The stock market was up on Wednesday as investors digested a fresh inflow of quarterly earnings that indicated a strong economy. The S&P 500 edged closer to the 5,000 level, another all-time closing high. Meanwhile, debate is still ongoing over the timing of interest rate cuts.

The stock market was up on Wednesday as investors digested a fresh inflow of quarterly earnings that indicated a strong economy. The S&P 500 edged closer to the 5,000 level, another all-time closing high. Meanwhile, debate is still ongoing over the timing of interest rate cuts.

Overall, S&P 500 grew 0.8% to 4,995, while NASDAQ rose 1.0% to 15,757.

Tweet of the Day

At today’s intraday high, S&P 500 is trading +0.49% above its February 2 gap day intraday high. S&P 500 has not accelerated in price since its exhaustive gap of February 2, as today’s gap has not led to significantly higher highs. This churning action at a top is typical at…

— Milton W Berg CFA (@BergMilton) February 7, 2024

Chart of the Day

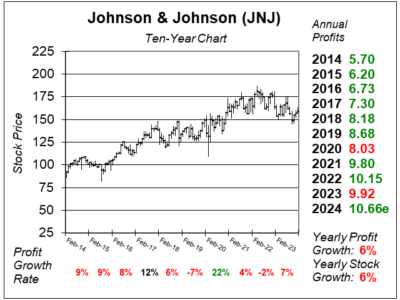

Here is the ten-year chart of Johnson & Johnson (JNJ) as of January 30, 2024, when the stock was at $159.

Here is the ten-year chart of Johnson & Johnson (JNJ) as of January 30, 2024, when the stock was at $159.

Johnson & Johnson delivered a lackluster earnings report as profit growth clocked in at -3% on 7% revenue growth. Its Pharmaceutical segment (now referred to as Innovative Medicine) delivered just 4% year-over-year sales growth, led by key brands including Darzalex and new product launches. The smaller MedTech segment delivered stronger growth, with quarterly revenue up 13%, mainly due to the recent Abiomed acquisition. This is good news for MedTech.

Johnson & Johnson expects medical procedures in 2024 to surpass pre-COVID levels, as the MedTech section benefits from delayed surgeries now taking place.

JNJ is stock with a high safety rating, a healthy dividend that’s increased for more than 60 years, and great long-term track record of growing annual profits. This is a true Blue Chip stock that is a core holding for conservative accounts. These shares are inexpensive for long-term investors to buy in. But note that the stock only grew 6% a year the past decade. This is a slow grower.

JNJ is a core holding in the Conservative Growth Portfolio. The stock is inexpensive with a P/E of only 15. But the company has litigation risk from lawsuits regarding its baby powder causing cancer, which has caused the stock’s weakness since last year.