The stock market was down on Wednesday after the Federal Reserve raised rates by 25 basis points. The central bank signaled that it is likely done with its rate-hiking campaign.

The stock market was down on Wednesday after the Federal Reserve raised rates by 25 basis points. The central bank signaled that it is likely done with its rate-hiking campaign.

Overall, S&P 500 fell 0.7% to 4,091, while NASDAQ declined 0.5% to 12,025.

Tweet of the Day

$AMD Guide is lower than consensus and Embedded now expected to be down in 2Q. On the flip side, Client is bottoming and Data Center is setting up for strong 2H growth.

Not a horrible report, but no big upside surprise…I think call buyers from today are likely to be unwinding. pic.twitter.com/HWkANC4bXG

— IvanaSPEAR (@IvanaSpear) May 3, 2023

Chart of the Day

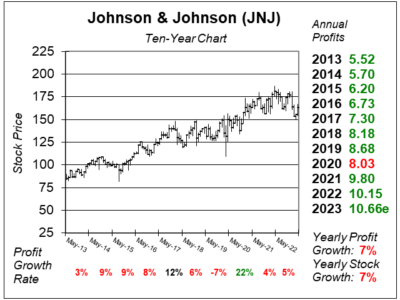

Our chart of the day is the ten-year chart of Johnson & Johnson (JNJ) as of April 26, 2023, when the stock was at $163.

Our chart of the day is the ten-year chart of Johnson & Johnson (JNJ) as of April 26, 2023, when the stock was at $163.

Johnson & Johnson is the world’s largest healthcare company. It is organized into three business segments: Consumer Health, Pharmaceutical, and Medical Technology. It is employing more than 140,000 workers worldwide engaged in research and development, manufacture and sale of a broad range of products in the healthcare field.

The company is set to spin off its Consumer Brands Division, named Kenvue (KVUE), into a separate company this week. Kenvue will have household brands including Band-Aid, Neutrogena, Listerine, Tylenol, and Johnson’s Baby Powder. Its shares are expected to be priced around $16-$18, and will begin trading on Friday.

JNJ is a core holding in the Conservative Growth Portfolio.