The stock market notched gains on Thursday as investors hoped that the Federal Reserve could be done on its rate-hiking campaign in 2023.

The stock market notched gains on Thursday as investors hoped that the Federal Reserve could be done on its rate-hiking campaign in 2023.

Overall, S&P 500 jumped 1.9% to 4,318, while NASDAQ accelerated 1.8% 13,294.

Tweet of the Day

The forward 12-month P/E ratio for $SPX of 17.1 is below the 5-year average (18.7) and below the 10-year average (17.5). #earnings, #earningsinsight, https://t.co/z8IWpmhNMm pic.twitter.com/YPeHa7yKaj

— FactSet (@FactSet) October 29, 2023

Chart of the Day

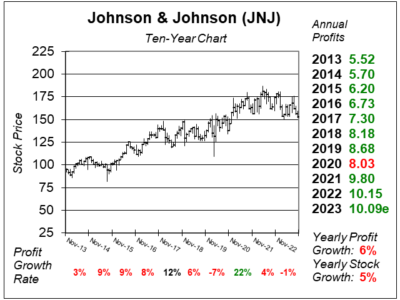

Here is the ten-year chart of Johnson & Johnson (JNJ) as of October 18, 2023, when the stock was at $153.

Here is the ten-year chart of Johnson & Johnson (JNJ) as of October 18, 2023, when the stock was at $153.

Johnson & Johnson is the world’s largest healthcare company. The company’s workers worldwide are engaged in the research and development, manufacture, and sale of a broad range of products in the healthcare field. These products are distributed to wholesalers, hospitals, and retailers, and used predominantly in the professional fields by physicians, nurses, hospitals, eye care professionals, and clinics.

Johnson & Johnson’s stock slumped to a one-year low as its consumer health spin-off, Kenvue, completed its separation last quarter. The stock is $152, down 11% from our last report when the shares were $172. With the separation of the new business, the company’s outstanding shares were reduced by 7%. The stock’s 2023 profit estimate has also fallen to $2.66 from $2.80 a quarter ago. Meanwhile, the bright side is it now has robust upside of 21% to our 2023 Fair Value, up from just 6% 2QtrsAgo. Year-over-year, profit grew 4%, missing estimates of 5%, while revenue grew 7%.

JNJ is a core holding in the Conservative Growth Portfolio. The stock is inexpensive with a P/E of only 16. However, the company has litigation risk from lawsuits regarding its baby powder causing cancer.