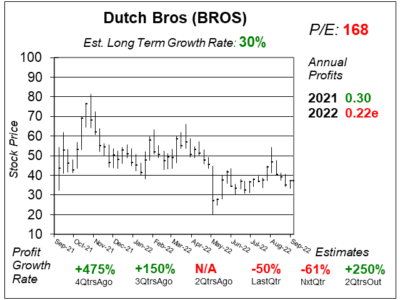

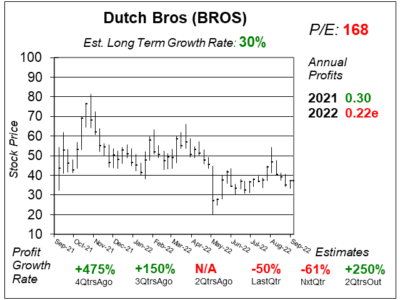

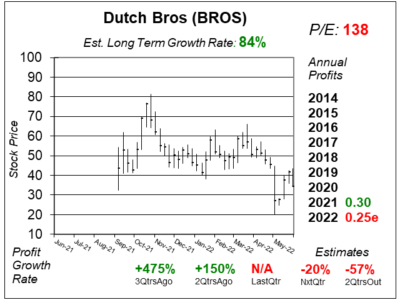

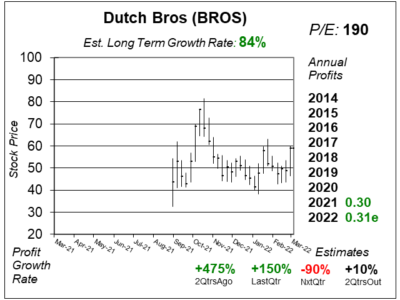

Dutch Bros (BROS) is Growing Revenue Fast; Inflation Hurting Profits

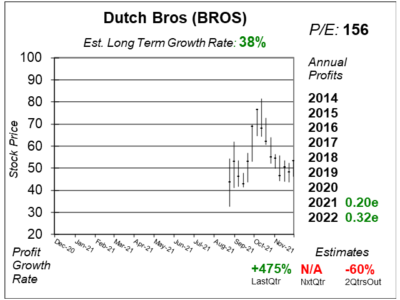

Dutch Bros (BROS) is growing revenue fast (44% last qtr), but profits are weak (-50%) due to high ingredient, packaging, and labor costs.

Dutch Bros (BROS) is growing revenue fast (44% last qtr), but profits are weak (-50%) due to high ingredient, packaging, and labor costs.

Dutch Bros (BROS) had a surprise loss last qtr as beverage ingredient and packaging prices rose. Now, the stock is a riskier bet.

Dutch Bros (BROS) could be the next big thing, as its energy drink/coffee shop drive-thrus are popping up across America.

Dutch Bros (BROS) has small drive-thru shops that offer consumers hot-or-cold espresso based beverages and energy drinks.