocks have been crashing as a recession seems more likely with inflation kicking up to a new high during the month of May.

Stocks have been crashing as a recession seems more likely with inflation kicking up to a new high during the month of May.

Friday’s news that the 12-month inflation rate rose from 8.3% in April to 8.6% in May spooked investors who were expected the rate of inflation to decline. During the past three market days:

- Thursday: prior to the bad news the S&P 500 was down 2.4%

- Friday: inflation numbers hi at 8:30am and the S&P declines 2.9%

- Monday: stocks continue to slid after digesting the bad news, as the S&P falls another 3.9%. The NASDAQ fell 4.7% on the day.

Overall, stocks have declined more than 10% in three trading days, from 4116 to 3750. Analysts expect further pain, with the market eventually declining to the 3400-3500 level.

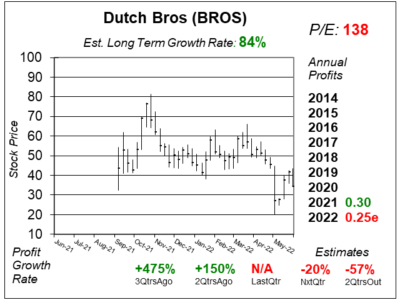

Chart of the Day

This chart is of Dutch Bros (BROS) which missed profit estimates last qtr dur to higher pre-opening costs and higher ingredient/packaging costs.

This chart is of Dutch Bros (BROS) which missed profit estimates last qtr dur to higher pre-opening costs and higher ingredient/packaging costs.

BROS was expected to make $0.01 in profits last qtr (EPS) and instead had a loss of $0.02 a share. The news spooked investors, who dumped the stock. Since then, the shares have rebounded somewhat, but higher ingredient costs aren’t going away soon.

Food and packaging costs rose to 27.4% of sales from 23.4% a year-ago. Occupancy rose to 17.7% from 15.1% a year earlier. And pre-opening costs rose to 4.6% of sales from 2.2% of sales a year earlier.

This is too young of a company to price the stock on a P/E basis, so I will use price-to-sales. The stock currently sells for 8x 2022 revenue, and my Fair Value is 6x, or $26 a share. With the stock having downside risk, I sold BROS from the Aggressive Growth Portfolio today.